While survey shows the most-desired ADAS features, there’s confusion about autonomous driving — ‘Is it self-driving, or is it just going to help me a bit and I still have to focus?’

Southfield, Mich.—Car buyers understand and want advanced driver assistance systems (ADAS) features that provide safer driving — and they expect them to be standard in new luxury and mainstream vehicles. But the same feelings do not apply when ADAS is applied to autonomous driving systems.

According to a spring 2023 S&P Global Mobility consumer survey, trust and familiarity remain barriers to car shoppers adopting autonomous driving technology. Put simply, as the amount of vehicle automation increases, consumer desire decreases.

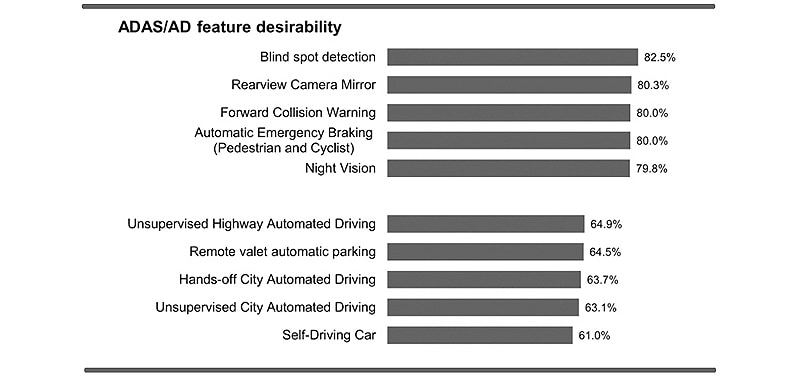

Each of the five most-desired ADAS features improves safety. Blind spot warning ranks as the most desired feature, wanted by 83% of consumers. More than 80% of those surveyed want forward collision warning and rear mirror cameras. Other top-five desired features include automatic emergency braking (AEB) for vehicles and pedestrians, as well as night vision.

“Exposure is helping to drive much of the desirability for these features,” said Yanina Mills, senior technical research analyst at S&P Global Mobility.

However, while autonomous driving features add convenience by reducing the tedium of driving, they fall well short of ADAS safety features when it comes to buyer desirability. “Safety versus convenience operate in two different ballparks of interest,” according to Brock Walquist, senior technical research analyst at S&P Global Mobility.

By contrast, consumer experience with self-driving is essentially non-existent, further inhibiting its desirability. Whereas many automated safety features poll in the 80th percentile range, only 61% of the 7,732 global respondents expressed interest in self-driving, making it the least desirable ADAS feature listed in the survey.

But increased capability doesn’t increase buyer desire. Consumers still prefer automated driving features where the driver maintains more control. Only 69% of consumers desire Level 2 autonomy. Even fewer (65%) buyers desire Level 2+ hands-off automated highway driving.

Among those polled, 53% of consumers felt that an autonomous car would drive more efficiently than a normal car, 48% felt that it would be safer, and 27% would use it to relieve tedious driving conditions.

Optimism about self-driving cars remains cautious at best — bearing in mind that “consideration” is high up the purchase funnel before purchase papers get signed. If OEMs want to convince more buyers that autonomous driving systems are worthwhile, they need to better communicate their benefits, Mills said.

Consumer sentiment is different across regions. Consumers in Mainland China, for example, have consistently shown the highest desirability scores for self-driving technology, while consumers in the US, UK, and Germany show the lowest scores in these areas.

“Consumers don’t exactly know how it is going to work. There is confusion,” Mills said. “They are asking, ‘Is it self-driving, or is it just going to help me a bit and I still have to focus?'”

The evolving nature of automated driving poses challenges — both to OEMs who want to sell these systems, and to consumers who are weighing their purchase. Automakers will need to better define the benefits of autonomy to improve its desirability to consumers.

Comments are closed.