Why do consumers choose one service facility over another? How honest do they think repairers are? How do they rate different types of service facilities? These questions and more are examined.

Draper, Utah—The global COVID-19 pandemic has resulted in changes in consumer attitudes in many areas, including the automotive aftermarket: why consumers choose one service provider over another, what offerings attract them to do business with a repair facility, as well as what helps retain their business.

In a just-released study by AutoNetTV, “Automotive Service Report: A Nationwide Survey of Vehicle Owners — Part 1 of 2,” its findings cover questions related to consumer attitudes about service centers.

“We wanted to understand their perceptions of service recommendations and their feelings of trust in service professionals,” stated the report. “We explored what actions or tools could be employed to increase customer trust in service recommendations.”

Below is a condensed version of the survey, for which AutoNetTV engaged Centiment, a Denver-based research company, to survey 1,031 vehicle owners in the U.S. Participants were over the age of 25 and routinely drive an automobile that he or she personally owns. They were split evenly among male and female. Every state but North Dakota is represented by participants.

Choosing an Automotive Provider

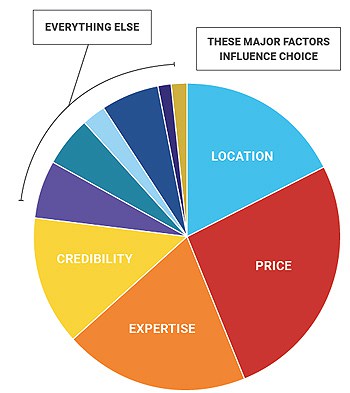

Question: When considering a specific automotive service provider to obtain your vehicle services (oil change, tire rotation, repairs, etc), what is the main reason you choose one provider over others?

The No. 1 criteria consumers used to select a service facility is price. Assuming a facility is following best management practices, they are still subject to fixed infrastructure cost, buying power constraints, and the prevailing labor rates in their specific market. Their prices will reflect an acceptable profit margin, constraining the range in which pricing can be used to attract customers.

The No. 2 reason for choosing a location is expertise. This is something that can be developed, demonstrated, and communicated prospective customers. Communicating the same with current customers will allay concerns and strengthen their relationship.

The No. 3 reason is location. Service centers tend to draw their customers from a three-mile radius around their location — when they move, they will select a facility within an acceptable distance.

Service Providers Frequented

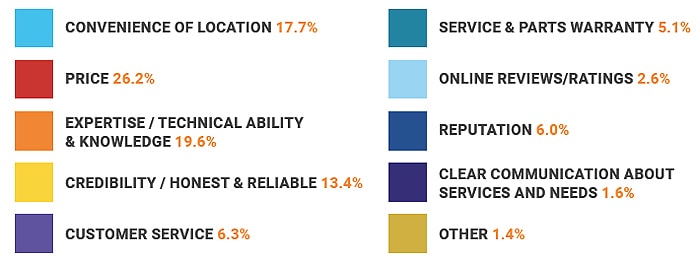

Question: Which statement best describes how you service your vehicle?

The survey found that 96% of consumers take their vehicles to three or fewer locations for all their service needs. This seems to emphasize the importance of investing in customer satisfaction through training (maintaining high levels of expertise) and customer communications that reinforce the reasons for doing business with their particular facility.

