Most auto market metrics are expected to decline in 2026 after outperforming forecasts in 2025 amid shifting consumer dynamics shift and policy uncertainty

Atlanta—Cox Automotive has released its 2026 automotive industry outlook, projecting new vehicle sales in the U.S. to hit 15.8 million units in 2026, down 2.4% from 2025 levels. Most forecasted metrics for the automotive market, according to Cox Automotive, are expected to be lower than in 2025, a year that outperformed most expectations.

“The fact is, most vehicle sales metrics in 2025 were slightly stronger than many forecast — including us,” said Jeremy Robb, interim chief economist at Cox Automotive. “Our 2026 forecast reflects a slowing market, but still a good one. While we’re expecting most sales metrics to be lower compared to 2025, the expected declines are modest, and we think there will be good news on interest rates and tax returns that help the auto market in the first half of 2026.”

A Market Defined by Fragmentation

The forecast is shaped in part by major forces pulling the economy in different directions, which will simultaneously help and hinder the auto industry in the year ahead.

- Bifurcated Consumer Dynamics: High-income households will benefit from wealth effects, tax relief and rate cuts, which can help power new-vehicle sales. But lower-income consumers will continue to feel the strain of prolonged inflation and high purchase costs of both new and used vehicles. This divergence will accelerate trade-down behavior, making value perception critical across the market.

- Fragmented Labor Market: A “jobless expansion” is emerging as gross domestic product (GDP) shows signs of growth through investment and productivity gains, but employment stagnates. Slow job growth will dampen household formation and confidence in big-ticket purchases, including vehicles. This weak labor market will be a headwind for the auto market, but stock market gains can be a tailwind.

- Inflation and Fed Risk: Inflation appears to be slowing, and recent rate cuts will improve household financial health. However, uncertainty surrounding Federal Reserve leadership and independence creates volatility, delaying the housing recovery and limiting auto sales growth.

- Policy Shifts and the EV Shock: The current administration will continue to have a heavy hand in industrial policy, which will ensure further uncertainty. Tariffs, fuel-economy adjustments and tax-code changes will create a complex and dynamic landscape, with the USMCA renegotiation front and center in 2026. Meanwhile, the electric vehicles market will enter its next chapter in 2026, without government incentives and off-lease EV models flooding the used market.

- AI’s Inflection Point: Emerging productivity gains from AI are real, but competitive fragmentation is likely to intensify as early adopters pull ahead. Investments in AI infrastructure are boosting GDP and retail efficiency, benefiting dealers and consumers through improved processes, pricing transparency and service. For the automotive industry, the challenge is whether AI investments will create value or if diverting capital from traditional R&D will prove costly.

2026 Auto Market Forecast Highlights

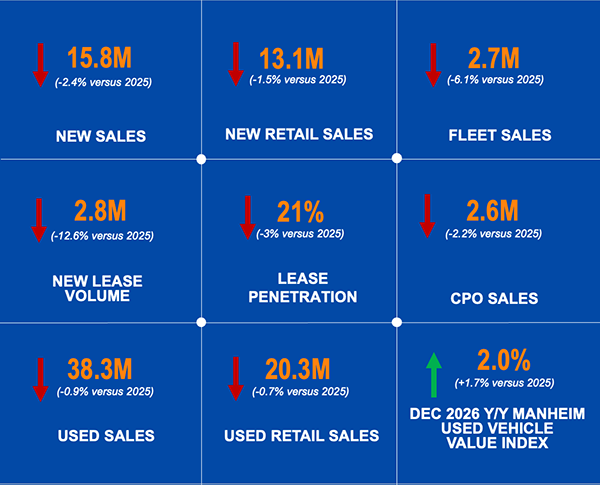

Cox Automotive’s 2026 outlook calls for a slowing but stable U.S. auto market, with most sales metrics expected to dip slightly from 2025 levels.

- Total New-Vehicle Sales: The new-vehicle market is projected to deliver 15.8 million units, down 2.4% from 2025.

- Retail New-Vehicle Sales: The retail sales pace is expected to fall 1.5% year over year, and fleet sales are forecast to drop more sharply, down by 6.1% from 2025.

- Leasing: EV and plug-in hybrid lease penetration is projected to decline, with an overall rate of 21%, down 3 percentage points from 2025.

- Retail Used-Vehicle Sales: A slight year-over-year decline in used retail sales is expected as affordability pressures sustain demand for lower-priced vehicles.

- Wholesale Values: The Manheim Used Vehicle Value Index is forecast to rise 2% year over year by the end of 2026, reflecting normal depreciation trends.

Comments are closed.