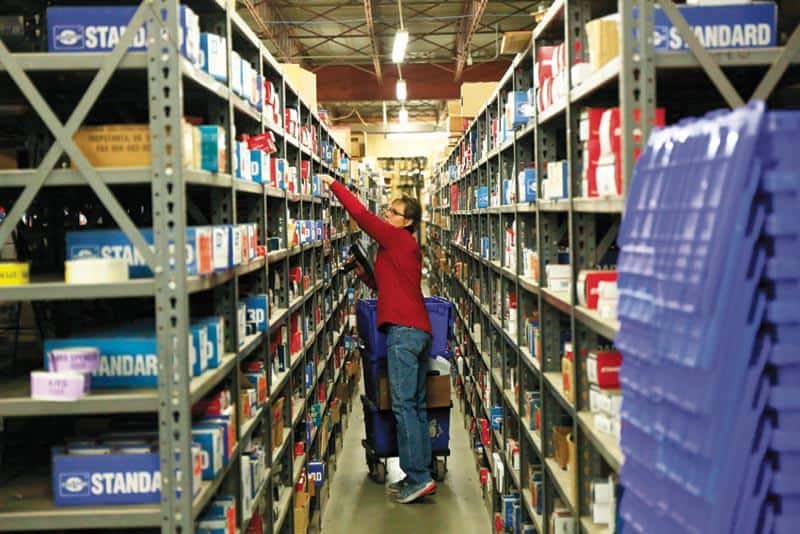

Manufacturers that control large warehouse product share in the traditional channel across major product categories are generally unaware of the lost sales

Fort Wayne, Ind.—The “2022 Lang Aftermarket Annual” reveals that leading car and light truck brands averaged a 64-percent annual share loss in 2020 at the service and repair shop level compared to their strength among warehouse distributors.

“This massive ‘Brand Share Shrink’ has increased dramatically in recent years and amounts to billions of dollars of lost sales suffered at the hands of competitors who remain largely hidden to leading brands at the warehouse level,” states the analysis.

The following are a few takeaways from the report.

Brand Share by Distribution Levels

Leading brands have different sales shares at various levels of the traditional aftermarket channel (traditional warehouses and jobbers engaged in two and three-step distribution).

Brand Share Shrink

Many leading aftermarket brands suffer a large loss of sales share and volume as their products pass through the multiple levels of the traditional distribution system.

Warehouse Brand Strength

Lang Marketing measures the annual strength of the five leading aftermarket brands across 75 product categories at different levels of the traditional distribution system. In this analysis, the five leading brands vary by major product categories.

In 2020, the five leading brands within each of 75 product categories combined for an average of 83 percent warehouse share. Over the past 10 years, the combined average share of the top five brands has steadily increased in many product categories.

Declining Product Share by Distribution Level

The five leading brands in each of these 75 major product categories (leading brands vary by product) declined significantly in share between the warehouse and service and repair shop levels of the traditional channel from 2010 to 2020.

Large Share Shrink

There was a 56-percent drop (Brand Share Shrink) between the warehouse and service and repair shop levels in the combined share of the top five brands across 75 product categories during 2010, increasing to 61 percent by 2015.

By 2020, the Brand Share Shrink between the warehouse and service and repair shop levels climbed to a 64-percent average.

Shrinking Dollar Volume

Leading brands experienced an $8.3 billion loss in 2010 product sales among service and repair shops compared to what their sales would have been had they achieved the same 2010 share among these service outlets that they captured at the warehouse level.

The Brand Share Shrink of leading brands between the warehouse and service and repair shop levels increased between 2010 and 2020, resulting in greater sales losses for leading brands.

Over $10 Billion Lost in 2020 Sales

In 2020, leading brands lost $10.4 billion in aftermarket product sales among service and repair shops compared to the combined sales that they would have achieved had they maintained the same share among these service outlets that they captured with warehouses.

Hidden Competitors Increase Their Product Volume

The manufacturers who control large warehouse product share in the traditional channel across major product categories are generally unaware of the billions of dollars in sales that they are losing (by the time their brands reach service and repair shops) to competitors whose tactics remain largely “hidden” to them.

Hidden competitors have increased the product volume that they are taking from leading brands at the warehouse level by one-quarter since 2010, up $2.1 billion over 10 years.

Much of the increase in product volume by hidden competitors has resulted from the surge of the foreign nameplate aftermarket, which has a large share of its service and repair shop volume generated by OE-supplier, foreign, and OE brands.

Much of this foreign nameplate product volume reaches service and repair shops through two-step sellers and channels other than traditional distribution.

Comments are closed.