The North American regional president of Bosch Mobility Aftermarket talks about legacy products, new technologies and new profit centers for shops

Aftermarket Matters Weekly caught up with Bosch’s Todd Hertzler to discuss everything from balancing the market needs of the current car parc to the emerging opportunities as vehicle technologies advance at unprecedented rates. Here’s a breakdown of the discussion. Note that the interview has been edited for clarity.

Aftermarket Matters Weekly: The aftermarket is at a convergence of legacy products and new technologies — how important are each and how do suppliers address the demands of both?

Todd Hertzler: It’s interesting because the headlines spend a lot of time talking about the sexy innovation that’s happening: electrification, automation and autonomous vehicles — and we’re absolutely investing in new technologies. At the same time, we have to also reconcile the fact that the majority of the car parc is not necessarily going to be using that advanced technology for years to come.

But to stay a player in this industry doesn’t mean that you can keep the status quo. You have to continue to invest and keep the parts affordable, available and on time. And to do that requires investments from suppliers, not just maintenance of existing lines.

AMW: How do you work that balance between present day needs and forecasting the needs of tomorrow?

TH: Our OE division is doing a lot of that forward thinking and it’s working with the aftermarket division to ensure that we have service-ready plans and products to launch into the market. For us, being an innovator in the OE space allows us to keep our eyes on the future. It’s really an important part of being a supplier on both sides of the business.

AMW: What are some examples of important legacy technologies?

TH: When talking about internal combustion-specific technologies it’s about fuel delivery: fuel pumps, fuel rails, fuel injectors, spark plugs, as well as after treatment, like oxygen sensors and engine management.

But there’s also fast-moving trade goods such as starters, alternators, filters, batteries, brakes and wiper blades. Some of which will carry over to the future, even in electrification — you’re still going to need to wipe the windshield. You’re still going to need to stop the vehicle. You’re still going to need cabin filters. Those will continue to play a huge role in the car parc in North America for many, many years to come.

AMW: The aftermarket was a much more quieter place with technology just 15 or 20 years ago. Would you say todays’ accelerated technology is unique to our times right now?

TH: One hundred percent. This was not something that was hyperfocus. At that time we were talking about small advancements to existing technology. The core of the technology was remaining the same — even when you talked about next generation. This, right now, is a complete upheaval. It’s like nothing we’ve seen in the automotive industry. Ever. And that’s why the positions that suppliers take is so incredibly important — are you committed to the legacy? Are you committed to the future? Or are you committed to both?

Just in general, 15 to 20 years ago, a lot of bets were starting to be made. But look at electrification of vehicles even then — it looks nothing like it does today. It’s completely different. If I were tell you 15 years ago that we knew exactly what was going to happen, it wouldn’t be the case today. But I think the speed in which we and the industry have adapted is really impressive. For us, innovation and new technology isn’t a pivot. It’s just part of the DNA.

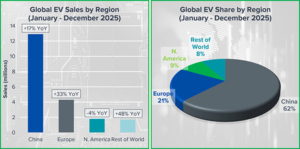

The adoption of new technology also has had its ebbs and flows. Looking at electrification, the industry was a lot more bullish on it 5 years ago than where we are today. And that’s caused some disruption in terms of technology development and deployment.

At Bosch, we like to think that we’re propulsion agnostic. So whether it’s electric, synthetic, standard, fossil fuel, hydrogen or fuel cell, we’re developing technology in almost every single space.

The only question is: When does that technology come to its time and then how do we scale it?

AMW: As a supplier to the OEs, what technology do you think is being developed today that shops will see once those cars come out of warranty in 5 to 7 years? There’s a lot of talk about ADAS (advanced driver assistance systems).

TH: ADAS is interesting for two reasons. When you think about autonomous, everybody assumes you’re talking about cars that drive themselves and you’re sitting in the back seat with your feet up, reading a book. But there’s multiple levels of autonomy — and ADAS has proved that. Whether it’s adaptive cruise control, emergency braking, lane detection warning, or whatever it may be, those are certain levels of autonomy.

They’re being deployed and we’re living in it now. The degree to which it’s “autonomous” may not be what people had thought it was going to be by now, but it doesn’t mean that the technology isn’t already here. So when you talk about what is something different for the aftermarket in 3 to 7 years, it’s already happening today, and ADAS servicing is going to get even more important.

Whether it’s sensors, the cameras or the calibration, ADAS servicing is required in order to ensure these vehicles continue to be safe. It’s going to be a really important piece because depending on the job you’re working on — calibrating the camera and the sensors — it’s almost a mandate. It has to be done.

The requirements to calibrate, at a certain point, are pretty prohibitive for the average shop. And we’re working to make that no longer the case. It’s an area that we’re very much focused on — it’s going to be a big part of a shop ticket.

Comments are closed.