Potential for hurricane development and forecasts of an expanding heat dome over Texas, Oklahoma, and Kansas next week could push oil prices higher

Washington, D.C.—The national average for a gallon of gas went five cents higher since last week, despite lower demand and the price of oil falling several dollars per barrel and struggling to stay above $80.

But the potential for hurricane development and forecasts of an expanding heat dome over Texas, Oklahoma, and Kansas next week could push oil prices higher. Refineries in these states may have to curb production to deal with the high temperatures.

“The heat is returning, and we are also entering the heart of hurricane season,” said Andrew Gross, AAA spokesperson. “While fewer drivers are fueling up at the moment, these looming weather concerns are a roadblock to falling pump prices. Gas prices may keep waffling until mid-September or longer.”

According to new data from the Energy Information Administration (EIA), gas demand slid from 9.30 to 8.85 million b/d last week. Meanwhile, total domestic gasoline stocks slightly decreased from 216.4 to 216.2 million bbl. Although demand has fallen, fluctuating oil prices have kept pump prices elevated.

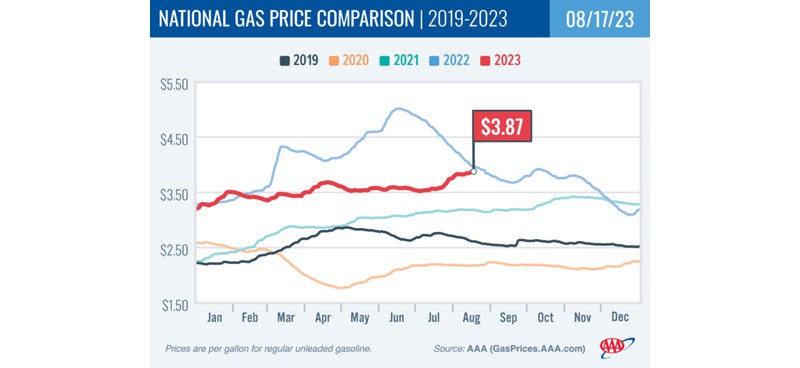

Today’s national average of $3.87 is 31 cents more than a month ago but seven cents less than a year ago.

Quick Stats

Since last Thursday, these 10 states have seen the largest increases in their averages: Arizona (+20 cents), Indiana (+17 cents), Michigan (+16 cents), Utah (+14 cents), Illinois (+12 cents), West Virginia (+9 cents), Wisconsin (+9 cents), California (+9 cents), New Mexico (+9 cents) and Kansas (+8 cents).

The nation’s top 10 most expensive markets: California ($5.18), Washington ($5.03), Hawaii ($4.79), Oregon ($4.69), Alaska ($4.49), Nevada ($4.42), Utah ($4.23), Arizona ($4.19), Illinois ($4.17) and Idaho ($4.10).

Oil Market Dynamics

At the close of Wednesday’s formal trading session, WTI decreased by $1.61 to settle at $79.38. Oil prices declined yesterday amid ongoing concern that if interest rates continue to increase, the economy could tip into a recession. If it does, oil demand and prices would likely decline. Additionally, the EIA reported that total domestic commercial crude inventories decreased from 445.6 to 439.7 million bbl.

Comments are closed.