Similar to the 2007-09 economic downturn, automakers are turning their attention to the aftermarket with renewed interest in today’s economic uncertainty

During the economic downturn of 2007-09, there was a shift in how dealerships helped drive profits in the wake of historically low new-vehicle sales: parts and service.

They developed strategies to encourage customers to turn to their service bays to build new revenue streams and take a bite out of the independent aftermarket.

The aftermarket was low-hanging fruit: dealers could emphasize, for example, customer segments where they already had a toehold (such as some luxury segments where 80 percent of owners thought dealerships and independent services were comparably priced, according to a Boston Consulting Group report).

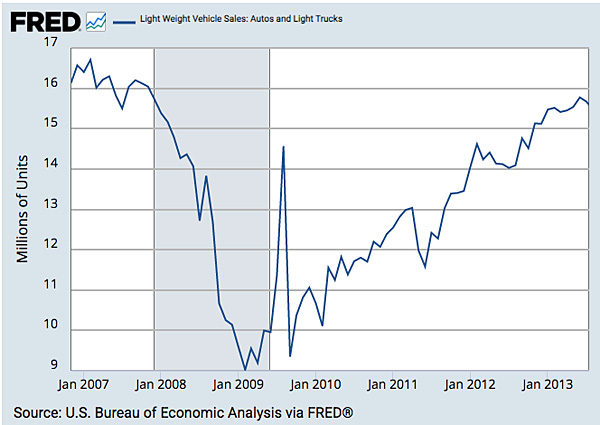

Who could’ve blamed them? Everyone needed to make a buck. According to the Federal Reserve Bank of St. Louis, new vehicle sales from 2007-2009 fell 40 percent. Faced with bankruptcy, Chrysler and General Motors were bailed out by the U.S. government. At one point, the federal government owned 61 percent of GM.

Light Weight Vehicle Sales: Autos and Light Trucks

But here we are again. While today’s economic circumstances are different and we’re not in a recession (hold on to your hats), the Administration’s recent tariffs, trade policies and, now, with new vehicles averaging price tags north of $50,000 for the first time.

I’m reminded of Mike Chung, who leads market intelligence at the Auto Care Association, who recently said, “It’s just really interesting in that any day you can wake up and see a news alert and think, wow, that could really affect my business. And certainly we are in those times.”

Automakers are now again increasingly turning their attention to the aftermarket as a reliable source of profitability. They’re treating the aftermarket as a boardroom priority. Close to one-third of U.S. automakers expect parts and service to contribute no less than half of their entire revenue with the next five years. Here they come again.

There’s a lot of new technology in vehicles today and more is coming down the road that requires OEM repair data to service them. It’s no secret automakers want to control the repair data that the independent service community relies on. They’d like to keep it in their dealerships’ bays.

Which is why, perhaps more than ever before, it’s important to support Right to Repair legislation so the aftermarket and consumers have access to all OEM repair data to successfully — and safely — return vehicles to the road. Keep the aftermarket the vibrant parts and service community that the driving public heavily relies on. And it’s legislation that has overwhelming public support — but only when voters and policymakers are made aware of what’s at stake.

You can help by speaking up. Take 30 seconds of your day by following this link to contact your members of Congress to support Right to Repair and let’s level the playing field. Everyone should have equal opportunity to take a bite of the aftermarket apple.

Comments are closed.