Study shows that EV owners have similar expectations of tire wear as do owners of gas-powered vehicles

Troy, Mich.—The satisfaction gap with original equipment tires between electric vehicles (EVs) and gas-powered vehicles is widening, as EV owners say their tires are wearing faster, according to the J.D. Power 2024 U.S. Original Equipment Tire Customer Satisfaction Study, released this week.

The study shows that EV owners have similar expectations of tire wear as do owners of gas-powered vehicles, despite EV tires naturally wearing faster due to greater vehicle weight and higher torque.

“The widening satisfaction gap between EVs and gas-powered vehicles highlights an opportunity for tire manufacturers and automakers to educate EV owners on the differences in performance,” said Ashley Edgar, senior director of benchmarking and alternative mobility at J.D. Power. “Additionally, because of the inherit conflict of maximizing vehicle range and optimizing tire wear for EVs, tire manufacturers and automakers need to work together to overcome the challenge without completely sacrificing tire performance in other areas, especially as the EV market continues to increase.”

Study Rankings

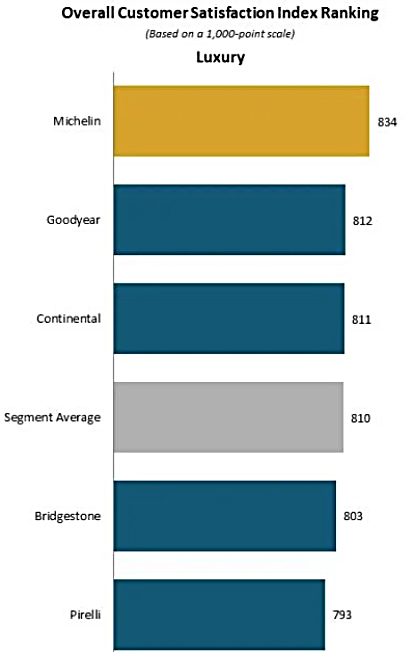

Michelin ranks highest in the luxury segment for a 21st consecutive year, with a score of 834. Goodyear (812) ranks second and Continental (811) ranks third.

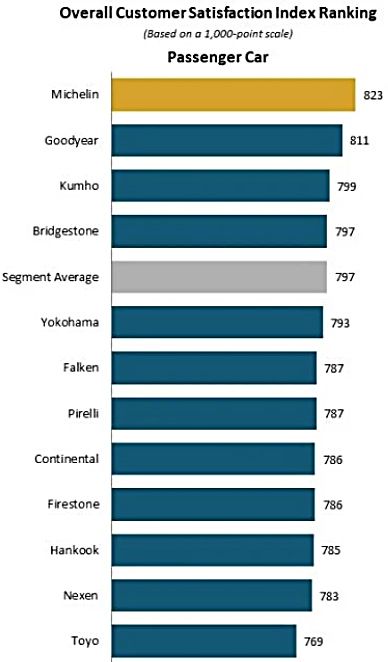

Michelin ranks highest in the passenger car segment with a score of 823. Goodyear (811) ranks second, followed by Kumho (799), ranking third.

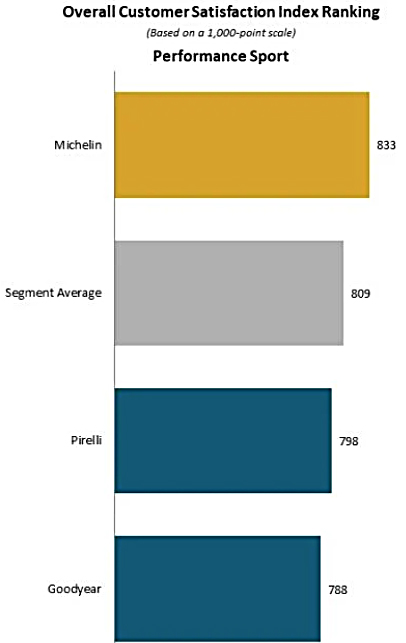

Michelin ranks highest in the performance sport segment with a score of 833.

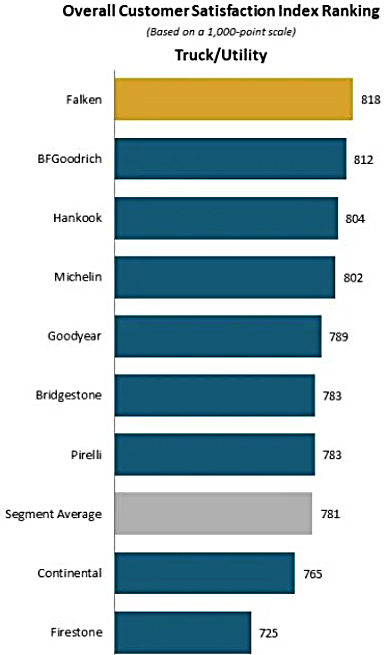

Falken ranks highest in the truck/utility segment with a score of 818. BFGoodrich (812) ranks second and Hankook (804) ranks third.

The U.S. Original Equipment Tire Customer Satisfaction Study measures tire owner satisfaction in four areas (in order of importance): tire ride; tire wear; tire traction/handling; and tire appearance. The study includes four vehicle segments: luxury; passenger car; performance sport; and truck/utility. The study is based on responses from 31,414 owners of 2022 and 2023 model-year vehicles and was fielded from August through December 2023.

Comments are closed.