Editor’s note: This is part two of a four-part series by Dave Schedin, CompuTrek Automotive Coaching & Training, who has more than 40 years in the automotive field and has coached shops to higher profitability since 2006. The first installment can be found here.

Being a more “bankable you” will involve doing something different than what you’re doing right now. Changing “thinking” choices will change your life and everything that you’re connected to in your sphere of influence; both in relationships and business.

During my uphill climb to understand how to be a “more bankable me,” and a profitable shop, I was advised to look at the price of what I was selling in precise detail. Walk with me though this short journey of how selling batteries can reveal how similar thinking elevated my business and brought increase.

Typical thinking and formula:

With a labor rate of $100 x .1, or $10, is used to R & R a battery to be “competitive.”

.1 (1 tenth) = 6 min. Even at .3, 18 minutes, it can be a challenge to R&R a standalone battery replacement, start to finish.

Technicality of one battery R&R:

Today’s battery install is now considered a high-tech procedure. Professional battery installs are typically at .5 or more but with some cars today, you have to reprogram the ECB & BCM to tell it a new battery was installed which ultimately could make the battery install .7 – 1.0…or more.

Cumulative time-cost of the technician:

Can your A level tech at .1 do the following in 6 minutes?

- Get RO

- Obtain keys

- Obtain the vehicle

- Validate battery with testing equipment (BTW, costs $500 to $2,500)

- Complete pre-computer scan for history/pending codes

- Install a battery to keep devices alive (ie. radio, ECM/BCM learned algorithms)

- Walk to the parts office

- Fill out parts requisition for the battery

- Wait for the battery to be pulled or pull it themselves

- Walk back to the vehicle

- Install the battery while cleaning the battery tray and terminals

- Perform ECM/BCM relearn/reprogram (on some makes/models as the computers track battery life)

- Retest the charging systems to validate the charging systems is 100 percent reliable

- Final road test

- Park the car

- Write the vehicle’s story

- Turn paperwork in, etc.

Let’s add in the advisor’s value:

- They took time to make the appointment

- Prepped the repair order (RO) using best practices (CDFM CompuTrek Process)

- Greet the customer and create / re-establish the relationship

- Write / finalize the RO

- Ask for/support customer with the radio code

- Get mileage,

- Check the vehicle in

- Print the RO

- Dispatch it to the shop

- Confirm with tech it actually needs a battery

- Look up parts to see if in stock

- Call the customer to sell the battery (the phone tagging begins)

- Give the tech the go-ahead,

- Finalize the story in the computer and process the paperwork

- Contact the customer – job complete

- Greet the customer

- Review the RO

- Facilitate the payment

- Walk customer out to vehicle

- File final paperwork

Sprinkle in the parts manager’s time (if you have one OR additional advisor tasks):

- Look up the battery

- Pull the battery

- Possibly deliver to the tech

- Receive the core

- Track the core as it’s returned to vendor

- Track you actually got the core return credit

The shop owner’s time:

- Sitting at their computer opening up the shop’s bank account online

- Repeatedly hitting the browser “refresh” key hoping the bank account goes up after each refresh

- NOT KNOWING WHY it’s not going up and they are not profitable!

IT’S CHRISTMAS!! ALL THIS FOR a $10 Labor Charge!!! Woohooooo!

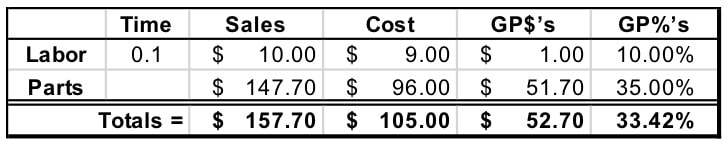

Unprofitable shops actuals:

Technician’s pay at $18/hr means, in your “Point of Sale” software, with 1/10th allowance of time to said tech, shows this valuable tech cost is only $1.80…but in reality, this is a tech who is probably hourly so while you show .1 of cost, it still took them .3 -.5 of time. which means you actually paid the hourly tech upward of $9.00, at .5, to install the battery.

This clearly does not show the value of repair shop employees, an education for the customers, or reflects that a “worker is worthy of his/her wages.” (tech, advisor and business owner).

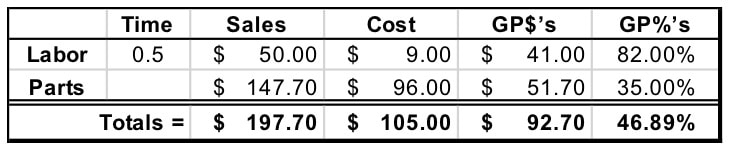

The profitable shop charges book time, typically .3-.5.

Difference in GP$ = $40 x 10 mo battery installs = $400 x 12 mo = $4,800 NEW GP dollars.

You would need to sell another 91 batteries the unprofitable way to gain $4,800 new GP dollars ($4,800 New GP$’s ÷ $52.70 old battery R&R GP$’s = 91 old way of battery pricing to hit new $4,800 GP$’s).

New applications to get unstuck toward all your services.

Imagine when a $30+/hr master tech does this task. Most wouldn’t install a battery for .1 so we go ahead pay .3+ to make the tech happy so they don’t yell at us. What happens then?

Fear is now driving our business as our motivation to keep our tech “happy” and at heart, we really know they should be paid more for this but if we don’t give them more, now we feel guilty. Now fear and guilt are running our businesses.

And … that customer, to make them “happy”, we still only charge $10 so they won’t yell at us for being too expensive, even though, we have never actually had this customer say, “You’re too expensive.” That one, or two customers, left an emotional scar so we price it according to how well they were able to “bully-dollar” us and we begin pricing based on mindsets and emotions that shouldn’t even be recognized.

To take an honest look at why I was undercharging required a full diet of humble pie. It required someone else to come in and look at my financials and how I was doing business from a 30,000-foot perspective. Oh, that humble pie was bitter at first, but sweet in the end!

No matter how many times you “race to the bottom” in your pricing, you will never please scarcity-thinking customers with your bottomed-out prices. It will never be low enough unless it’s free … and even then!

Fear and guilt have to stop running our businesses. No need to add more guilt to what you’re now realizing. Just ask yourself the most important question, “Where do I want to be at the end of 2020? What do I need to do to create the profitability I say I want?”

Staying competitive will not justify unprofitability, but it will confirm your fear or enable the customer to low-ball your business. My customer’s “no’s” seemed to convert over to my self-worth and value at an alarming rate. Their “no” was a measuring tool that I was “less than.” While my goals were, of course, to be more profitable, my competing commitment was more powerful because I wanted to avoid the pain I self-created with that “no.”

When I became self-aware and authentic toward what was running on “autopilot,” my inner circle team and coach helped me to set new goals of creating higher self-worth which simultaneously elevated a higher worth of a battery replacement service expression to my customers toward what we were actually performing. And guess what? I sold more batteries at higher prices than I ever did with low-ball pricing. I became a more “bankable me” because I became a better me.

Next: THE BANKABLE ME: Part 3 – How to identify blind spots and plot new course. Also, look for Schedin at ASA’s ATE NW in March in Seattle and sign up for one, or two, of his many classes being offered.

………………………

Dave Schedin can be reached at 800-385-0724, dave@computreksystems.com, and www.computreksystems.com.

Comments are closed.