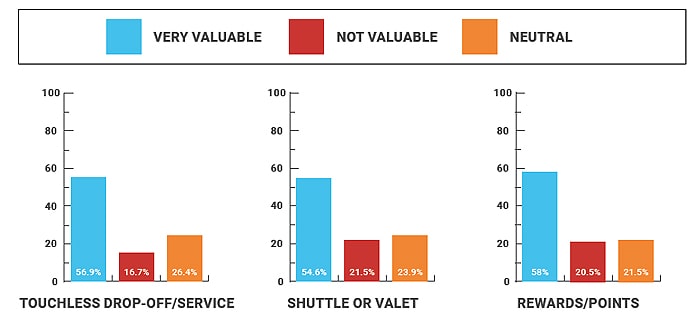

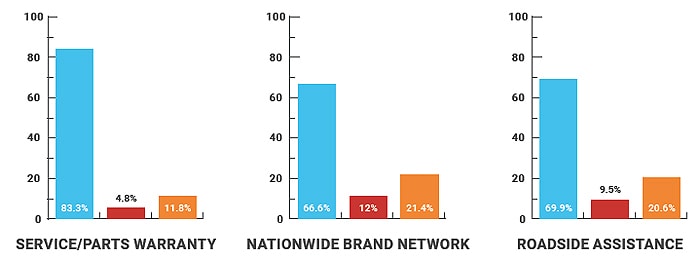

Importance of Facility Offerings

Question: Please rate the following services, offerings, or benefits in terms of their value to you as a customer.

Note: This question probes how consumers value various offerings. Respondents rated a parts and service warranty as the No. 1 offering followed by having a complete range of services at one location. The No. 3 offering was Roadside Assistance, with a network of affiliated provider location coming in at No. 4. Peace of mind and convenience may be behind these selections.

The offerings valued the least were in-store financing (No. 9), shuttle or valet service (No. 8), and Touchless vehicle drop-off (No. 7). AutoNetTV anticipated that these offerings would have been more highly valued during the downturn and safety concerns related to COVID-19.

The top offerings can be obtained by individual facilities. Program or buying group affiliation often comes with regional or national warranty and service availability.

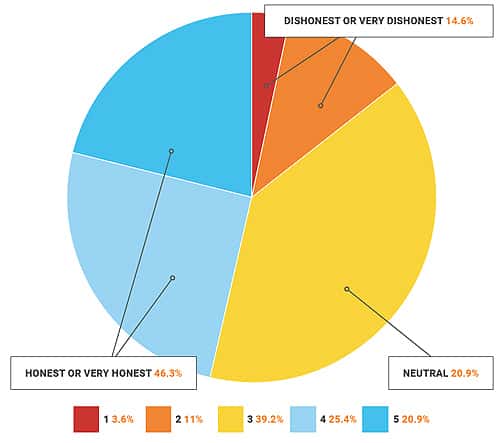

Honesty of Most Providers

Question: How would you rate the honesty of most automotive service providers in the industry? Use a scale in which 1 represents the lowest level of honest and 5 represents the highest level of honesty.

This question probes respondent’s perception of the honesty of their preferred service provider. Less than 15% rated the automotive industry, as a whole, as having a Low or Very Low level of honesty. The largest response was neutral at 39% revealing an opportunity to be positively influenced by the behavior of and communication with service professionals.

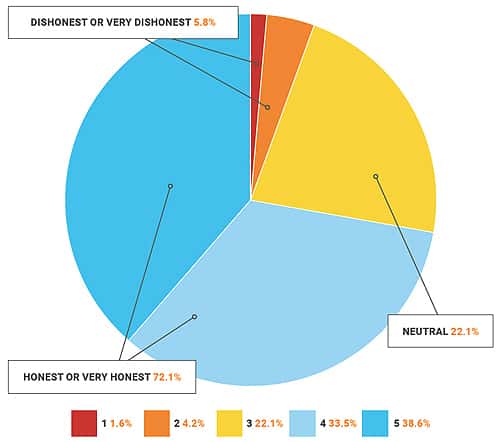

Honesty of Preferred Provider

Question: How would you rate the honesty of your preferred automotive service provider? Use a scale in which 1 represents the lowest level of honest and 5 represents the highest level of honesty.

The percentage of responses rating the preferred service provider as having a Very high level of honesty is nearly double the same response for the industry as a whole. This reinforces the importance of behaving honestly as well as the impact of open and honest communications with customers to building trust. As seen in the question above regarding the “loyalty” of customers, with 62% taking their vehicle to the same provider for all of their services, the perception of honest behavior by a service provider leads to greater customer retention and, therefore, more service business.

