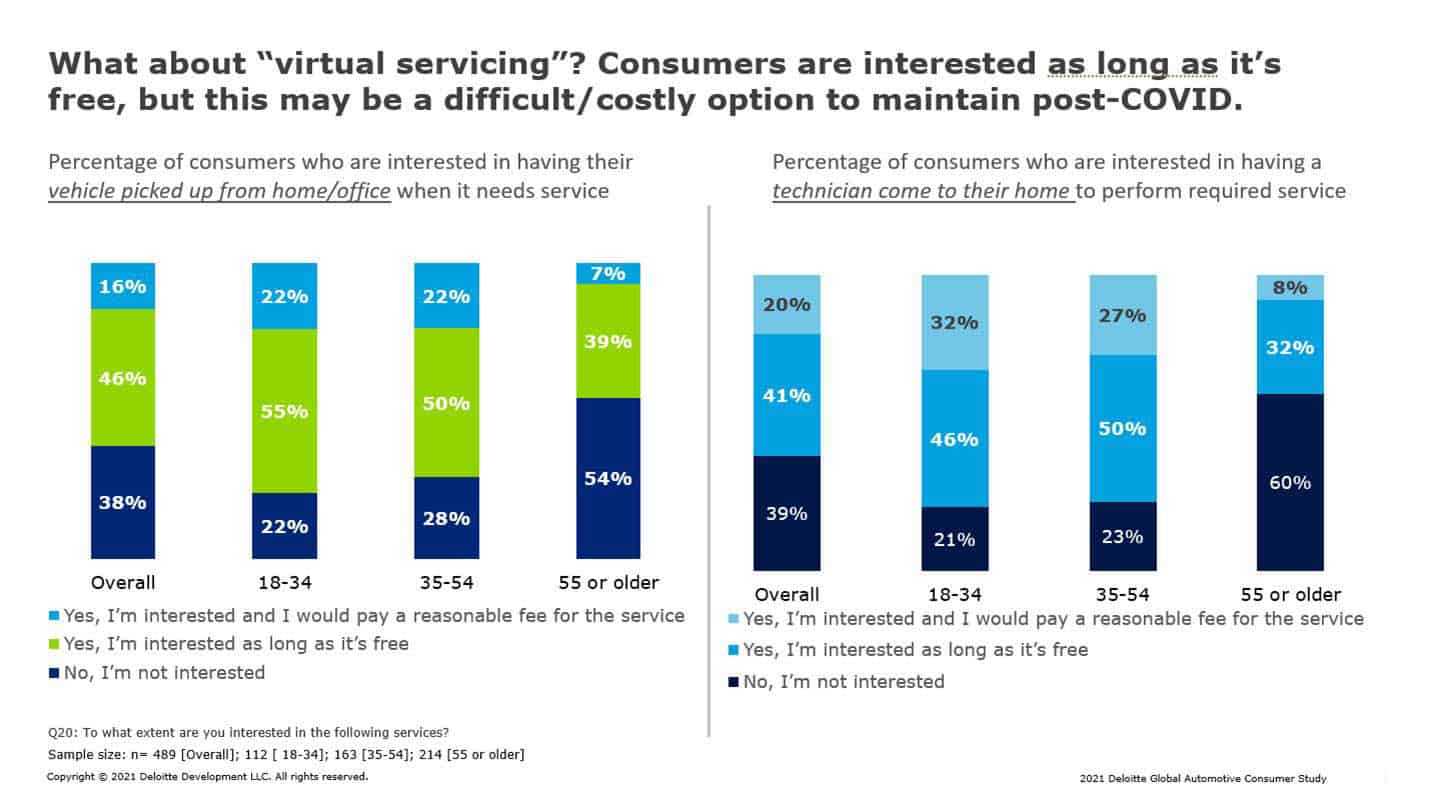

More than 60 percent of surveyed consumers say they would be interested in having a professional technician come to their home to perform required service

The global automotive industry, similar to every industry throughout the global movement economy, faced significant challenges throughout 2020.

As the novel coronavirus pandemic started, supply chains became distressed as suppliers and automakers were forced to shut down plants; dealerships shifted to digital and contactless selling channels; and repair facilities were left in search of quality parts.

