Technician knowledge gaps, training, T&E investments and more are raising safety concerns once vehicles land in the shop. And return to the road.

Jacksonville, Fla.—While advanced driver assistance systems (ADAS) technologies are increasingly being developed and implemented in today’s vehicles to help mitigate human error and avoid accidents, there are challenges for the collision repair community to keep up with those advancements.

Technician knowledge gaps, the calibration process involving precise alignment of cameras and sensors, meeting the necessary tool and equipment investments, and more are raising safety concerns for the driving public once their vehicles land in the shop. And return to the road.

Can the repair industry keep up with the rapid adoption of ADAS? Can technicians continually update their skills and training as these technologies expand? Further complicating matters are proprietary technologies native to different brands and model segmentation. And let’s not forget the diminishing number of skilled technicians and the ever-present tech shortage bringing new talent to the industry.

To better understand those challenges, the University of Northern Florida (UNF) recently released research based on a survey of collision shops on the ADAS workforce in order to better understand where the repair industry is today and the hurdles it must overcome.

Below are key findings from UNF, as outlined in its white paper, “ADAS: Skilled Labor Shortage in Auto Collision Industry Poses Motorist Safety Risk.”

— Business Categories —

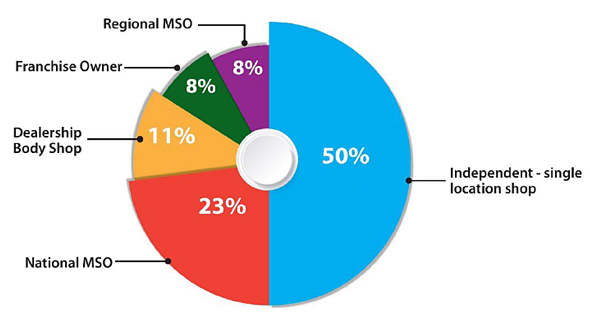

1. The auto collision repair providers are dominated by small, single location operations

The survey data revealed that nearly half of the shops surveyed are independently owned, single-location operations. Among these, 64% employ five or fewer technicians, while 26% have between six and 10 technicians on staff.

2. ADAS skills proficiency remains limited across the auto repair industry

ADAS technologies have introduced substantial brand-specific complexity, driven largely by differences among original equipment manufacturers (OEMs).

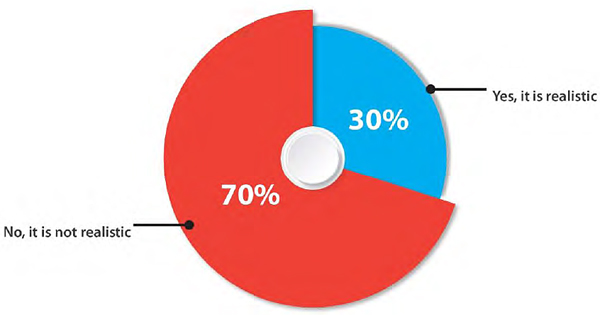

— Perception of Any One Technician Servicing 30 Brands —

Notably, 70% of surveyed businesses reported that it is not possible for a single technician to effectively service ADAS systems across 30 different vehicle brands, a range that reflects the diversity of the U.S. automotive market.

Despite the growing importance of ADAS technologies, only 72 out of the 304 businesses surveyed reported having dedicated ADAS technicians. Of those, 42 businesses indicated that their technicians had received formal training from original equipment manufacturers (OEMs), including 14 from small operations. The remaining 30 businesses — also, including 14 small operations — relied on informal training methods.

The findings highlight not only the limited presence of specialized ADAS personnel, but also the lack of access to formal, brand-specific training, particularly in smaller operations.

