For gas station operators to remain relevant, they need to adapt and future-proof their business

The exponential sales growth of full electric or plug-in hybrid vehicles, though from a relatively small base, is necessitating rapid growth in fast and reliable electric vehicle (EV) charging infrastructure and is consequently compelling gas station operators globally to adapt and future-proof their retail business.

Opportunities and Challenges for Gas Station Operators

While considerable uncertainties around the pace of transition to EVs remains, DBRS Morningstar believes this transition is unlikely to have a material negative effect on the credit risk profiles of most gas station operators, over the near-to-medium term, especially for those with more diverse site locations.

That said, to integrate reliable EV charging infrastructure into their service offerings and adapt other aspects of their business, DBRS Morningstar expects gas station operators to be subject to higher capital investment requirements going forward.

Furthermore, over the longer term, operators would need to evolve and address challenges around intensifying competition, their changing business and operating model as well as infrastructure concerns, in order to maintain market share, profitability, and relatively stable credit risk profiles.

Conversely, the transition also provides a growth opportunity for those gas station operators that address these challenges and execute a successful transition.

Rapid Acceleration in EV Sales

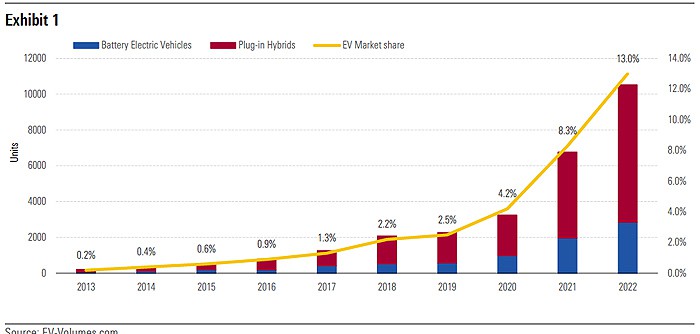

As shown in Exhibit 1, the total number of EV sales globally increased substantially by 55% year over year in 2022 with over 10.5 million EVs sold.

Furthermore, EVs accounted for approximately 13% of global passenger vehicle sales in 2022, growing from 8.3% in 2021. Similarly, electric light commercial vehicle (LCV) sales worldwide increased by more than 90% in 2022 as well.

EV Sales Fueled by a Global Drive for Zero Emission Vehicles

Consumer acceptance aside, the growth in EV sales is in large part driven by government legislation, electrification targets across the world, and incentives to build supporting infrastructure.

As an example, the European Union has approved a ban on sales of new petrol and diesel cars from 2035 onward, along with more stringent new emission standards for cars and vans that are aligned with the goals set out in its “Fit for 55” package.

The U.S. Inflation Reduction Act of 2022, combined with the adoption of California’s Advanced Clean Cars II rule by a number of states, could result in a substantial increase in EV market share in the U.S., broadly in line with the national target of 50% of vehicles sales being EVs by 2030.1

Similarly for Electric LCVs, a total of 27 countries, including the United States and a number of European nations, have pledged to achieve 100% zero emission vehicles bus and truck sales by 2040.

Charging Infrastructure Key to Supercharging EV Adoption

One of the main challenges to EV adoption is the lack of easily accessible, fast, and reliable charging infrastructure. As per a report from IEA, there were 2.7 million public charging points worldwide at the end of 2022, a 55% increase on 2021 stock, and this is expected to grow by another 35% in 2023.

In addition to China, countries in Europe and North America continue to invest heavily in rolling out EV charging infrastructure. As an example, in North America, major EV and battery makers have announced cumulative investments of over $52 billion in the last year or so, including Canada’s deals with carmaker Stellantis and Volkswagen to build EV battery manufacturing plants in Ontario, which involves billions of dollars in government subsidies.

The infrastructure bill passed by the Biden Administration in November 2021 provides for $7.5 billion investment in EV charging infrastructure and over $7 billion in EV battery components.

Notwithstanding this rapid growth (from a small base), this transition away from the sale of fossil fuel based products is unlikely to have a profound impact on the oil and gas sector in the near-to-medium term.

This is largely due to the limited amount of oil likely to be displaced by EVs (as per IEA estimates, road transport oil demand is expected to be 460 thousand barrels per day below 2019 levels of approximately 43 million barrels, by 2028).

Therefore, gas station operators should have time to take a balanced approach when it comes to adjusting their overall infrastructure and service offerings. Any structural changes to the business model and operations of gas station operators will need to align with the pace at which the fuel mix transitions.

Considerable Challenges Pose Roadblocks for Gas Station Operators

While the trends around EVs and charging points represent opportunities for gas station operators, which have the advantage of an established network of stations as well as access to large spaces in prime locations, they are also faced with significant challenges.

