Toyota remains a mainstay in California, continuing to capture the largest segment of new car sales market share at 17.4 percent, followed by Tesla, then Ford

Sacramento, Calif.—Franchised new car dealers in California are trying to catch up with high demand despite a decline in new car sales in the third quarter of 2022.

The weakened economy, supply chain issues, labor availability, and chip shortages all lead to predictions that new vehicle registrations in 2022 will only hit 1.68 million by the end of the year (lower than anticipated last quarter).

Year-to-date, new vehicle sales in the United States dropped 13 percent as compared with 2021. Comparatively, California’s decline in sales slipped 16.1 percent when compared to the first nine months of 2021. While Q3 posted a statewide double-digit light vehicle registration decline for the fourth quarter in a row, that streak is expected to end as we reach the end of 2022 and anticipate an increase in these registrations.

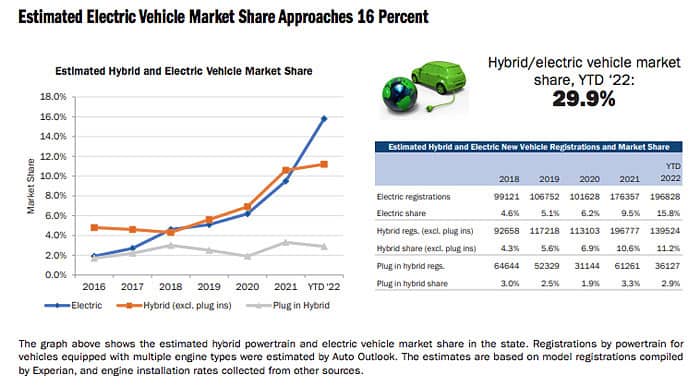

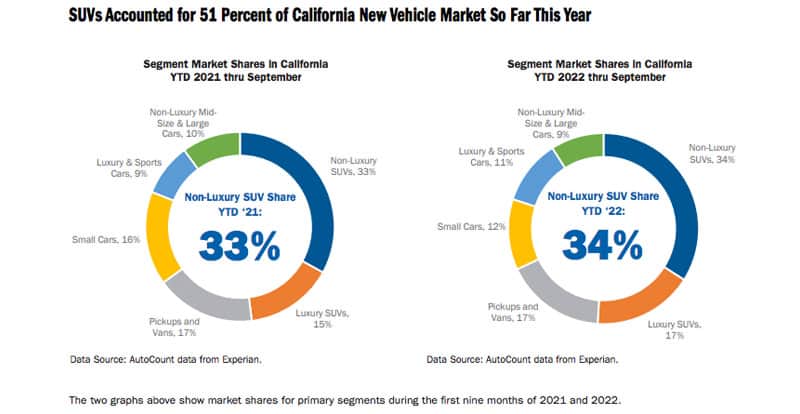

Year over year, SUVs (both luxury and non-luxury) have increased market share by three percent, increasing from 48 percent in Q3 2021 to 51 percent in Q3 2022. The estimated electric vehicle (EV) market share hit 15.8 percent. Overall, this year the hybrid/ EV market share is at 29.9 percent.

“As California’s economy remains uncertain, statewide franchised new car dealers are encouraged by the continued strong consumer demand for vehicles of all makes and models,” said California New Car Dealers Association Chairman, John Oh, General Manager, Lexus of Westminster.

“Our dealers are anxiously awaiting an inventory influx of both internal combustion engine and electric vehicles from our manufacturers. We have long-standing relationships with our loyal customers and we’re ready and willing to help get them the vehicles they desire today. We simply need our manufacturers to make and send us more cars,” said Oh.

Brand Market Share

Toyota remains a mainstay in California, continuing to capture the largest segment of new car sales market share at 17.4 percent, followed by Tesla, then Ford rounding out the top three brands in California. Both Tesla and Genesis increased new vehicle registrations for Q3, while all other brands saw declines. Hybrids excluding plug-in registrations also rose year-to-date up to 11.2 percent; however, plug-in hybrid registrations declined slightly from last year, only reaching 2.9 percent of registrations so far this year.

Segment Market Share

Midsize vehicles are performing much better than the overall market only down 13.2 percent while the industry average sits at 21.6 percent lower than last year. Two-row SUVs have been gaining market share in their segment, up 3.3 percent from 2019. Light trucks accounted for 68.3 percent of the California new vehicle market compared to 78.9 percent in the nation.

Model and Brand Rankings

The Tesla Model Y remains the top-selling light truck in the California market with 61,544 registrations this year. In second place: the Toyota RAV4 with 44,738 units sold. The top-selling passenger car model YTD in the state is the Tesla Model 3 with 56,851 registrations and the Toyota Camry came in second with 40,350 registrations capturing 10.2 percent of the market share. As with last quarter, the state’s top-selling mainstays were impacted by inventory shortages.

Regional Variances

Both Northern and Southern California performed similarly in terms of the percentage of change year to date, with percentage declines of 16.2 and 16.8, respectively. As with last quarter, the San Francisco Bay market was least affected by the decline in sales, but only marginally showing a percentage drop of 13.3 while LA and Orange counties declined by 17.9 percent and San Diego dropped by 14.5 percent.

Comments are closed.