Here are the top 10 largest weekly decreases in gas prices for states and least expensive markets

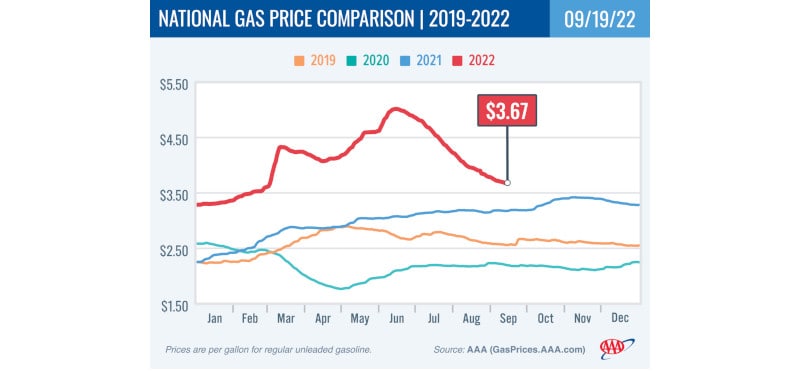

Washington, D.C.—Fewer drivers fueling up helped the national average pump price to drop four cents in the past week to reach $3.67. But it’s the smallest weekly decline in months and may signal that the streak of daily falling national average gas prices, approaching 100 days, is nearly finished.

“All streaks have to end at some point, and the national average for a gallon of gas has fallen $1.34 since its peak in mid-June,” said Andrew Gross, AAA spokesperson. “But there are big factors tugging on global oil prices — war, COVID, economic recession, and hurricane season. All this uncertainty could push oil prices higher, likely resulting in slightly higher pump prices.”

Meanwhile, most of the country is now using less expensive winter blend gasoline, so modest pump price reductions have occurred. Only California has yet to make the switch, but that happens on Nov. 1.

According to the Energy Information Administration (EIA), gas demand decreased from 8.73 million b/d to 8.49 million b/d last week. And total domestic gasoline stocks declined by 1.8 million bbl to 213 million bbl. Although gasoline demand has decreased, fluctuating oil prices have led to smaller pump price decreases. If oil prices spike, the national average will likely reverse as pump prices increase.

Today’s national average of $3.67 is 24 cents less than a month ago but 48 cents more than a year ago.

Quick Stats

The nation’s top 10 largest weekly decreases: Connecticut (−14 cents), Indiana (−13 cents), Rhode Island (−13 cents), Massachusetts (−12 cents), Ohio (−11 cents), West Virginia (−11 cents), New Jersey (−11 cents), New York (−10 cents), New Hampshire (−10 cents) and Maine (−10 cents).

The nation’s top 10 least expensive markets: Mississippi ($3.10), Louisiana ($3.13), Texas ($3.17), Georgia ($3.17), Arkansas ($3.19), Tennessee ($3.22), Alabama ($3.24), South Carolina ($3.25), Kentucky ($3.27) and Missouri ($3.32).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI increased by a penny to settle at $85.11. While a strengthening dollar helped to cap crude price increases at the end of last week, prices decreased earlier in the week after the Consumer Price Index showed that inflation remains stronger than expected. As a result, the market is concerned that the Federal Reserve could take more drastic measures that could lead to a recession, which would likely lead to a drop in crude demand and prices. For this week, persistent demand concerns could put downward pressure on prices. EIA’s latest weekly report also showed that total commercial crude inventories increased by 2.4 million bbl to 429.6 million bbl.

Comments are closed.