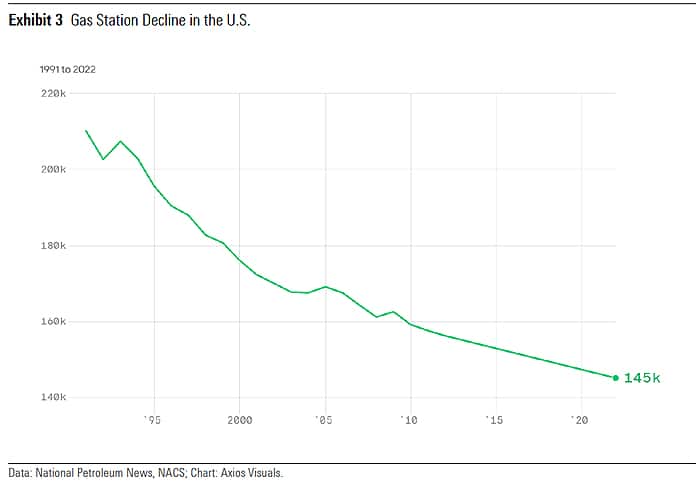

Gas station numbers have already seen a rapid decline across Europe and North America over the last two decades due to intense competition and lower margins, and the transition to EV charging is likely to result in further declines and consolidation in the sector.

Exhibit 3 highlights the decline in the number of gas stations in the U.S. In the UK, as well, gas stations have declined by over 35% during the 2000 to 2022 period. For gas station operators to remain relevant, they need to adapt and future-proof their business by addressing a number of key challenges, including significant capital investment requirements, intensifying competition, and a changing business and operating model as well as infrastructure concerns.

1. Significant Capital Investment Requirements

In response to the transition, large gas station operators, as well as the world’s largest oil and gas companies, such as BP, Shell, Exxon, and Chevron, have all started to make considerable investments in EV charging infrastructure.

While these investment requirements are significant, DBRS Morningstar notes that gas station operators could benefit from government incentives and are likely to form partnerships with third-party service providers for installation, maintenance, and repair, which could reduce their capital investment burden.

That said, finding the right partner for operational ease, technology upgrades, as well as scalability of operations will be critical.

Furthermore, DBRS Morningstar believes that, while fuel sales are currently the key driver of traffic, a considerable portion of overall sales for gas station operators is already derived from more profitable ancillary products and services, such as convenience and food offerings as well as vehicle-related services such as car washes.

Given longer time requirements for EV charging, combined with convenient locations, long opening hours, and easy parking, gas stations could increasingly be well suited for selling a wider range of products, from ready-to-eat snacks and meals to larger grocery baskets.

Consequently, to support future traffic flows, we expect value added service offerings to attract a relatively higher share of capital allocation going forward, as evidenced by Parkland Corporation’s (rated BB, Stable) acquisition of the M&M food market business in 2022.

2. Intensifying Competition

As it relates to EV charging, gas station operators would not only be competing among themselves but potentially also with government installed charging points, utility companies entering the space, as well as chargers located at retailer and other destination locations.

For example, Walmart already hosts 1,300 EV fast-charging stations at 280 of its locations and is planning to install new EV fast-charging stations at thousands of Walmart stores across the U.S.

Similarly, arrangements like Tesla’s deal with other Original Equipment Manufacturers (OEM), including Ford, General Motors, Volvo, and Mercedes-Benz to allow access to over 12,000 Tesla charging stations in North America by 2024, intensify the competition in this space.

All this incremental competition is in addition to home chargers, which meet approximately 70% of total EV charging needs today.

3. Changing Business and Operating Models: Urban versus Highway Stations

Depending on the evolution of the competitive landscape, gas stations may evolve differently depending on their location, ability to offer additional value or services, and the profile of their customer base.

Due to their high volume and limited nearby alternatives, highway gas stations are more likely to be suitable for the roll out of EV charging infrastructure, and governments are more likely to consider public-private partnership models for developing or expanding charging infrastructure at these locations.

Urban gas stations, especially those with limited space and no other value or service offering, are more vulnerable to alternative charging service providers, including the “in-house” option available to households with personal charging units.

4. Macro Infrastructure Concerns Beyond the Operators’ Control

While home chargers can slowly charge over a longer period, consumers will likely desire public charging stations to be fast chargers.

These chargers require reliable and efficient grid connectivity. For context, if EV vehicle sales grew in line with the federal government’s 2030 uptake goal, the U.S. EV related energy demand is expected to increase to about 230 billion kilowatt hours (kWh) up from 11 billion kWh in 2022.2

As such, grid reliability and infrastructural support could be a concern for gas station operators, especially for more remote or highway locations, while more urban charging needs could increasingly be covered by non-gas-station operators.

Given the aforementioned challenges and opportunities, DBRS Morningstar expects the EV transition to be measured in the near-to-medium term and unlikely to materially affect credit risk profiles of most of the gas station operators. As the pace of transition accelerates, gas station operators will need to evolve and redefine their service offerings to remain competitive.

Comments are closed.