Editor’s note: The following insights are provided by McKay & Company on its latest Aftermarket Index report. Suppliers interested in access and participation in the reports can contact Brian VanCamp at MacKay & Company, brian.vancamp@mackayco.com

Looking at supplier sales to each channel in the U.S. since 2021, it’s tough to say for certain if one was hit harder than the other and what the new normal will be going forward

Lombard, Ill.—In a period of record level demand for freight services such as we’ve seen over the last two years, the last thing the industry needed was a global disruption to the pipeline of service parts and maintenance items.

Manufacturing suppliers, especially those who serviced both the OEM dealers and the independent distributors, were faced with a never-ending challenge when it came to order fulfillment. With order boards constantly exceeding capacity, it became a choice of which orders were shipped and which ones were delayed. Delivery dates were constantly changing and could easily be delayed weeks or months.

Over the last year, shortage issues seemed to have cleared up. At the same time, freight demand has tapered off to a more “normal” pace. The challenge became correcting and managing inventories which were either bloated from overstock or filled with parts which no longer had vehicles waiting for installation.

Looking at supplier sales to each channel in the U.S. since 2021, it’s tough to say for certain if one was hit harder than the other and what the new normal will be going forward.

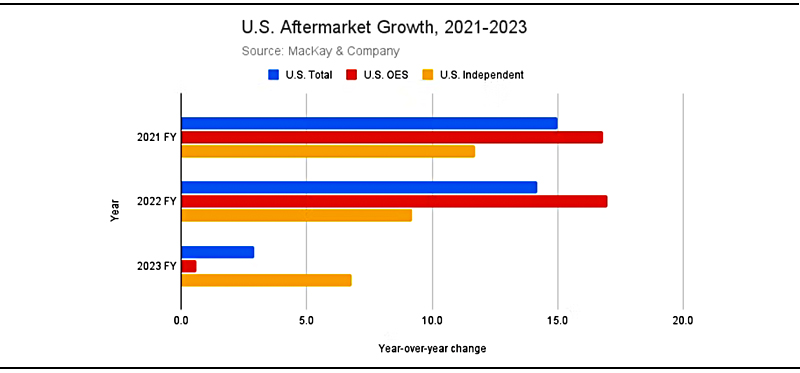

In December of 2021, the combined total sales from 19 primary suppliers as measured by Aftermarket Index at MacKay & Company, had increased by nearly 15% over the prior year. Both the OES and independent channel sales were booming with double-digit growth in every North American region. Fast-forward a year to the end of 2022 and the story is similar with year-over-year growth in the U.S. up 14%. The channel splits also held their position from the previous year with the OES sales up by 17% and the independent distributors finished at +9.2%.

2023 was a very different story. With the full-year data nearly complete, the total change is around 3% from 2022 in the U.S. By channel though, independents at +6.8% have outpaced the OES at +0.6%.

| Year-Over-Year Change | 2021 FY | 2022 FY | 2023 Est. |

| U.S. Total | +15% | +14.2% | +2.9% |

| U.S. – OES | +16.8% | +17% | +0.6% |

| U.S. – Independent | +11.7% | +9.2% | +6.8% |

Upon further investigation, a few potential causes for the shift in numbers have surfaced although none have consistently topped the list. These include the proliferation of true “all-makes” lines being tried and adopted for vehicles earlier in their lifecycle (than traditionally seen), an increase in vehicles being kept out of service as freight demand has decreased, and an extensive surplus of parts in the OES channel which has greatly reduced the need to re-order stock for the better part of the year.

While these types of dramatic shifts are not unheard of, they’re typically followed by a period of course-correction and not seen as permanent changes to the parts business.

We have certainly seen a slow-down in the overall pace of part sales in the North American aftermarket but have yet to see any indication that the channels are going to shift from their current positions. Channel movement is one of the key metrics being monitored as part of The Aftermarket Index as it moves into the first half of 2024.

Comments are closed.