As calendar year 2020 came to a close, three words that came to mind were those stated by Joe Kyrikoza, vice president and general manager at IHS Markit — the recovery continues.

As of this writing, light vehicle sales are recovering at rates exceeding expectations forecasted throughout the pandemic, although the market showed some signs of weakness the two months leading into the holidays. In the fourth quarter of 2020, U.S. light vehicle sales were down 2.4 percent compared to the previous year. And overall, car and light truck sales dropped nearly 15 percent, the lowest total since 20121.

On the supplier side, optimism is increasing according to the Original Equipment Suppliers Association’s (OESA) Q4 2020 Supplier Barometer. Regardless of revenue size, according to the report, responses indicate a much-improved outlook in comparison to the third quarter. The ongoing pandemic remains the greatest threat to the industry, but those fears have eased. Labor constraints are impacting suppliers’ ability to fulfill volumes in the face of the pre-mentioned improving sales.

“Automotive manufacturers are taking a hard look at the resiliency of a globally integrated supply chain brought to its knees by parts production disruptions in China even before the coronavirus spread around the world,” Deloitte’s automotive leaders said in its July publication, “Restarting the global automotive engine.”

Focusing on independent repair facilities in the U.S., 91 percent of shops reported a decrease in revenue this year while 1.3 percent do not expect to financially recover, according to IMR. The aftermarket, or replacement business is known for its resiliency in the midst of crises.

“The interesting thing about this pandemic isn’t that it’s led to new trends or changed the trends. What it has done is turbocharged them. Things that might have happened five years out, are happening sooner. And they are happening in greater volume. We’ve seen that with digitalization, with e-tailing, with consolidation pressures in the industry,” Paul McCarthy, president of the Automotive Aftermarket Suppliers Association (AASA), said during the Automotive Aftermarket Summit 2020 on December 3 in Shanghai.

In Deloitte’s 2021 Global Automotive Consumer Study, an annual analysis of automotive consumer behaviors and trends impacting the rapidly evolving global mobility ecosystem, we found that nearly 70 percent of consumers in the United States have no plans to alter their timeline for acquiring next vehicle because of the COVID-19 pandemic.

Of those surveyed, 17 percent stated they will acquire their next vehicle later than originally planned. And more than 60 percent of surveyed consumers said they would be interested in having their vehicle picked up from their home or office when it needs service, with 20 percent of those stating they would even pay a reasonable fee for that service.

Topics we expect to be of interest and stealing headlines in 2021 include:

- The continued adoption of electric vehicles worldwide;

- Continued consolidation throughout the supplier and aftermarket networks;

- Global trade and tariff policies;

- Aftermarket pricing evolves to better manage analytics, market strategy, product know-how, and business considerations;

- And an increasing focus on sales and service in our ‘new world’ of safety-related precautions.

We should also expect to see vehicle miles traveled (VMT) continue to return to pre-pandemic levels. The unknown at this point, from our perspective, is whether the shift to online parts sales will continue to increase or professional technicians and DIY customers will return to in-store purchasing. If the shift to online sales continues, suppliers, retailers, and warehouse distributors should continue working closely together to ensure on-time delivery of parts and repair of vehicles.

These shifts are adding to the complexity of the aftermarket industry’s multi-layered ecosystem with varying degrees of interaction across different players and this ecosystem is rapidly expanding with new entrants that are trying to protect and grow their market share. These shifts will likely require more sophistication in collecting and synthesizing data to uncover insights into price setting and execution, consumer behavior, and market trends. Developing strategies to effectively create, communicate, and capture value and fulfilling demand across channels will likely be required.

Both the automotive new vehicle sales and automotive aftermarket businesses proved to be resilient in the midst of the ongoing COVID-19 pandemic. While there will be challenges to overcome in early 2021, the industry will likely show its strengths throughout the year as it continues to provide the right parts at the right time at the right price. And maintaining a healthy global supply chain infrastructure will be vital.

Jason Coffman is a principal in Deloitte’s Consulting practice with more than 25 years of combined industry and consulting experience. He currently leads Deloitte’s Automotive Supplier practice overseeing Consulting, Advisory, Tax, and Audit.

1 IHS Markit Automotive and the Alliance for Automotive Innovation

Disclaimer

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor.

Comments are closed.