The interest and demand for renewable diesel fuel has grown exponentially due to federal and state government low carbon fuel policies

Editor’s note: This article first appeared on the Diesel Technology Forum, written by Allen Schaeffer

Frederick, Md.—Using renewable fuels in existing internal combustion engines is an important option for decarbonizing various sectors of the economy, including transportation. These fuels are proven. They’re generally more available and affordable than other decarbonization strategies such as zero emissions/electrification approaches which require new vehicles and infrastructure to realize benefits.

The interest and demand for renewable diesel fuel has grown exponentially thanks to federal and state government low carbon fuel policies, the biomass-based diesel tax credit, and a growing preference by fleet users as a decarbonization strategy. To meet this growing demand, new investments in refining capacity and feedstock production, as well as their impact on future supplies of renewable diesel, are becoming clearer.

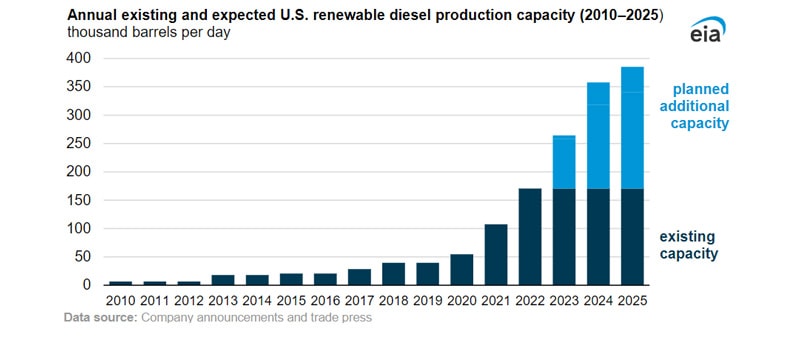

The U.S. Energy Information Administration (EIA) recently updated its forecast for the country’s renewable diesel production capacity, indicating it could more than double by the end of 2025, factoring in projects that are under construction or anticipated to begin development shortly. The EIA estimates that at the end of 2022, US renewable diesel production capacity was 2.6 billion gal/year. New analysis indicates it could grow to 5.9 billion gallons per year by the end of 2025, assuming all announced projects proceed as planned.

Renewable diesel is a drop-in replacement fuel, equivalent to petroleum diesel, suitable for use in any new or existing diesel engine. Renewable diesel has some of the highest greenhouse gas reduction scores found in the federal Renewable Fuel Standard, the California Low Carbon Fuel Standard, as well as the Oregon and Washington Clean Fuels Program. According to the EIA, users on the West Coast consumed an average of 520,000 barrels/day of distillate fuel in 2021 making it the nation’s largest renewable diesel importing region. The EIA’s new analysis predicts that the region could displace its diesel fuel needs by 2025, through the growth in renewable diesel capacity if the projected increases are realized.

Renewable diesel fuel’s characteristics enable it to be distributed through existing pipelines. It can be used at 100% levels, or in any blend, with petroleum diesel.

Government incentives contained in the Inflation Reduction Act of 2022 extended biomass-based diesel tax credits through 2024, driving new investment in new renewable diesel production capacity nationwide. According to the EIA, eight states are now home to new renewable diesel refineries slated to begin production or are scheduled to launch in 2022 and early 2023. These include CVR Energy’s plant in Wynnewood, Oklahoma; Diamond Green Diesel’s plant in Port Arthur, Texas; HollyFrontier’s plant in Artesia, New Mexico; HollyFrontier’s plant in Cheyenne, Wyoming; Montana Renewables’ plant in Great Falls, Montana; New Rise Renewables’ plant in Reno, Nevada; Seaboard Energy’s plant in Hugoton, Kansas; and Shell’s plant in Norco, Louisiana.

Comments are closed.