AAA forecasts that Memorial Day road trips will be up 6% over last year, with more than 37 million Americans driving to their destinations

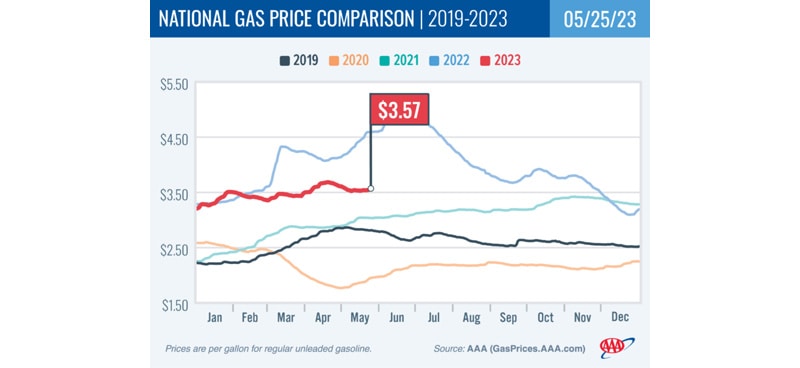

Washington, D.C.—The seasonal surge in gasoline demand leading into the long holiday weekend resulted in the national average for a gallon of gas rising four cents since last week to $3.57. AAA forecasts that Memorial Day road trips will be up 6% over last year, with more than 37 million Americans driving to their destinations.

“The rise in demand for gasoline is helping to push pump prices higher for now,” said Andrew Gross, AAA spokesperson. “But the increase is mitigated by the low cost of oil, which is wobbling around in the low $70s per barrel. Pump prices could stabilize or fall once this long weekend is in the rearview mirror.”

According to new data from the Energy Information Administration (EIA), gas demand increased from 8.91 to 9.43 million b/d last week. Rising demand has helped to boost pump prices. Meanwhile, total domestic gasoline stocks decreased by 2 million bbl to 216.3 million bbl. If gas demand grows amid tighter supplies, drivers will likely see pump prices rise.

Today’s national average of $3.55 is eight cents less than a month ago and $1.02 less than a year ago.

Quick Stats

Since last Thursday, these 10 states have seen the largest increases in their averages: Wisconsin (+15 cents), Colorado (+12 cents), Indiana (+9 cents), New Jersey (+9 cents), Idaho (+9 cents), Montana (+8 cents), Connecticut (+8 cents), Maine (+7 cents), New Hampshire (+7 cents) and Michigan (+7 cents).

The nation’s top 10 most expensive markets: California ($4.81), Hawaii ($4.75), Washington ($4.63), Arizona ($4.58), Nevada ($4.24), Oregon ($4.20), Utah ($4.08), Illinois ($3.97), Alaska ($3.94) and Idaho ($3.83).

Oil Market Dynamics

At the close of Wednesday’s formal trading session, WTI increased by $1.43 to settle at $74.34. Oil prices rose yesterday amid growing market optimism that energy demand is rebounding. However, price increases were capped due to the market expecting another interest rate increase from the U.S. Federal Reserve, which could result in the economy tipping into a recession. If the economy enters into a recession, oil demand and prices would likely decline. Additionally, the EIA reported that total domestic commercial crude inventories decreased significantly by 12.4 million bbl to 455.2 million bbl last week.

Comments are closed.