The study examines revenues per bay, increasing revenues, parts markup strategies, the technician shortage and more

Cambridge, Mass.—Results from a survey of 618 shop owners and managers, including a smaller group of service advisors and technicians, has shed light on the state of general repair shops in the U.S. The study, a benchmark report by PartsTech, examines revenues per bay, increasing revenues, parts markup strategies, the technician shortage and more.

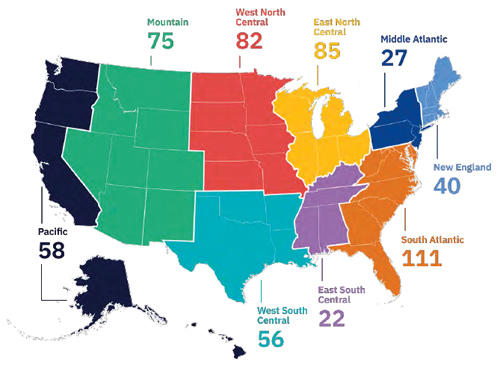

Survey respondents were from within the nine Census Bureau divisions, as shown below.

The following are key takeaways from the report.

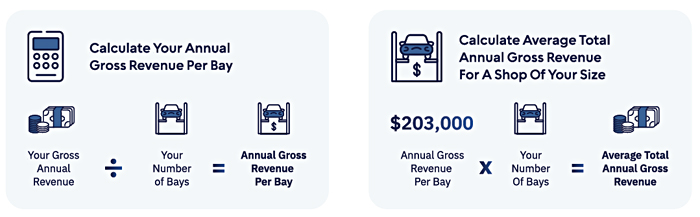

The Average Annual Gross Revenue per Bay is $203,000

How does your shop’s revenue compare? Find out if your shop’s gross revenue is aligned with the majority of shops in the United States or if your revenue falls above or below average.

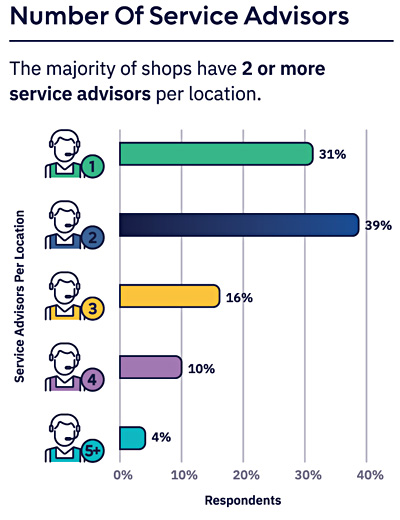

Hiring a Second Service Advisor Can Increase Gross Annual Revenue by $35,000 Per Bay

PartsTech compared annual gross revenue per bay between shops with one service advisor and those with two service advisors. Its analysis revealed an average gross revenue of $35,000 higher per bay per year for those with two service advisors per location compared to those with only one service advisor.

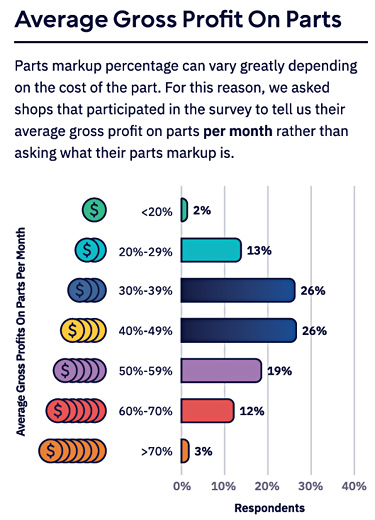

67% of Respondents Should Consider Changing Their Parts Markup Strategy

Parts markup percentages can vary greatly from part to part depending on the cost, and as such, rather than asking shops what their parts markup is, PartsTech asked about their average gross profits on parts per month.

The report states that while the top averages were tied between a gross profit on parts of 30-39% and 40-49% per month, this falls below the benchmark range recommended by industry experts of 55% to a more optimal benchmark of more than 60%.

With this benchmark range in mind, PartsTech suggests that 67% of respondents should prioritize updating their parts markup strategy to achieve a 55-60% gross profit on parts so they are not leaving money on the table.

Amidst the Technician Shortage, Only 3% of Respondents Are Prioritizing Improving Employee Turnover and Retention

PartsTech surveyed participants on their top anticipated challenge over the next 5 years; 45% highlighted “The Technician Shortage” as the top concern. Though when asked about their top three goals for the next 12 months, there’s a gap between this tech shortage challenge and the action plans and steps needed to address it.

And yet despite a significant technician exodus, only 3% intend to “Improve Employee Turnover/Retention.” Similarly, other goals that directly and indirectly address the technician shortage, such as “Implementing New Tools and Technology” (7%) and “Attending Training and/or Sending Team to Training” (8%), ranked low in priority, according to the report.

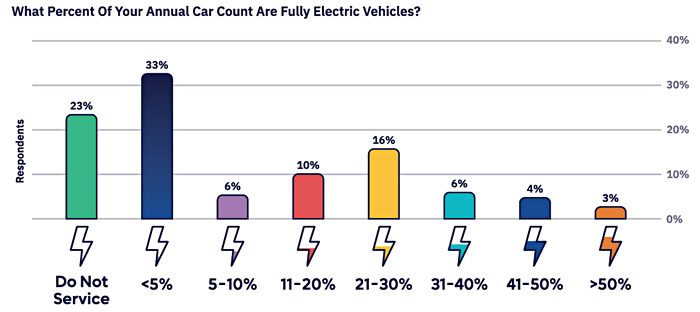

Ensuring Technicians Receive EV Training Alleviates Concerns About Future EV Challenges

PartsTech states that 28% of all respondents identified “EV” as their anticipated top challenge. When considering respondents whose teams have not received EV service training yet, 39% selected “EV” as their top challenge, ranking only second to the “Technician Shortage.”

However, according to the report, only 15% of respondents whose teams have received EV training selected it as their top anticipated challenge. PartsTech noted that this suggests that proactively sending technicians to regular EV training prepares shops with the knowledge and confidence to enter the service and repair EVs.

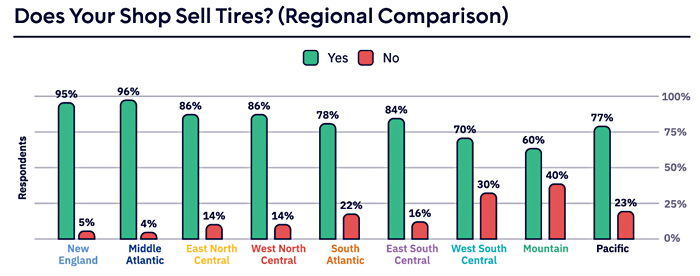

Tire Sales — A Service Expansion Opportunity in the East North Central, West North Central, and South Atlantic Regions

Tires emerged as one of the top 10 ordered “parts” by shops in the East North Central, West North Central, and South Atlantic regions in 2023, according to PartsTech, noting that this is a trend not observed in the remaining six regions.

However, the report states that in both the East North Central and West North Central regions, 14% of survey respondents indicated that their shop does not sell tires, and 22% in the South Atlantic region said the same.

The entire report can be downloaded here.

Comments are closed.