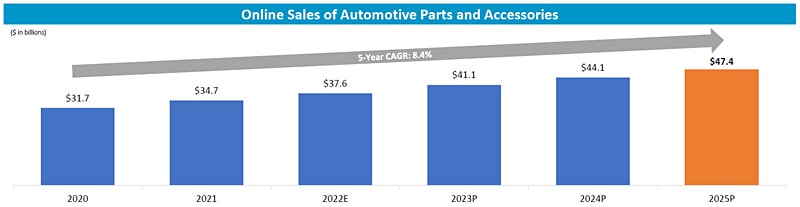

In another projection, e-commerce sales of automotive parts hit $37.6 billion in 2022 and are forecast to grow to $47.9 billion in 2025

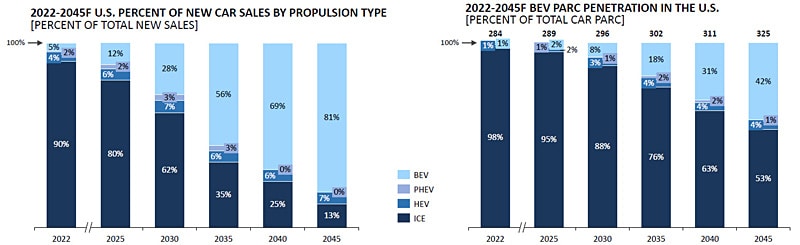

Bethesda, Md.—In 2021, hybrid and electric vehicles accounted for 9.4% of new light vehicles sold. How many will be sold in 20 years and what percentage of the vehicle population will they account for?

According to Auto Care Association’s Michael Chung in his updated Joint Electrification Forecast, battery electric (BEVs) and plug-in hybrid electric vehicles (PHEVs) are expected to represent 81% of new U.S. light vehicle sales in 2045 and account for 42% of U.S. vehicles in operation (VIO).

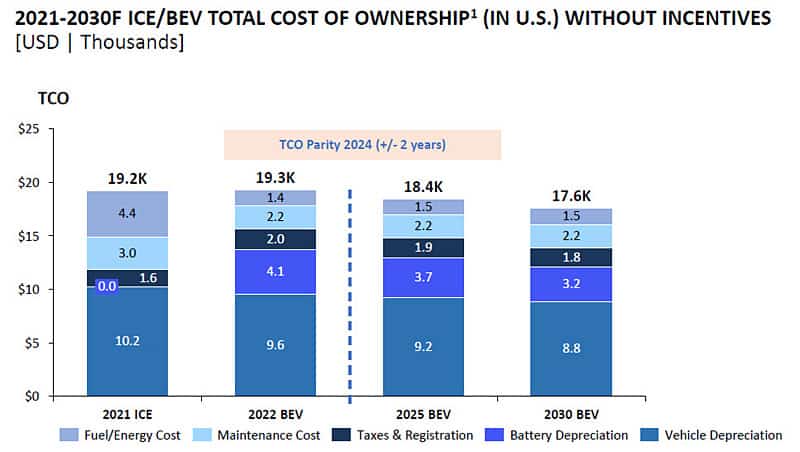

One interesting development, Chung notes, is the anticipated reduction in the total cost of owning an EV — this is driven by lower battery costs due to advancements in battery technology — as pictured below, depreciation of this key component is forecast to reduce, making the total cost of owning an EV less than one powered by an internal combustion engine:

As we are still relatively early in the implementation of this new technology, issues related to infrastructure and geographic distribution of EVs arise:

• Infrastructure: Challenges for fast-charging infrastructure exist — there are 12.5 times more places to refuel a gas-powered vehicle (145,000) than an electric vehicle (11,600, not including nearly Tesla’s 16,000 chargers; The Wall Street Journal). Distribution of chargers is geographically uneven — Manhattan has 320 stations and only 29 gas stations (Bloomberg) — while Minnesota has about 55 non-Tesla charging stations (The Wall Street Journal).

• Accessibility and Reliability: Problems can compound in remote areas where service technicians may be several hours away, along with the issue of charger operability — in a study of more than 11,500 owners of battery electric / plug-in hybrid electric vehicles in 2022, J.D. Power reported that 20% of study participants did not charge their vehicle while at a public charging location, 72% of whom “due to the station malfunctioning or being out of service” (J.D. Power).

The Joint Electrification Forecast also includes insights on EV adoption in China, service, and deeper dives into parts growth by category.

2022 U.S. holiday online retail sales hit nearly $240 billion, mostly on Cyber Monday, which became the biggest online shopping day in U.S. history: ~$10.7 billion (Statista).

E-commerce trends

Like other categories, the automotive aftermarket sees continued strength in the e-commerce channel. E-commerce was on an upward trajectory before the pandemic is expected to trend positively in the coming years. In 2022, e-commerce sales of automotive parts hit $37.6 billion and are forecast to grow to $47.9 billion in 2025:

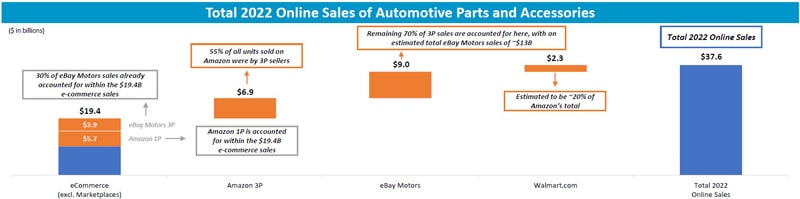

As Chung reports, e-commerce is a complex network of retail providers and third-party auto parts marketplaces — this forecast accounts for first-party and third-party sales through Amazon and eBay, as well as Walmart.com:

In the medium and heavy-duty vehicle space fleet owners favor purchasing by phone, and the online channel accounts for 13% of parts sales in 2021:

Regarding consumer behavior, e-commerce has been sticky even as we transition to a post-COVID era. Speaking of which, are we …

Post-Covid normalcy

The pendulum appears to be swinging back to normalcy for a few things:

• Overseas freight rates have come back to earth: rates for Asia-US West Coast, Asia-US East Coast, and Asia-North Europe prices for the week of December 13 are 91%, 80%, and 78% lower than a year ago, respectively (Freightos Weekly Update)

• Used vehicle prices have receded: 1-3 year old, 4-7 year old, and 8-13 year old vehicles are down 8%, 13%, and 13% from their recent highs of $42,375 in July, $31,265 in January, $19,215 in April, respectively.

Comments are closed.