Whether you are investing for the first time, or reinvesting from created cash flow, your investment into workflow systems, new equipment, training or other business elements requires due diligence

In parts one, two, three, four, five and six we learned about driving profits, creating cash flow and cash flow reserves. Whether you are investing for the first time, or reinvesting from created cash flow, your investment into workflow systems, new equipment, training or other business elements requires due diligence. You want to ensure your return on investment, ROI, is a healthy one enhancing current cash flow — not draining it.

We will cover a few workflow elements and look at ways to measure ROI. We will start with some tangible equipment and facility-upgrade elements and then move into some seemingly non-tangible elements such as training and incentive plans.

So let’s start with some basic equipment. But before we do that, you need to understand the thinking and belief systems around the equipment and what it does for you and your customers. If you want to buy preventative maintenance (PM) fluid servicing equipment but your staff doesn’t believe in PM services, then planned ROI wouldn’t be realized fully as the thinking is not in place to make it work. ROI is always maximized when you first look at the thinking and beliefs around the new change coming and the buy-in it will take from your team.

ROI is both dollars AND time. Equipment ROI is best managed by looking at the “Time ROI” it takes to pay off the equipment. After the equipment is paid off, then the Gross Profit ROI is looked at. Tracking systems need to be in place to count services and Gross Profit (GP) dollars, or your ROI will be just a guess.

Let’s talk about a power steering fluid exchange machine. Let’s see what our equipment and inventory investment will return for us. There are machines that take .7 to 1.0 hour to actually do the service and then there are machines that take only .2 to .4 to complete the service. Machines that only take .2 to .4 return a great time ROI as you are able to perform two to five services in an hour verse 1.0 to 1.5 services in an hour.

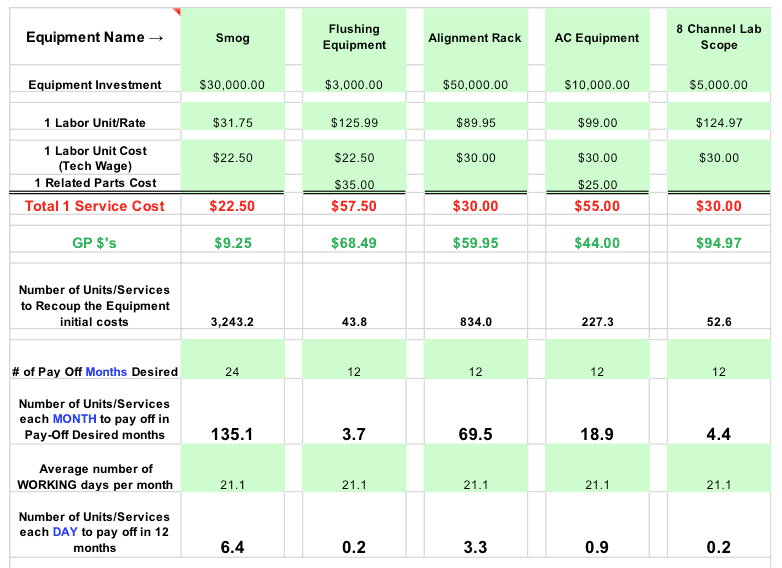

This is a copy of an Excel workbook (see below on how to get it for free) and the second column shows flushing equipment “Time ROI,” where the $3,000 machine is paid off in 12 months by only having to sell 7.7 services a month or .4 services a day. Sell more services or sell each service for more and it accelerates payoff ROI.

Using this Excel tool, you can “reduce it to the ridiculous” and see how fast you can pay off equipment. It is also great to embed this kind of a tool into your business plan when you approach your lender, as it shows you have done a great deal of research and know you ROI payoff point.

The following is a chart for training elements. While this is a bit more challenging, you should be able to ask your training company for the typical ROI for some or all of their training. Just because you got the training doesn’t mean it got implemented. When I hear shops say this or that training didn’t work, I always ask the next two questions: Did you fully implement? And if so, how long did you stick with it?

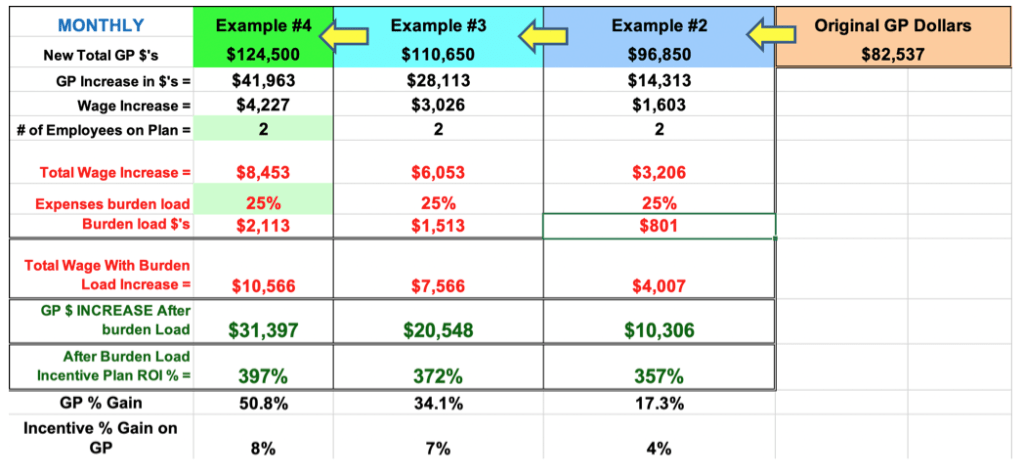

Lastly, let’s look at Incentive Plans. For each position in your company, break down the results produced for the position that closest resembles true cash flow. For advisors use GP dollars and not sales. For techs use sold hours. Our incentive plan Excel tools, for advisors and technicians, shows a shop that incentive plans for each increase in level of GP dollars or sold hours should yield a minimum of 300 percent ROI. Most our advisor plans yield about 400-500 percent ROI or more, which means the money is paid in incentive ONLY when the money is there.

Here is an example of a shop averaging $82,537 monthly GP dollars. Example two gets the shop to $96,850, which is an increase of $14,313 in new GP dollars. After incentive increase with related benefits costs the shop paid $4,007 more in incentive and cleared $10,306 in New GP Dollars. That’s a 357-percent Incentive Plan ROI. Where else can you, as a shop owner, invest $4,000 and in one month return over $10,000?

There is work in analyzing and creating incentive plans at this level — but it’s worth it. You have a $10,000 return in 30 days and now you do that for 12 months and you just increased new GP dollars by $120,000 or more!

Workflow systems to drive cash flow is like building a super-highway and it takes a bit of effort to build a highway you can drive 70 MPH for hours. It takes a bit of effort to build your Workflow to Cash flow Super-Highway. In the end the right ROI will payout great dividends.

You are not alone trying to “reinvent the wheel.” Get a coach with proven results to walk with you during the processes.

———————————————————————

** Forward this “Aftermarket Matters Weekly” to another shop BEFORE June 1 and cc Coach Dave (copy and paste the email below) and CompuTrek will email you Coach Dave’s ROI Excel workbook for FREE!

Next from Coach Dave in the Workflow to Cashflow Series: Part 8 – discover two workflow systems you should be using that can bring 15-20 percent more immediate sales.

Dave Schedin can be reached at 800-385-0724, dave@computreksystems.com, and www.computreksystems.com. A complimentary 30-minute discussion is available for the asking.

Comments are closed.