Consumers Rate the Following …

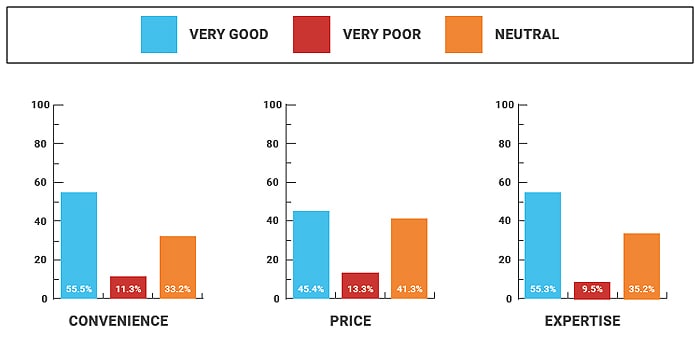

Consumers’ perceptions among the primary types of automotive service facilities: Quick Lubes, Repair Centers, Tire Centers, and new car Dealerships

In addition to asking vehicle owners to rank the considerations they had when choosing one location over another, AutoNetTV also wanted to see if consumers had different perceptions among the primary types of automotive service facilities: Quick Lubes, Repair Centers, Tire Centers, and new car Dealerships. For the following four questions, AutoNetTV provided a randomly chosen picture of each type of location to aid in identifying the type of service facility.

Dealerships received the highest number of Very Good (5) ratings in every category. When also including Good (4) ratings, new rankings emerge in some areas. For Convenience, Quick Lubes (62.4%) edged out Dealerships (62.0%) for the top spot. For Price, Quick Lubes again take the top spot with 52.8%, with Tire Centers earning second place with 50.4%.

Dealerships remain the top-rated location type for the remaining categories (when combining Good and Very Good ratings) for Expertise, Credibility, Customer Service, and Warranties. The less complex and less time consuming services typically offered at a Quick Lube facility likely impacted the consumers’ perception of Expertise and Warranty for those locations.

Quick Lube Attribute Ratings

Question: Please rate Quick Lubes on the following attributes.

Repair Centers Attribute Ratings

Question: Please rate Repair Centers on the following attributes.

Tire Centers Attribute Ratings

Question: Please rate Tire Centers on the following attributes.

Dealerships Attribute Ratings

Question: Please rate Dealerships on the following attributes.

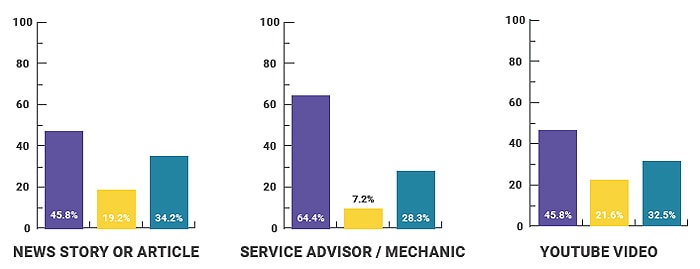

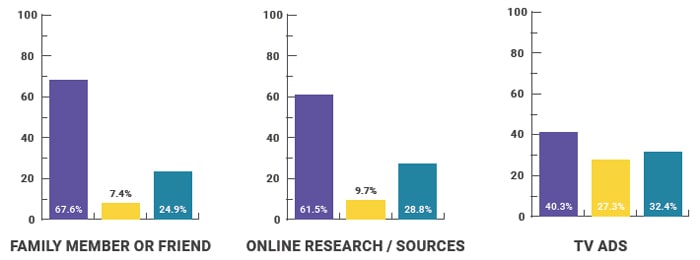

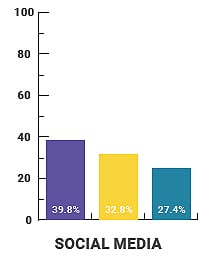

Trusted Source of Vehicle Advice

Question: Rate the following sources in terms of their levels of trustworthiness in providing vehicle care advice.

The percentage of customer responses that rate the preferred service provider as having a high level of honesty is nearly double the same response for the industry as a whole. This reinforces the importance of behaving honestly as well as the impact of open and honest communications with customers to building trust.

As seen in the previous question regarding the “loyalty” of customers, with 62 percent taking their vehicle to the same provider for all of their services, the perception of honest behavior by a service provider leads to greater customer retention and, therefore, more service business.

Part 2 release of results will cover questions related to consumer attitudes regarding maintenance services, their trust in recommendations, and how service professionals can increase both in their activities and/or interactions with vehicle owners.

Comments are closed.