Retailers not hurt by recent economic headwinds such as higher interest rates, gas prices, inflation and declining GDP

Fort Lauderdale, Fla.—Haig Partners LLC has released its Q1 2022 Haig Report that tracks trends in auto retail and their impact on dealership values. Due to record-high earnings, dealership blue sky values have reached new heights. Buy-sell activity is off to a strong start in Q1 2022 with many private and public dealers looking to expand their networks.

Retailers have not been hurt by recent economic headwinds such as higher interest rates, higher gas prices, higher inflation and declining GDP, demonstrating the strength of the auto retail business model.

Highlights from the Q1 2022 Haig Report include:

- The “chipdemic” continues to create extraordinarily favorable conditions in auto retail

- The average publicly owned dealership made $7.1M in LTM Q1 2022, 10% higher than year-end 2021

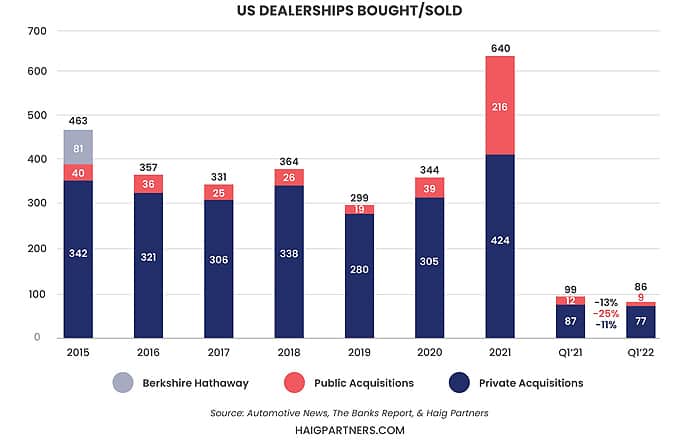

- Public company spending on US auto acquisitions was $588M in Q1 2022, 35% higher than Q1 2021

- Public equity valuations are 100% higher than they were before the Pandemic

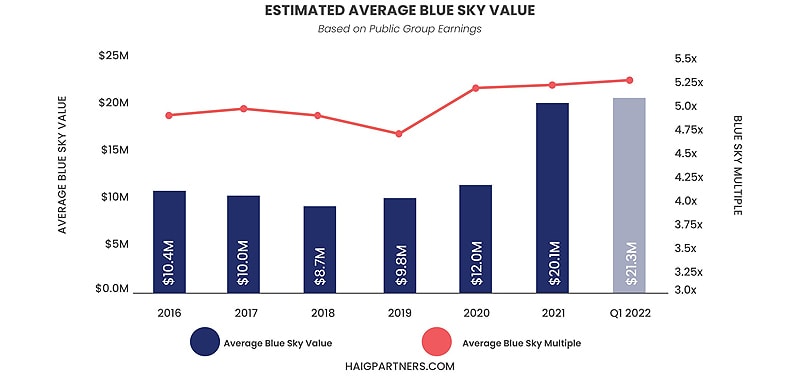

- Average blue sky values rose an estimated 117% from the end of 2019 and are at record-high levels

- Current general economic indicators are having little impact on the auto retail industry as pent-up demand drives record profits for dealerships

- The near to mid-term outlook for dealerships appear bright, but threats such as continued consolidation, EVs, and “The Agency Model” are emerging

“The first quarter of 2022 may bring auto dealers their highest profits ever. This is a uniquely good time to be an auto dealer,” said Alan Haig, President of Haig Partners. “It raises the question as to how much longer these conditions can last. Our math indicates that the level of pent-up demand is so high that it will take three or more years before consumers will be satisfied and we would return to a situation where supply and demand would be in balance again. During that time, dealers should enjoy profits that are elevated above the years before the pandemic and chipdemic. Even so, there are risks on the horizon for dealers that include continued consolidation by the public retailers and ‘The Agency Model’ being pushed from the OEMs.”

For more findings from the Q1 2022 Haig Report and the impact consolidation has on automotive retail, register for the upcoming NADA webinar, “The Future of Auto Retail and How Tomorrow is Impacting Today’s Buy-Sell Activity,” taking place on June 8.

Download the full Q1 2022 Haig Report at www.haigparners.com/haig-report.

Comments are closed.