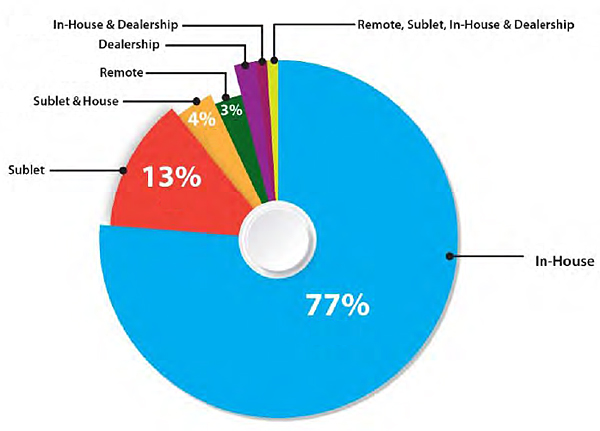

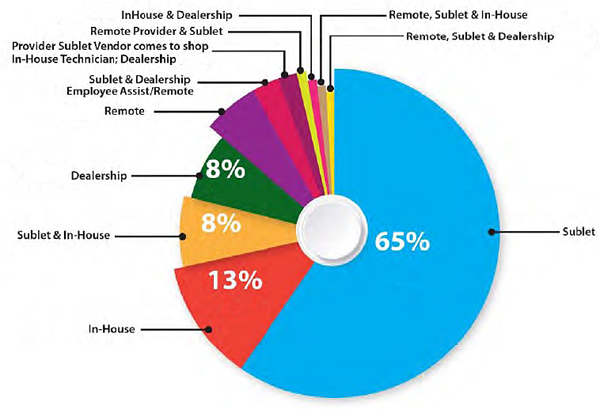

3. Pre/post scans and ADAS calibrations follow two distinctive operational approaches

The study found that pre/post scans and ADAS calibrations are typically managed through different service delivery approaches. Pre/post scans are generally performed by in-house technicians, while ADAS calibrations are more often outsourced to third-party providers.

— Pre/Post Scans —

— ADAS Calibration —

This division reflects the varying levels of in-house capability and investment in ADAS-related equipment, where calibration often requires specialized tools/software, controlled environments, and brand-specific knowledge.

4. Difficulty in finding skilled ADAS technicians highlights workforce gap

The study’s results highlight a pronounced shortage of qualified technicians with the expertise required for ADAS calibration. Of the 304 respondents, only 81 reported no difficulty; however, they represent a minority in the industry. About one-third (105 respondents) indicated that recruitment and retention are challenging. The remaining 118 respondents reported relying on subletting to make up for the lack of in-house expertise. These findings further highlight the widespread shortage of ADAS-trained technicians. To bridge this gap, subletting appears to be a common solution.

5. The quality of outsourcing ADAS calibrations remains unknown

Due to the shortage of in-house ADAS calibration expertise, many auto repair shops depend on external vendors for the needed calibration service. While outsourcing is a common practice, especially among small operations, the study did not evaluate the quality, consistency, or accuracy of subcontracted ADAS calibration or that brand specific services are being carried out.

As ADAS systems continue to be added to the fleet of vehicles, further research is needed to assess the reliability and safety implications of outsourcing ADAS calibrations services.

The Challenges Ahead

Just 11% of shops surveyed with fewer than 10 technicians reported having technicians who had received formal ADAS training, which, according to the report, “raises concerns about the overall readiness of the sector to deliver consistent, high-quality, safe ADAS services.”

The industry’s dependence on subletting is reflective of shops’ inability to support the technical demands of servicing a broad scope of ADAS systems (up to 30 brands in the U.S.) Those demands present “significant operational burdens” on small businesses, many of which lack the resources, training, and brand-specific expertise required to manage ADAS diagnostics and calibration independently.

The need for pre/post scans and ADAS calibration is expected to grow with the increasing integration of safety technologies and features. “Compounding this,” UNF states, is that “many ADAS systems are proprietary, making it extraordinarily difficult, if not impossible, for a single technician to remain proficient across such a wide range.”

Download the complete report here.

Comments are closed.