Led by Tesla, electric vehicle prices fall in January as sales continue to slow; new EV prices declined to $55,715

Atlanta—New vehicle prices climbed to a new January record last month, according to estimates released this week by Kelley Blue Book, beating the previous high established in January 2023. New vehicle prices last month fell from the record high set in December 2025.

The monthly decline was seasonally normal, as prices typically decline as the market takes a breather after strong year-end results, when luxury vehicles account for a higher mix of total sales. Sales incentives were lower last month as well, as automakers pulled back to protect margins.

- In January, the ATP for a new vehicle was $49,191, a 1.9% increase from year-earlier levels and, according to Kelley Blue Book records, an all-time high for January. The ATP last month was down 2.2% from December, a seasonally normal decline. The December 2025 record ATP was revised down to $50,318.

- The average new vehicle manufacturer’s suggested retail price (MSRP) — commonly called “the asking price” — in January also climbed higher compared to year-earlier estimates. At $51,288, the average MSRP was 2.1% higher year over year, an increase below long-term averages. Typically, MSRPs show an annual increase of approximately 3% in January. The average MSRP has been above $50,000 for 10 straight months, according to Kelley Blue Book estimates.

- Automakers reduced sales incentives in January. Last month, the average incentive package was equal to 6.5% of ATP, or roughly $3,200. A year ago, incentives averaged 7.1%; in December, incentives averaged 7.5% of ATP, the highest point in 2025. Last month, sales incentives were strongest for luxury vehicles and full-size pickup trucks; full-size SUVs, compact cars, and midsize cars had among the lowest incentive levels.

- In January, the best-selling vehicle segment was again the compact SUV segment (e.g., Toyota RAV4, Honda CR-V, Nissan Rogue and Chevrolet Equinox), where ATPs were $36,414, down 0.4% year over year in an industry that recorded a 1.9% gain. The popular compact SUV segment is a reminder that many excellent vehicles are available at more than 25% below the industry average.

- In January, with the subcompact Mitsubishi Mirage all but gone, the U.S. market no longer has a new vehicle with an average MSRP below $20,000. Last month, the Nissan Versa, with an average MSRP of $22,315, took up the mantle as America’s most affordable vehicle, but the role will be short-lived as reports suggest production of the Nissan Versa ended in December.

- Popular full-size pickup trucks continue to pull the industry average higher. The average MSRP in January for a full-size pickup was above $70,000 for the fifth consecutive month; despite sky-high prices, more than 150,000 were sold. For comparison, the subcompact car segment, where the average MSRP was less than $26,000 in January, fails to attract buyers. Less than 4,000 subcompact cars were sold last month.

“January’s pricing story is really a reminder of how much mix still matters in this market,” said Erin Keating, executive analyst at Cox Automotive. “We hit a new January high even as prices naturally pulled back from December’s luxury-heavy finish. Consumers are still finding plenty of options below the industry average, especially in core segments like best-selling compact SUVs, but the disappearance of true entry-level vehicles continues to lift the floor higher. At the same time, strong sales of full-size pickups and large, luxury SUVs keep pulling the averages up, proving that demand for high-priced models remains incredibly resilient.”

Led by Tesla, EV Prices Fall in January as Sales Continue to Slow

- New electric-vehicle (EV) prices declined to $55,715 in January. Average transaction prices were lower by 0.6% compared to year-earlier levels and down 3.1% from December.

- Incentives for EVs fell notably in January, to an average of 12.4% of ATP, down from an upwardly revised 18.3% in December and below the 12-month average of 13.7% in 2025. Still, at 12.4% of ATP, EV sales incentives continue to be well above industry averages.

- Tesla, which accounted for approximately 60% of total EV sales in January, had an ATP of $52,628 in January according to Kelley Blue Book estimates, down from $53,678 in December. Compared to January 2025, Tesla prices were lower by 2.2%, in an industry that saw ATPs rise by 1.9%.

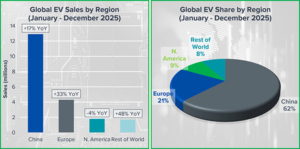

- EV sales in January are now being estimated by Kelley Blue Book at just over 66,000 and were lower year over year by nearly 30%. Compared to December, EV sales were down by approximately 20%, slightly better than the industry’s monthly decline of 25.4%.

Comments are closed.