As the DIY market builds throughout 2022, it will slow — and perhaps reverse — last year’s recovery of DIFM repair from the DIY surge promoted by COVID-19 in 2020

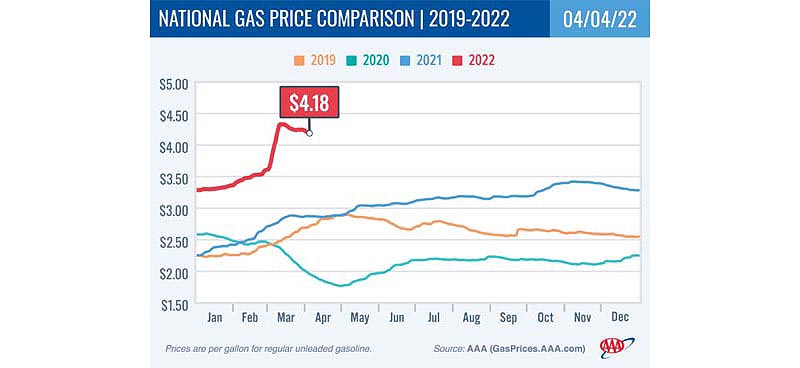

Fort Wayne, Ind.—As high gas prices tighten consumers’ wallets, vehicle owners will resort to more DIY (do it yourself) repairs, particularly routine maintenance jobs. And as the product share of the DIY market builds throughout 2022, it will slow — and perhaps reverse — last year’s recovery of DIFM (do it for me) repair from the DIY surge in 2020 promoted by COVID-19, according to Wednesday’s release of The Lang Aftermarket iReport.

Collectively, today’s pump prices will alter consumer auto repair behavior in three significant ways: mode of repair, how auto repairs are purchased, and where DIFM repairs are performed. Take a look how from these report highlights.

How Repair Purchases Are Made

It’s been well established that high gas prices force consumers to reduce shopping trips and cut unnecessary driving. This will lead to an increase in online purchases of automotive parts by DIYers, not to mention whatever savings might be available from online sources.

Consequently, consumer efforts to reduce driving will also affect DIFM repairs, which will boost o2o (online to off-line) auto repairs, enabling consumers to purchase repairs and products online and then go to a repair site an on-appointment basis for off-line installation.

Products already experiencing significant o2o activity (such as tires) will see an increase in o2o volume, with other types of repairs, such as oil changes and brake work, potentially receiving a boost from the streamlined purchase opportunities provided by o2o auto repair.

Where DIFM is Performed

Lang Marketing has found in previous nationwide studies that consumers’ perceptions of repair costs differ by outlets. For example, specialty repair outlets are generally perceived as providing lower prices than other outlets for a wide range of repair jobs.

And foreign specialists are regarded as more economical (and generally equal in ability for most jobs) than dealerships in servicing foreign nameplates, so they are likely to gain additional repair business from consumers.

Dealerships Respond to Budget-Minded Consumers

Dealerships with oil change lanes and quick service operations are likely to fare better than dealerships who don’t provide those services in attracting consumers faced with budgetary restraints.

Dealerships can adapt to those new circumstances by advertising competitive prices on selected repairs and using lower-priced aftermarket parts, especially on older vehicles, instead of more expensive OE parts.

Private Label and Aftermarket Brands

In appealing to budget-challenged consumers, repair outlets of all types, especially independent repair outlets, can price repairs based on the use of private labels and economy brands to reduce the total cost of repair jobs. This will offer consumers, especially those with older vehicles, repair costs that are more suited to their constrained budgets.

The Big Picture for 2022

In 2022, Lang predicts that the average car and light truck will be driven fewer miles than last year. An increasing share of these miles will be accounted for by older vehicles and foreign nameplates. This will impact the aftermarket in three major ways.

First, although fewer miles will be recorded in 2022, there will be an increase in mileage by older vehicles, which average greater aftermarket product use per mile than younger vehicles. This will provide a tailwind for aftermarket product growth during the year.

Second, struggling new vehicle sales (the result of a short supply of fuel-efficient cars and light trucks available for dealership to sell, combined with the shifting consumer buying habits resulting from higher gas prices) will curtail new vehicle sales this year and increase the average age of vehicles on U.S. roads. As a result, older vehicles will account for a growing portion of total miles driven.

Third, foreign nameplates will account for a growing share of new vehicle sales, aided by their high fuel efficiency. The relatively high fuel efficiency of foreign nameplates will reduce their scrappage rate. Both of these factors will increase the number of foreign nameplates on U.S. roads and add to their aftermarket product volume and share.

Comments are closed.