Based on inventory levels at the beginning and end of the month, dealers turned roughly 50 percent of their inventory in August

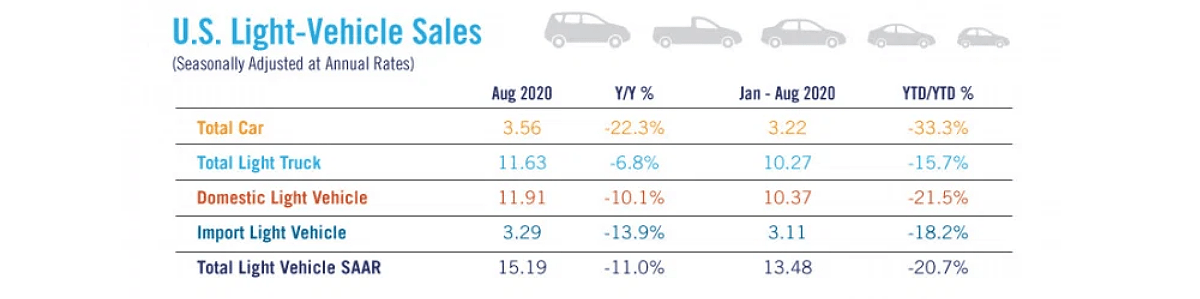

Tysons, Va.—New light-vehicle sales continued to recover in August from April lows. August’s SAAR of 15.2 million units marked a 4.8 percent increase from July’s SAAR of 14.5 million units but is down 11 percent compared with August 2019, according to NADA Chief Economist Patrick Manzi in his latest NADA Market Beat report.

And through eight months of 2020, new light-vehicle sales were off by 20.7 percent compared with the same period in 2019. Raw sales volume in August 2020 totaled 1.33 million units, representing a decline of 19.1 percent from August 2019.

However, there were two fewer selling days last month than in August 2019, which also included the Labor Day sales weekend. While the differences in the sales calendar contributed to a lower raw volume of sales in August, the sale volumes this September will likely see a boost compared with September 2019.

After adjusting for daily selling rates, retail sales volume in August was off by 10 percent year over year, according to Wards Intelligence. Since April, fleet sales volume has decreased more than retail sales volume. Fleet sales fell by roughly 32 percent compared with August 2019. While significant, it was actually a smaller fleet sales drop than in recent months, which averaged 66 percent in the April-July 2020 period.

Vehicles sold in August spent less time on dealer lots and had lower average discounts compared with August 2019. According to J.D. Power, 45 percent of vehicles sold this August spent fewer than 20 days on the lot, up from 35 percent in August 2019. Average incentive spending per unit is expected to be $4,105, down $49 from August 2019 and $848 from its high in April 2020.

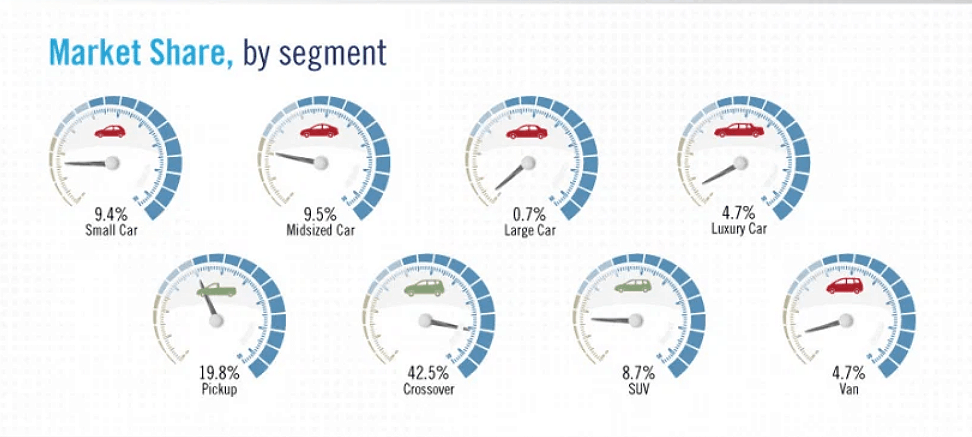

Based on inventory levels at the beginning and end of the month, dealers turned roughly 50 percent of their inventory in August. OEMs have been working hard to restore production, especially in popular segments such as crossovers and pickups, but steady sales led to inventory levels rising only 0.9 percent throughout August. At the end of the month the industry-wide days’ supply was 52 days, down from 55 days in July 2020 and 61 days in July 2019. And days’ supply for the crossover, pickup and SUV segments all remain below the industry benchmark of 60 days.

Those inventory constraints—coupled with low consumer confidence, persistently high unemployment and tightening credit standards—still present some economic headwinds. However given steady monthly gains in retail sales and the expectation that inventory levels will continue to rise, Manzi said NADA remains optimistic about the new-vehicle sales recovery for the rest of the year.

Comments are closed.