Chinese automakers are improving their technology, design, and manufacturing processes, gaining market share in new regions

New York—Mainland China’s automotive industry is rapidly expanding into export markets and could disrupt the leadership positions of traditional global legacy automakers. In 2022, it passed long-time No. 2 exporter Germany, and through the first quarter of 2023 surpassed Japan as the world’s leading vehicle exporter.

Chinese automakers are improving their technology, design, and manufacturing processes, gaining market share in new regions, and addressing brand recognition issues to continue their growth in the European market. However, political risks and regulatory challenges remain a concern for Chinese manufacturers as they navigate different markets worldwide.

Data from China’s General Administration of Customs stated that China exported 3.32 million vehicles in 2022, with a year over year growth rate of 57% — with battery-electric vehicle exports accounting for more than one-in-four total exports. The pace shows no signs of slowing year-to-date, with January-April 2023 export volume surging by 76% year-over-year, to nearly 1.5 million vehicles.

Part of that rapid growth was due to Chinese automakers capitalizing on the shortage of chips and other core components among legacy Western OEMs’ supply chains. By contrast, many Chinese automakers have access to a complete industrial chain, which helped rapidly increase capacity while Western automakers had to cut production.

China’s strong vehicle exports also have helped the country’s auto sector cushion the impact of softening demand for new cars in the domestic market. In the coming quarters, China’s new vehicle market is expected to continue to face headwinds from economic uncertainties and tepid consumer spending – putting pressure on domestic automakers to find new export markets.

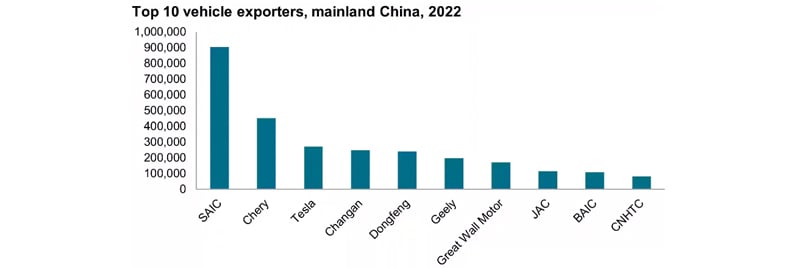

Currently, SAIC Motor and Chery rank first and second in terms of export scale, although BYD and Geely are ramping up their export operations. BYD’s current strategy is to enter markets that already have an immediate demand for new-energy vehicles, especially markets with tariff reductions, purchase tax reductions or subsidies. By cooperating with experienced overseas distributors, the BYD network has expanded from its launch points in South Asia and South America to the Middle East and Europe.

Gaining footholds in Europe

Chinese automakers face challenges in the European market, however, due to brand recognition issues and strong consumer loyalty to domestic brands in countries like Germany and France. However, SAIC’s investment in the undervalued British MG brand provided an opportunity to use the marque’s historical presence as a way of establishing an overseas marketing foothold that domestic Chinese brands like Great Wall or Chery might not. Since 2020, MG has sold more cars outside of Mainland China than domestically – it aims to sell more than 200,000 vehicles in Continental Europe and England this year.

By comparison, BYD recently released the Atto 3, which is also known as the Yuan Plus, in England to complimentary reviews. But there has been little marketing support, and with only four dealerships, brand familiarity is an issue. Same holds true for Xpeng, Ora and NIO. BYD is considering building a factory in Europe to help reduce costs and avoid customs duties; it will also allow consumers to build trust in BYD.

And Chinese brands need to establish that trust if they are to conquest legacy-brand customers. European consumers with long memories recall the cataclysmic failures of early Chinese vehicles in NCAP crash tests. Those days are long gone, however. Several new models currently entering Europe — such as BYD Atto 3, Ora Funky Cat, and MG 4 Electric — all received five-star ratings in European crash tests, and their safety performance has been greatly improved.

The initial wave of Chinese vehicles also carry a competitive price advantage: In the UK, for example, the Volkswagen ID.3 has a starting price (as of the week of June 12) of around GBP 37,000. The comparable MG 4 is SAIC’s latest compact electric car, with a starting price of less than GBP 27,000 and a top model priced at about GBP 32,500 for a richly configured car.

In terms of new markets, Norway is a tempting target, as 90% of its market is new-energy vehicles. But the top 15 brands are Tesla and established European, Japanese, and Korean brands. Still, that hasn’t stopped the entry of Chinese brand EVs such as the Hongqi E-HS9, Aiways U5, Voyah Free, BYD Tang, Xpeng P7, and NIO ES8 and ET7.

