Despite a rise in overall number of service visits, U.S. dealerships are losing customers to the independent aftermarket at a steady rate

Atlanta—A new study from Cox Automotive shows a drop in dealer service retention. Despite a rise in overall number of service visits, U.S. dealerships are losing customers to independent competitors at a steady rate.

This is because cars on the road are getting older, yet loyalty to getting cars serviced where they were purchased is not what it once was, according to the Cox Automotive Service Industry Study.

“These findings from our market data and surveys underscore the urgent need for dealerships to reassess their service strategies to recapture market share and enhance customer retention,” said Skyler Chadwick, director of product consulting at Cox Automotive.

Older Cars Increase Need for Service, But Customers Are Less Loyal

The average age of cars in the United States in 2025 is trending to be 12.8 years, which is higher than last year’s 12.6 years. This trend is causing more business for automotive services and repair companies. Dealerships that offer service and parts made over $156 billion in 2024, with over 270 million repair orders.

Service and parts now make up 13.2% of a dealership’s total income, which is up from 12.4% in 2023, according to NADA, showing why dealerships often rely on healthy fixed operation revenue to make up for shrinking profit margins on selling new and used cars.

Dealerships Losing Both Service Business and Pipeline Sales to Independent Shops

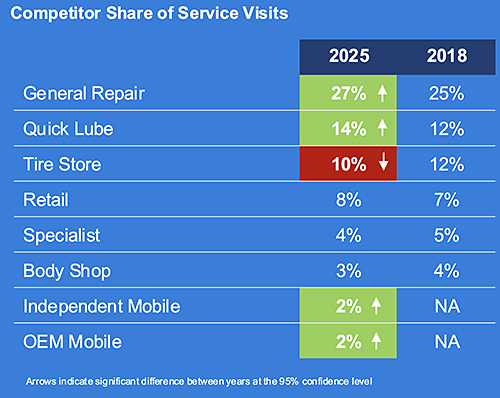

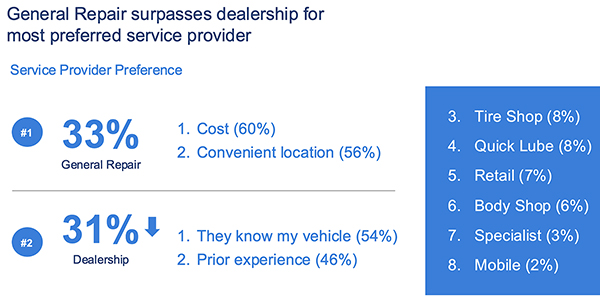

Even though dealerships are making more money from service, they are losing customers to regular repair shops, quick oil change places, and mobile service companies. Dealerships handle 12% fewer service visits than they did in 2018.

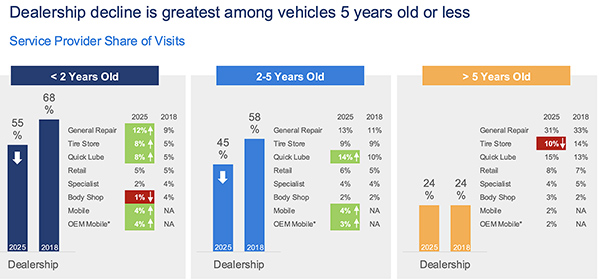

They are losing most business from cars that are five years old or newer. In 2025, only 54% of people with cars two years old or newer went back to the dealership where they purchased for service, which is down from 72% in 2023.

This idea of “buying here but getting service somewhere else” is hurting long-term customer loyalty. Car owners who get their car serviced at the dealership are much more likely (74%) to buy their next car from the same place.

Use Digital Tools and Make Things Easy to Get Customers Back

The study shows that customers are most often frustrated with unexpected costs and lack of communication. Nearly half of vehicle owners (45%) are dissatisfied with their dealership service experience — primarily due to unexpected costs and poor communication.

Yet, dealership repair costs in 2025 averaged $261, lower than the $275 average at general repair shops. Owners are seeking transparent pricing, easy scheduling, and flexible service options. Fifty-five percent think it’s very important to be able to compare costs online.

To regain loyalty, dealerships must embrace digital tools that simplify communication and offer modern conveniences such as after-hours scheduling, pickup and delivery and rideshare integration.

The Service Lane: A Good Place to Find Used Cars

Dealerships could get used cars from their service lanes, but they often miss this chance. The study says that over half of car owners who need a big repair might trade in their car. But, only a few of them are told how much their car is worth when they bring it in for service.

Using the service lane to find specific inventory you need and have a solid understanding of its condition is smart sourcing without spending a lot of money.

“Dealerships are sitting on a goldmine — over half of customers facing major repairs would consider trading in — yet most are never approached with an appraisal, leaving millions in inventory acquisition costs on the table,” Chadwick said. “There is a clear call to action here for dealerships to proactively address customer dissatisfaction, strengthen communication and improve sales to service coordination to build back market share through lasting relationships.”

Comments are closed.