Heading into February, pump prices will likely dip, though gas prices going into the holidays were likely the low for the winter

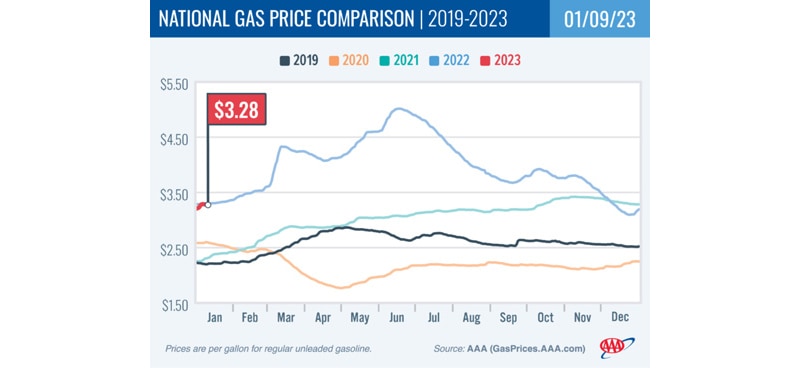

Washington, D.C.—The recent surge in gas prices caused by frigid weather and robust holiday road travel may be ending. While the national average price rose daily starting on Christmas Eve, when it was $3.09, the steam may have run out as pump prices flattened and then fell by a penny over the weekend. The national average for a gallon of gas rose seven cents since last week to $3.28.

“As we head toward February, pump prices will likely dip, barring any jolt in the global oil market,” said Andrew Gross, AAA spokesperson. “But it is likely that the national average prices we saw heading into Christmas may have been the lows for this winter.”

According to data from the Energy Information Administration, gas demand dropped from 9.33 million to 7.51 million b/d last week. Meanwhile, total domestic gasoline stocks fell by 300,000 bbl to 222.7 million bbl. Lower gasoline demand has contributed to limiting increases in pump prices.

Today’s national average of $3.28 is three cents less than a month ago and two cents less than a year ago.

Quick Stats

The nation’s top 10 largest weekly increases: Ohio (+22 cents), Colorado (+17 cents), Wyoming (+16 cents), Indiana (+16 cents), Iowa (+15 cents), North Carolina (+13 cents), Minnesota (+13 cents), Illinois (+12 cents), Michigan (+12 cents) and Arkansas (+12 cents).

The nation’s top 10 most expensive markets: Hawaii ($5.00), California ($4.42), Nevada ($3.96), Washington ($3.92), Alaska ($3.72), Oregon ($3.70), Pennsylvania ($3.65), Washington, D.C. ($3.47), New York ($3.45) and Arizona ($3.42).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI increased by 10 cents to settle at $73.77. A lower dollar helped to push crude prices higher at the end of the week. However, crude prices declined earlier in the week amid ongoing global economic concerns due to rising COVID-19 cases in China. Crude prices could decline further this week if economic concerns persist.

Comments are closed.