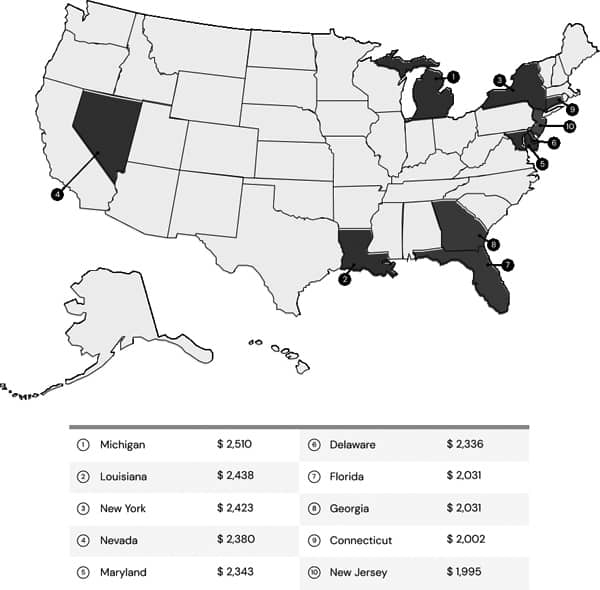

Five Northeast states rank among the 10 most expensive, while Michigan is first in U.S. for highest vehicle insurance costs

Cambridge, Mass.—A new report from Insurify shows that the average American is spending $1,705 per year on auto insurance in 2022, up 4% from 2021 and a 17% from 2020. Michigan drivers pay the most for car insurance, spending $2,510 per year on average — $805 more than the national average and $1,748 more than the yearly average of $762 in Hawaii, the cheapest state for auto insurance. Across the country, drivers pay 5% less for coverage just for being married, and up to 17% less if they own their home.

Key findings from the report, 2022 Auto Insurance Trends Report: Who’s Paying More for Coverage, include:

Luxury, electric cars are priciest to insure

Tesla Model 3 owners have the second-most expensive car insurance premiums of any vehicle model in 2022, according to Insurify data. Model 3 drivers are spending $3,040 per year for auto insurance — $1,335 more than the national average. The Infiniti Q5 is the most expensive vehicle to insure in 2022 with an average premium of $3,149 per year.

Northeast drivers pay up for coverage

Northeast drivers are also paying more for car insurance in 2022. Five Northeast states — New York, Maryland, Delaware, Connecticut, and New Jersey — rank among the 10 most expensive states for auto insurance. The average driver in one of these states is paying $2,220 per year for coverage, which is $515 more than the national average.

Ways Americans are considering cutting insurance costs

In the face of rising vehicle ownership costs, the report also finds that 65% of Americans are considering driving less and 10% are thinking about dropping their car insurance coverage altogether, despite the serious legal and financial risks of driving without insurance. Americans are additionally considering the following actions to save on vehicle insurance, fuel, and maintenance expenses in 2022:

- 30% of drivers are thinking about purchasing a hybrid or electric vehicle

- 30% of drivers are considering switching to a different insurance provider

- 16% of drivers are thinking about moving to a different location with better public transportation and walkability

For Americans, the insurance market’s current volatility likely won’t stabilize until at least mid-2023, according to Betsy Stella, Insurify’s Vice President of Insurance Partnerships. “Based on our comprehensive research and feedback from over 100 carriers, the general consensus is that it will be eight to 12 months [from fall 2022] before the market stabilizes. Some think it could be several years before a soft market returns.”

Comments are closed.