Deloitte’s 2023 outlook explores five manufacturing industry trends that can help organizations turn risks into advantages and capture growth

New York—Despite supply headwinds, labor shortages, and an uncertain economic environment, the manufacturing industry continues to surpass the expectations of previous years. To maintain this growth, leaders should leverage digital technologies, adopt strategies for the future of work, and drive supply chain resiliency. Deloitte’s 2023 outlook explores five manufacturing industry trends that can help organizations turn risks into advantages and capture growth.

Competing in the current market demands a new approach

Manufacturing has demonstrated continued strength in 2022, building on the momentum it gained emerging from the pandemic, and surpassing expectations from the prior two years. While overall demand and production capacity have hit recent highs, there are indications that the near-term outlook may not be as bright.

The industry is currently experiencing concerns related to inflation and economic uncertainty. In addition, manufacturers continue to grapple with talent challenges that may limit the industry’s growth momentum. Moreover, supply chain issues including sourcing bottlenecks, global logistics backlogs, cost pressures, and cyberattacks will likely remain critical challenges in 2023. As leaders look beyond leading amid disruption and revamp their approach, Deloitte’s 2023 manufacturing industry outlook examines five important trends to consider for manufacturing playbooks in the year ahead.

Five manufacturing industry trends to watch

- TECHNOLOGY: Investing in advanced technologies to help mitigate risk

Manufacturers have increased their digital investment over the past few years and accelerated the adoption of emerging technologies. Companies with higher digital maturity have shown greater resilience, as did those that accelerated digitalization during the pandemic. Continued investments in advanced manufacturing technologies can help develop the required agility.

2. TALENT: Implementing a broad range of talent management strategies to reduce voluntary exits

Addressing the tight labor market and workforce churn amid shifting talent models is expected to remain a top priority for most manufacturers in 2023. Despite a record level of new hires, job openings in the industry are still hovering near all-time highs. Additionally, voluntary separations continue to outnumber layoffs and discharges, indicating substantial workforce churn. This prevailing workforce shortage, elevated by supply chain limitations, is reducing operational efficiency and margins. Manufacturers are pursuing several approaches to strengthen their talent retention strategy.

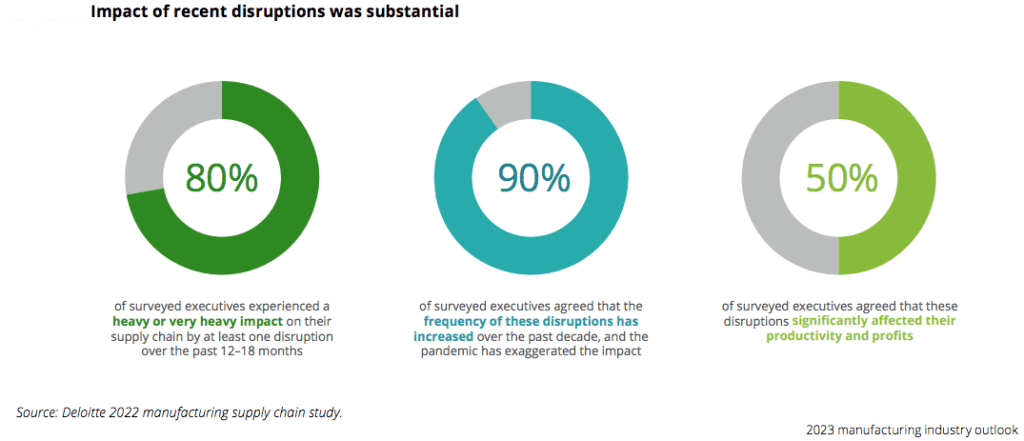

3. SUPPLY CHAIN: Relying on time-tested mitigation strategies with enhanced tactics to achieve supply assurance

Of surveyed executives, 72% believe the persistent shortage of critical materials and the ongoing supply chain disruptions present the biggest uncertainty for the industry, even in the coming year. Manufacturers are mitigating these risks not only with increased utilization of digital technology but also with time-tested approaches including building local capacity and moving from just-in-time sourcing to create redundancy in the supply chain.

4. SMART FACTORY: Taking a holistic approach to smart factory initiatives to unlock new horizons

Manufacturers will likely continue progressing toward smart factory transformations, as these initiatives drive future competitiveness. Many manufacturers are making investments in laying the technology foundation for their smart factories. One in five manufacturers is already experimenting with underlying solutions or actively developing a metaverse platform for their products and services.

5. SUSTAINABILITY: Focusing on corporate social responsibility

The fast-evolving environmental, social, and governance (ESG) landscape may require close monitoring in 2023 for manufacturers. Many organizations voluntarily comply with a complex network of reporting regulations, ratings, and disclosure frameworks. But regulators globally are also moving toward requiring more disclosures for nonfinancial metrics. Manufacturers are progressing toward their ESG commitments by making operational changes across their value chains.

Comments are closed.