Aftermarket service facilities, however, can increase customer loyalty and revenue by taking advantage of what they do best — being easier to do business with

Troy, Mich.—Quick oil change, full-service maintenance and repair, and tire replacement segments all received declining grades in a survey released this week. Customer satisfaction is lower for the performance of the service advisor, specifically noting increased wait times, and fewer advisors providing helpful advice. There is also lower satisfaction with service advisor courtesy.

According to the J.D. Power 2023 U.S. Aftermarket Service Index (ASI) Study, released on Tuesday, overall satisfaction declines year over year in the three segments that comprise the study (based on a 1,000-point scale): quick oil change (-18 points); full-service maintenance and repair (-7); and tire replacement (-6).

“Independent service providers must remain focused on retaining their customer base,” said Leonard Martin, director of automotive retail at J.D. Power. “Aftermarket service facilities can increase customer loyalty and revenue by taking advantage of what they do best — being easier to do business with. Convenience, speed and price are very attractive to today’s vehicle owners who are looking for excellent service, and aftermarket service providers can leverage those factors to stem the tide of owners going to dealerships.”

The study, now in its fourth year, measures customer satisfaction with aftermarket service facilities, providing a numerical index ranking of the highest-performing facilities in the U.S. aftermarket. Performance in the three segments — full-service maintenance and repair, quick oil change, and tire replacement — is based on the combined scores for seven measures that comprise the vehicle owner service experience. These measures are (in alphabetical order): ease of scheduling/getting vehicle in for service; fairness of charges; service advisor courtesy; service advisor performance; service facility; time to complete service; and quality of work.

A detailed look at the drivers of satisfaction in each segment reveals that satisfaction with quick oil change declines in all seven measures, with the largest decline in service facility (-22); satisfaction with full-service maintenance and repair declining in six of seven measures, with satisfaction only improving in ease of scheduling (+3); and tire and replacement declining in six of seven measures, with satisfaction improving only with time to complete service (+1).

Following are key findings of the 2023 study:

- Aftermarket service providers’ customer advocacy keeps up with dealers: The Net Promoter Scores (NPS) of independent service providers are competitive with those of franchised dealerships when comparing service visits for model-year 2020-2023 vehicles included in the 2023 ASI and the J.D. Power 2023 U.S. Customer Service Index (CSI) Study. Independent service providers have an NPS score of 54 for full-service maintenance and repair, while dealerships have a score of 51. The NPS scores for tire replacement are 57 among dealerships and 56 among independent tire stores. NPS scores for oil changes are 54 for dealerships and 47 for quick oil change providers.

- Quick and easy facility fixes that improve satisfaction: Improving satisfaction at independent service centers can be as simple as providing complimentary snacks or electrical power for customers’ electronic devices. The three amenities that have the largest effect on satisfaction are offered less than 15% of the time. Service facility satisfaction is 825 when complimentary snacks/beverages are offered, a 91-point increase vs. when they are not (734). Similarly, facility satisfaction is 81 points higher when providers make a device charging station available than when this amenity is not offered (735). Giving customers a workspace to plug in computers is another easy way to boost satisfaction yet is currently provided only 7% of the time.

- Aftermarket service providers can get a revenue jolt: The ever-increasing electric vehicle (EV) marketplace service needs and shorter length of service intervals is creating an opportunity for aftermarket service providers. The study finds that tire repair and replacement needs for EVs trend much higher than the industry average for internal combustion engine (ICE) vehicles. The types of work being done at a higher rate on EVs than the industry average include tire maintenance (49% vs. 28%, respectively); tire repair (41% vs. 12%, respectively); and tire replacement (34% vs. 21%, respectively).

“Aftermarket service providers can benefit from an increase in tire replacement and repair business as automakers offer more EVs,” Martin said. “The heavier EV weight due to batteries coupled with the instant torque results in more tire wear and tear, which is an opportunity for the aftermarket industry.”

Study Rankings

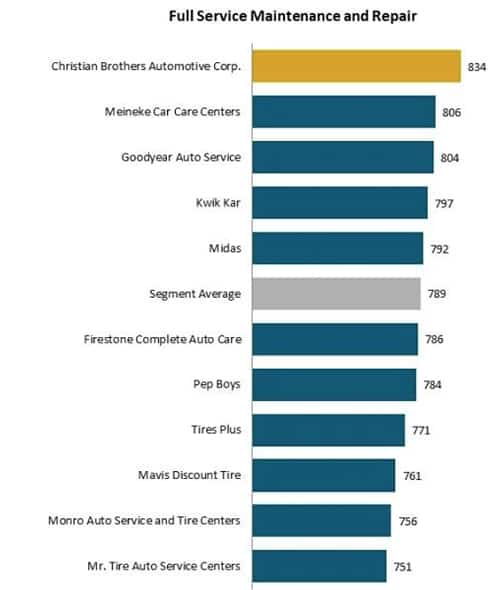

• Christian Brothers Automotive Corp. ranks highest in satisfaction for full-service maintenance and repair for a fourth consecutive time, with a score of 834.

• Meineke Car Care Centers (806) ranks second.

• Goodyear Auto Service (804) ranks third.

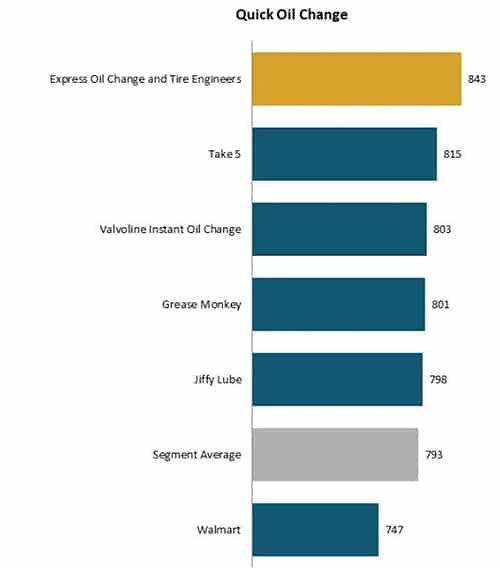

• Express Oil Change and Tire Engineers ranks highest in satisfaction for quick oil change with a score of 843.

• Take 5 (815) ranks second and Valvoline Instant Oil Change (803) ranks third.

• Goodyear Auto Service ranks highest in satisfaction for tire replacement with a score of 840.

• Discount Tire ranks second (835) and Jiffy Lube (832) ranks third.

The 2023 U.S. Aftermarket Service Index (ASI) Study is based on responses from 11,194 vehicle owners. Survey data collection was conducted online from January through March 2023. Survey respondents were initially selected from online consumer panels. Respondents were screened for having aftermarket service performed in the past 12 months.

Comments are closed.