Russia and Central Asia opportunities

The Russian market also presents an opportunity for Chinese brands, due to the withdrawal of European, American, Japanese, and Korean car companies on account of the Russian invasion of Ukraine. In the absence of Western OEMs, Chinese brands like Chery, Haval, and Geely have seized market share. According to the Russian Dealers Association, by the end of 2022, the number of passenger car brands in the Russian market had decreased from 60 before the conflict to 14. Except for the three local brands LADA, GAZ and UAZ, the other brands are all Chinese.

Several Central Asian “Belt and Road” markets, particularly Uzbekistan, are also receiving attention from Chinese automakers due to close economic and trade exchanges with China, low political risks, and potential for growth. BYD announced last year to set up a joint venture factory with local manufacturer UZAVTOSANOAT JSC (UzAuto) in Uzbekistan to produce new-energy vehicles.

That said, political risk is a major concern for Chinese car companies expanding overseas, as seen with Turkey’s recent increase in import tariffs on Chinese electric vehicles from 10% to 40%. Another example of this is that Chinese automaker Great Wall Motor had to drop its plan last year to acquire GM’s idled Talegaon plant in India as the deal failed to gain approval from Indian regulators. The deal was under scrutiny from local authorities from the signing of the MOU in January 2020. The political tension between India and China served a major element behind the failed acquisition.

Targeting North America

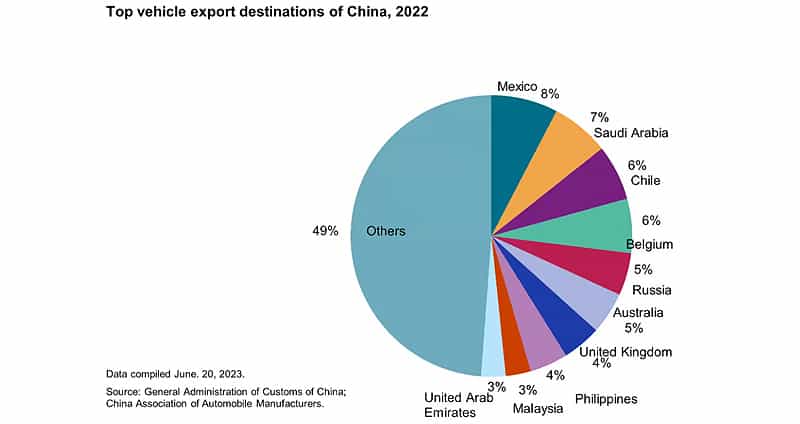

Strong exports of China-made vehicles into Mexico have made the country by far the top export destination of Mainland China. However, Mainland China’s vehicle exports to Mexico in recent years are mainly led by General Motors’ vehicles made in China. With GM increasingly leveraging its Chinese joint venture factory to supply vehicles to Mexico, and Tesla shipping more models from its Shanghai plant to Canada, imported China-made vehicles will grow their share in the North American region.

However, Chinese automakers have taken a cautious approach to the US, the region’s largest auto market. The 25% tariff that the US imposed on vehicles imported from Mainland China is not the main deterrent that keeps Chinese brands out of the US market. Rather, the tense US-China political tensions do not present the right atmosphere for Chinese automakers intending to enter the US market.

As the US aspires to become a major player in the global electric vehicle industry, its policies in the next few years will continue to support local manufacturing and local sourcing. The Inflation Reduction Act (IRA) passed by the Biden Administration in 2022 has tied EV tax credits to certain criteria, including sourcing of battery components and critical minerals in the US or with a US free-trader partner.

Since the passing of the IRA in 2022, global automakers including Hyundai and Honda have announced plans to set up EV battery manufacturing plants in the US to support local EV manufacturing. However, it is unrealistic for Chinese automakers to commit huge investments in the US, when faced with the geopolitical risk and expected small initial sales volumes once they eventually were to enter the US passenger vehicle market.

Against this backdrop, Chinese automakers including BYD and Great Wall Motor have opted to prioritize Europe and Southeast Asia in their global expansion plans, where they are more likely to obtain scale and get approval for setting up local production facilities.

Western OEM plants in Mainland China

The rise of Chinese automakers also has squeezed market shares of global automakers in the Chinese domestic market and forced them to adjust their strategies to cope with the intensifying competition. French automakers have leveraged their joint venture plants in China to produce certain models for export. That tactic is also in place with Kia for its EV5 and BMW for new-generation MINI electric vehicles moving production to China.

As more joint-venture brands transfer production capacity to China for export, it is evident that Chinese factories are becoming more efficient and capable of producing vehicles for global markets and global standards. With China being the world’s largest electric vehicle market, the shift towards new-energy vehicle production in Chinese factories is significant for the global uptake of battery electric vehicles.

China’s expanding automotive industry is not just a matter of economic growth and technological advancement. It is also a sign of China’s increasing influence in the global market, and its potential to disrupt established industries. As Chinese automakers gain market share in different regions, they are a challenging the dominance of traditional players, and forcing them to adapt to a new reality.

Comments are closed.