Many decisions must be made throughout the process to ensure costs are minimized without compromising final system functionality

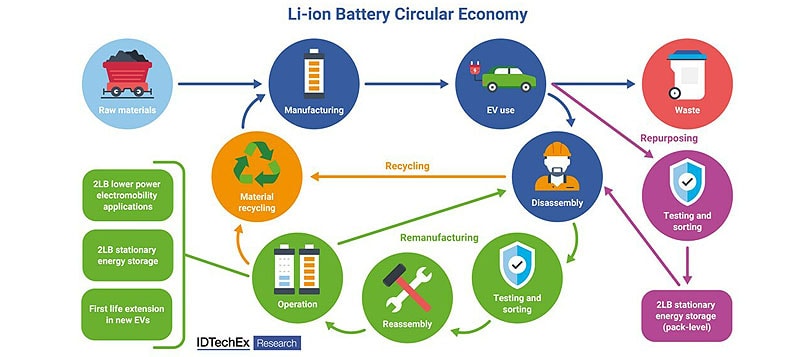

Boston—The Li-ion EV battery circular economy comprises multiple important steps, requiring decisions from key stakeholders at any one part. Second-life EV batteries can be useful after their first life in an EV. Depending on their health, performance and degradation, their life can be extended in a new EV; they can be repurposed into less demanding applications such as stationary storage or lower power electromobility applications or recycled.

Battery second use (B2U) delays the eventual recycling process. The recycling of EV batteries can be beneficial for batteries of certain chemistries. Notably, Nickel Manganese Cobalt (NMC) batteries are typically recycled to extract high-value materials, such as nickel and cobalt, for use in new EV batteries. This can make recycling these types of batteries profitable. However, some battery chemistries, such as (Lithium Ferrophosphate) LFP, do not create such strong economic value propositions for recyclers.

The alternatives to recycling such batteries are disposal, remanufacturing, or repurposing. Remanufacturing or repurposing offers to extend the battery’s lifetime in a second-life application. Remanufacturing refers to the disassembly of a battery, and this could be to pack-, module- or cell-level. Repurposing a battery is deemed by IDTechEx as more so the integration of batteries into second-life systems only at pack-level, without performing more in-depth disassembly procedures.

Companies in the second-life market have demonstrated the techno-economic feasibility of their systems and repurposing processes. However, many decisions must be made throughout the process to ensure costs are minimized without compromising for final system functionality.

Some key considerations to be made in a full remanufacturing process would include types of battery to be procured, battery grading tests to be used, and depth of battery disassembly. The latter is a key consideration because the battery disassembly process is far from being automated, and therefore human intervention is needed at most if not every step.

Manual labor is a key contributor to overall remanufacturing costs, and increasing the depth of disassembly requires more labor, adding more cost. However, increasing the depth of disassembly allows remanufacturers to use the best-performing cells in their final second-life system. This would increase these systems’ competitivity with new Li-ion battery energy storage systems (BESS) on a performance level.

Indeed, EV battery design also plays a big role in the ease of battery serviceability. EV batteries with a cell-to-pack design create possibilities of faster disassembly times with the absence of a module. Remanufacturers could look to procure such batteries in the future to facilitate the faster creation of second-life systems through the reconfiguration of an EV battery’s best-performing cells.

Some players, such as Connected Energy and ECO STOR AS in Europe, are choosing to integrate second-life stationary storage batteries at pack level, bypassing a strict remanufacturing process with greater depth of disassembly. With pack-level reconfiguration, repurposers reduce safety risks, energy use and costs associated with a full remanufacturing process.

But is there a catch? One consideration is that repurposers would have to ensure that procured batteries are provided to them by an automotive OEM at certain performance specifications, e.g., minimum State-of-Health, internal impedance, etc. This relies on partnerships between both automotive OEMs and repurposers to manage this supply of high-quality batteries while still dealing with batteries that do not meet these minimum performance specifications, for example via recycling.

Ultimately, many considerations must be made when remanufacturing retired EV batteries. Cell-level disassembly and reconfiguration can facilitate the use of the best-performing cells in second-life systems, while trading off increased costs with greater depth of disassembly. However, there are signs that players in the market are leaning toward pack-level integration of second-life batteries to reduce safety risks and disassembly times and costs.

Repurposers are partnering with automotive OEMs to help assure a streamlined supply of high-quality batteries is fed into their repurposing processes. Second-life pack-level integration is a market trend that is expected to continue.

To find out more about the techno-economic feasibility of second-life battery systems, refer to IDTechEx’s new report, “Second-life Electric Vehicle Batteries 2023-2033.” The report also includes more information on the second-life regulatory landscape; battery design, chemistry, and technology developments; battery performance testing and modeling; key player activity; and 10-year forecasts for the second-life market (GWh installed) and EV battery availability.

Comments are closed.