Find out the nation’s 10 largest weekly decreases and 10 least expensive markets for prices at the pump

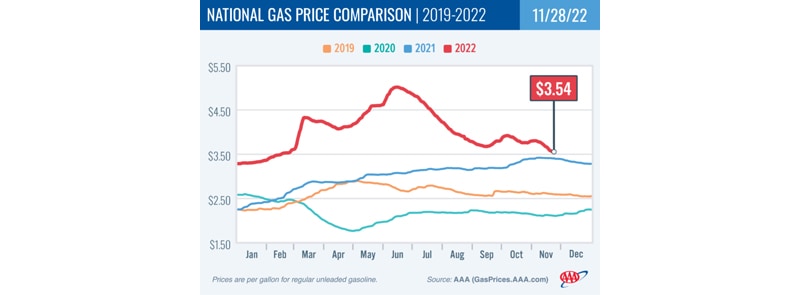

Washington, D.C.—The national average pump price for a gallon of gas dropped 12 cents in the past week. It is the steepest weekly decline since early August — nearly four months ago. Meanwhile, the cost of oil edged lower on fears of economic slowdowns elsewhere around the globe. Because of these factors, the national average for a gallon of gas fell to $3.54.

“Gas prices are dropping nationwide, with some of the largest decreases happening on the West Coast,” said Andrew Gross, AAA spokesperson. “But the West also has the farthest to fall because its prices are so elevated. For instance, California is still $1.50 higher than the national average.”

According to data from the Energy Information Administration (EIA), gas demand fell from 8.74 million to 8.33 million b/d last week. Meanwhile, total domestic gasoline stocks rose by more than 3 million bbl to 211 million bbl. Increasing supply and fewer drivers fueling up have pushed pump prices lower. As demand remains low and stocks grow, drivers will likely see pump prices keep falling.

Today’s national average of $3.54 is 22 cents less than a month ago and 15 cents more than a year ago.

Quick Stats

The nation’s top 10 largest weekly decreases: Alaska (−30 cents), California (−21 cents), Indiana (−20 cents), Wisconsin (−20 cents), North Dakota (−20 cents), Nevada (−17 cents), Oregon (−17 cents), Illinois (−17 cents), Michigan (−17 cents) and Oklahoma (−16 cents).

The nation’s top 10 least expensive markets: Texas ($2.88), Mississippi ($3.02), Oklahoma ($3.02), Arkansas ($3.03), Georgia ($3.03), Louisiana ($3.07), Tennessee ($3.10), Missouri ($3.10), Alabama ($3.12) and South Carolina ($3.13).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI decreased by $1.66 to settle at $76.28. Crude prices dropped last week despite the EIA reporting that total domestic commercial crude stocks had declined substantially by 3.7 million bbl. Instead, prices declined because the market is concerned that oil demand could decrease due to growing economic concerns. For this week, persistent concerns that economic growth might stall or reverse course could push prices lower. However, the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, collectively known as OPEC+, are meeting on December 4. In October, OPEC+ decided to cut its collective crude oil output by 2 million b/d through 2023. If OPEC+ decides to revise its production reduction agreement to more than 2 million b/d, prices could spike.

Comments are closed.