EVs continue to lead the way when it comes to automotive complexity and their repair represents a significant cost delta over ICE vehicles

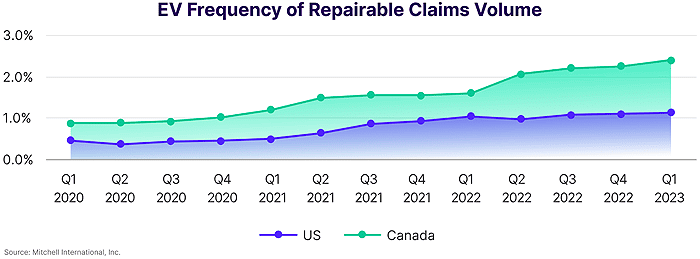

San Diego—In Q1 2023, electric vehicle (EV) repairable claims frequency rose to 1.13% in the US and 2.41% in Canada, up a modest 0.03% and 0.15% respectively, according to Mitchell’s latest Plugged-In: EV Collision Insights publication.

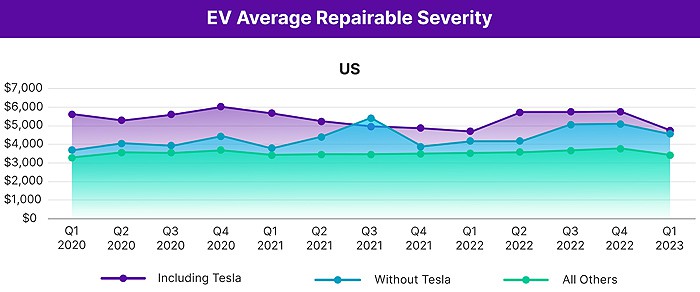

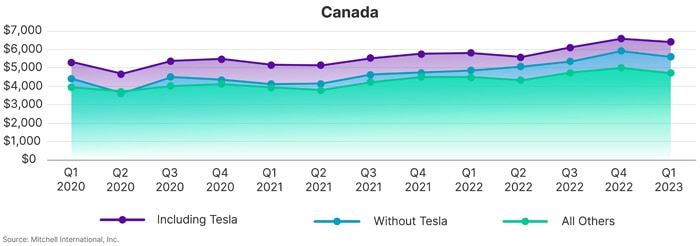

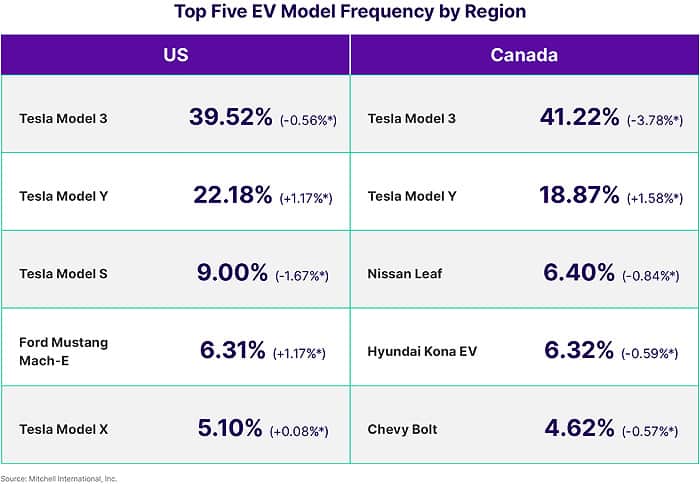

While Tesla remains the dominant player, the company’s U.S. market share of repairable vehicles fell in Q1 2023 to 75.8% of all EVs repaired, down from 76.78% in Q4 2022. The Ford Mustang Mach-E continued to capture additional repairable market share as it maintained fourth position in U.S. EV frequency.

The Cadillac LYRIQ and Rivian R1S sport utility vehicles entered U.S. collision repair facilities for the first time in Q1 2023, with the Rivian R1T slowly gaining ground as well, but still well outside the top 10 most frequently repaired EVs.

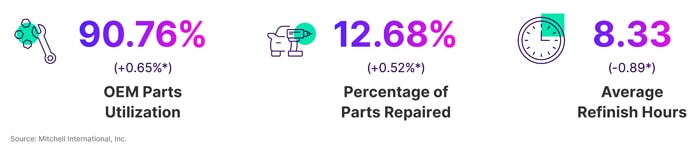

EVs continue to lead the way when it comes to automotive complexity and their repair represents a significant cost delta over vehicles with internal combustion engines (ICEs). In the previous Plugged-In: EV Collision Insights report, Mitchell noted that EVs not only require more mechanical labor hours on average than their ICE counterparts, but also more refinish hours with an average of 8.33 compared to 7.4 for the rest of the market.

A closer look at these numbers by vehicle make reveals that Tesla accounted for the largest portion of this delta since 34.28% of Tesla repairs were written for a three-stage refinish operation — adding 7.83% of additional cost to the overall repair.

As EV adoption increases, the impact to industry stakeholders is expected to grow. Collision repairers will face additional training, tooling and equipment requirements to properly and safely restore these interconnected vehicles to OEM standards.

Automotive insurers, on the other hand, will need to account for higher than average repair costs and cycle time when determining policyholder premiums. Today, there are approximately 160,000 public EV charging ports in the US and 20,000 in Canada. However, S&P Global Mobility predicts that the US will triple its number of publicly available EV chargers by 2027 to meet expected consumer demand and financial investments made through the National Electric Vehicle Infrastructure program.

Likewise, the Canadian government has set an objective of adding 50,000 public charging ports by 2030. AGraham Evans, research and analysis director at S&P Global Mobility, stated, “For mass-market acceptance of battery electric vehicles (BEVs) to take hold, the recharging infrastructure must do more than keep pace with EV sales. It must surprise and delight vehicle owners who will be new to electrification, so that the process seems seamless and perhaps even more convenient than their experience with gasoline refueling, with minimal compromise on the vehicle ownership experience.”

*Difference between Q1 2023 and Q4 2022

Comments are closed.