The slight drop in gas demand has helped to limit pump price increases. However, as crude oil prices remain volatile, the price per gallon for gasoline will likely remain elevated.

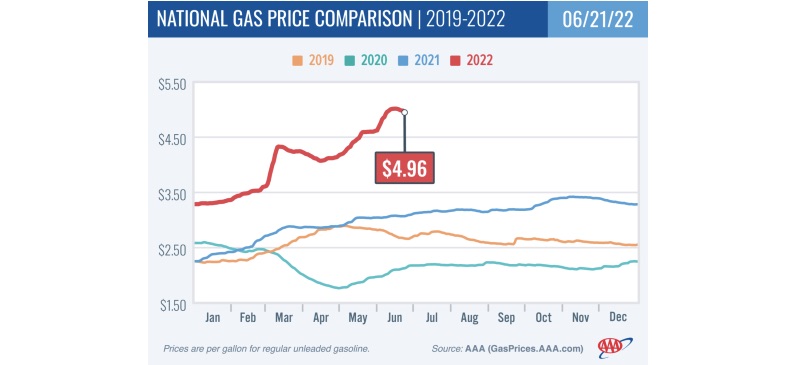

Washington, D.C.—The national average for a gallon of gas fell below $5, bringing modest relief at the pump for beleaguered drivers. The primary cause is the tumbling cost of oil, which fell from $122 to around $110 per barrel due to fears of a global recession and its associated economic slowdown. As a result, the national average for a gallon of gas is $4.96, a nickel less than a week ago.

“The recent high prices may have led to a small drop in domestic gasoline demand as fewer drivers fueled up last week,” said Andrew Gross, AAA spokesperson. “This dip, coupled with less costly oil, has taken some steam out of surging pump prices. And this is happening right before drivers gas up for what AAA forecasts will be a busy July 4th travel weekend.”

According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks fell by 700,000 bbl to 217.5 million bbl last week. Meanwhile, gasoline demand declined slightly from 9.2 million b/d to 9.09 million b/d. The slight drop in gas demand has helped to limit pump price increases. However, as crude oil prices remain volatile, the price per gallon for gasoline will likely remain elevated.

Today’s national average of $4.96 is 37 cents more than a month ago, and $1.89 more than a year ago.

Quick Stats

The nation’s top 10 largest weekly decreases: Indiana (−10 cents), Florida (−9 cents), Wisconsin (−9 cents), South Carolina (−8 cents), Ohio (−8 cents), Maryland (−8 cents), New Jersey (−8 cents), Michigan (−7 cents), Kentucky (−7 cents) and North Carolina (−6 cents).

The nation’s top 10 least expensive markets: Georgia ($4.46), Mississippi ($4.47), Arkansas ($4.50), Louisiana ($4.51), South Carolina ($4.52), Alabama ($4.57), Tennessee ($4.58), North Carolina ($4.60), Oklahoma ($4.62) and Texas ($4.63).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI decreased by $8.03 to settle at $109.56. Crude prices dropped last week amid broad market concern regarding the potential for economic growth to slow after the U.S. Federal Reserve raised interest rates by 0.75 percent. Slower than expected economic growth would likely lead to a decline in crude demand. Crude prices would likely follow suit. Additionally, crude prices decreased after the EIA reported that total domestic stocks increased by 1.9 million bbl to 418.7 million bbl. If EIA’s next report shows crude stocks increasing again, prices could decrease further.

Comments are closed.