Analysts say a record nearly one in four vehicle trade-ins toward new car purchases with negative equity carried more than $10,000 in debt

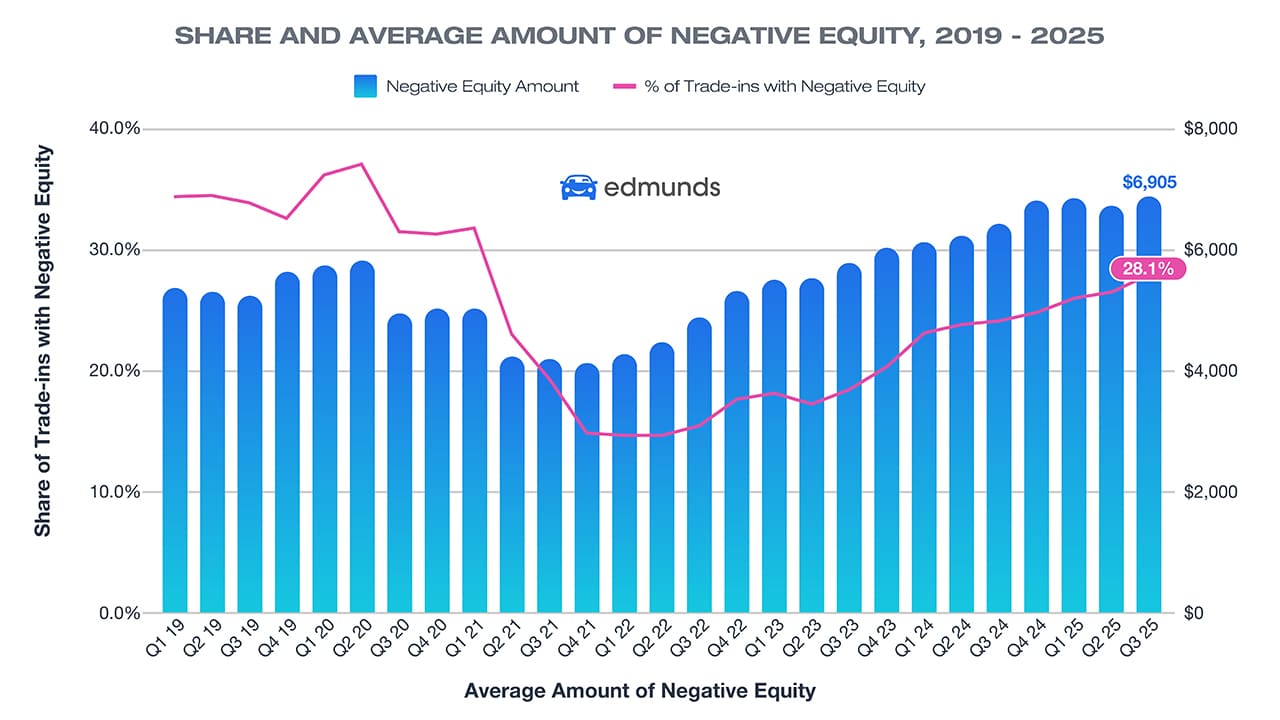

Santa Monica, Calif.—More Americans are finding themselves upside down on their car loans, according to Edmunds. Q3 2025 data from Edmunds shows that a growing share of owners are trading in vehicles worth less than what they owe — and the debt they are rolling forward is growing:

- More than one in four new vehicle trade-ins are underwater, a four-year high. 28.1% of trade-ins toward new-car purchases had negative equity, up from 26.6% in Q2 2025 and 24.2% in Q1 2025. This is the highest share Edmunds has on record since Q1 2021, when 31.9% of new-car trade-ins were upside down.

- Americans with upside-down car loans owe more than ever. The average amount owed on upside-down loans hit a record $6,905 in Q3, edging past the previous high of $6,880 set in Q1 2025.

- Nearly one in three underwater car owners owe between $5,000 and $10,000 in debt — a new record high. 32.9% of negative-equity trade-ins fell into this range in Q3, up from 32.6% in Q2 and continuing a steady climb since last year.

- A record share of underwater car loans are carrying five-figure debt. Nearly one in four (24.7%) trade-ins with negative equity carried more than $10,000 in debt in Q3, surpassing the previous high of 24.6% set in Q4 2024. Another 8.3% of trade-ins with negative equity carried more than $15,000 in debt, up from 7.7% in Q2 2025.

Analysts warn of long-term consequences

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” said Ivan Drury, Edmunds’ director of insights. “Nearly one in three upside-down car owners owe between $5,000 and $10,000 — and a growing share owe far more than that. Much of this stems from shoppers trading out of vehicles too quickly, or carrying loans taken out during the pandemic car market frenzy, when prices were at record highs. Those choices are now catching up, making it far harder to buy again without piling on even more debt.”

Rolling debt drives higher monthly payments

To highlight the financial effect of rolling negative equity into a new vehicle purchase, Edmunds analysts compared the costs for consumers who financed a new vehicle involving a trade-in with negative equity in Q3 against the industry average for all financed new vehicles. The average monthly payment for buyers who rolled negative equity into a new loan was $907 in Q3, down slightly from Q2’s high of $915 and $140 more than the overall industry average monthly payment of $767. They also financed $11,164 more than the typical new-vehicle buyer.

| Year | Share of New Vehicles Purchased with a Trade-in | Share of Trade-ins with Negative Equity | Average Amount of Negative Equity | Average Trade-in Age (Years) |

| 2025 | 44.6% | 28.1% | -$6,905 | 3.7 |

| 2024 | 43.2% | 24.2% | -$6,458 | 3.6 |

| 2023 | 44.4% | 18.5% | -$5,808 | 3.2 |

| 2022 | 45.2% | 15.5% | -$4,894 | 2.9 |

| 2021 | 48.6% | 19.4% | -$4,200 | 3.2 |

| 2020 | 48.3% | 31.6% | -$4,964 | 3.5 |

| 2019 | 45.9% | 34.0% | -$5,251 | 3.6 |

Comments are closed.