The Big Five and dozens of independent MSOs and dealers continued to acquire and develop hundreds of shops

Consolidators, Accelerators and Independent MSOs remain undaunted in their pursuit of growth. In a year that saw interest rates more than double, shops rates and repair costs surge more than 10% and the technician shortages continue to bedevil everyone in the industry, the Big Five, the seven private-equity backed Accelerators and dozens of independent MSOs and dealers continued to acquire and develop hundreds and hundreds of shops — more than 550 in total.

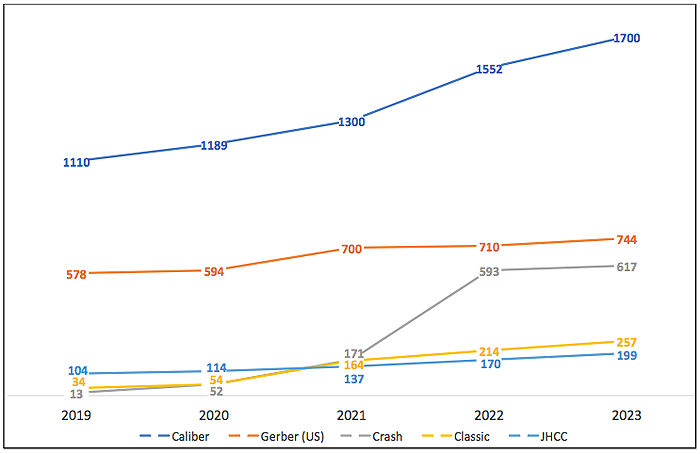

Throughout 2023, the Big Five (Caliber, Gerber, Crash Champions, Classic Collision, and Joe Hudson’s) acquired and developed new shops at a steady 9% pace, while focusing on improving performance in their existing footprints. Their combined total of 278 additional locations included a large number of brown and greenfield shops. The next tier of private equity-backed collision repair platforms, the Accelerators grew their total locations by a blistering 50% with 101 additional locations. Largely unnoticed were the 173 other locations acquired or opened by independent MSOs and dealers.

Capital has been abundantly available for most of these acquirers. Many of the private equity-backed firms that entered the collision space in 2022 continued to pay up for platform and add-ons as they accelerated their acquisitions throughout the year. Independent MSOs and dealers seem to find other sources of capital that has allowed their growth to accelerate as well. This ready access to capital confirms that private equity investors continue to gain confidence that consolidation will continue for years into the future.

The collision repair industry has shown impressive resilience amidst a downturn in global mergers and acquisitions (M&A) activity. According to Dealogic, 2023 saw global M&A volume drop 18% year-over-year to a 10-year low, with private equity deals witnessing a particularly steep 38% decline. In contrast, M&A volume in the collision repair sector remained remarkably steady. This steadfast performance despite broader market fluctuations highlights the collision repair industry’s unique appeal and enduring ability to attract investment even in challenging conditions.

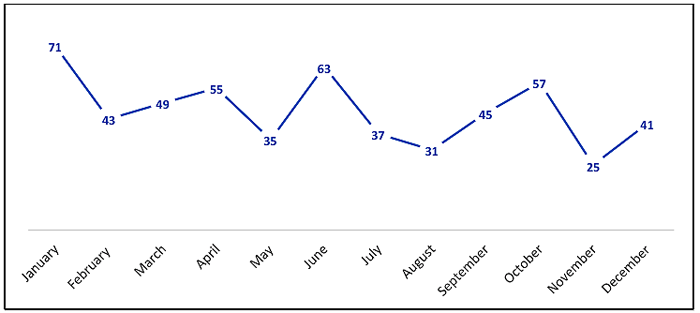

The year got off to a strong start, with 316 shop add-ons in the first half, including acquisition of MSOs, single shops, and new location developments. As the Federal Funds Rate rose through the latter half of 2023, transactions continued at a more moderate pace. The year concluded with a notable 25% reduction in the number of shops added versus the first half of the year, closing out the second half of 2023 with 236 add-ons. While uncertainty in the economy likely played a role in decreasing deal volume, perhaps the main driver of the declining volume was the slowdown in the pace of acquisitions by two energetic acquirers, Crash Champions and CollisionRight.

Add-on Locations by month by all acquirers and developers (US)*

M&A Deal Trends – 2023

Despite rising interest rates across financial markets in 2023, valuations in the collision repair M&A space have remained stable for most sellers. But valuations have remained especially strong for top, well-run independent MSOs. The sector’s most active acquirers continued to value the most attractive acquisitions at multiples comparable to 2021, defying expectations of value compression.

However, deal structures have been shifting in this high interest rate environment — creating market dynamics that are a bit less favorable to sellers. More transaction proposals now incorporate contingent earnout provisions and/or seller financing. Earnouts allow buyers to protect downstream performance risk when agreeing to higher upfront valuations. Meanwhile, seller notes offer cheaper financing to fuel deals. Across the board, buyers are proposing more earnouts and notes in this climate compared to recent years.

But while valuations hold strong for prime MSO assets, other factors are hindering deal completion rates. Buyers today display less tolerance for potential business vulnerabilities during due diligence like questionable quality of earnings, staff turnover, DRP loss risk, or real estate problems. As capital costs increase, buyers are vetting opportunities with extra caution before closing deals. In years past, many of these concerns could be overlooked or waived to push transactions through. Today’s more discerning due diligence is causing more deals to be re-traded at lower prices or abandoned outright after signing letters of intent.

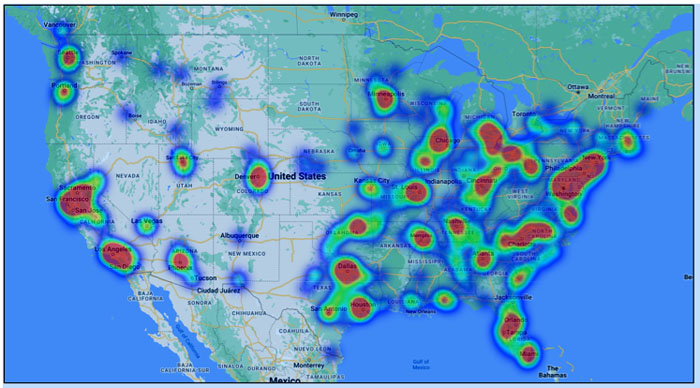

Regional Trends – 2023

Distinct regional consolidation patterns emerged in 2023 as consolidators targeted key markets to expand their geographic footprints. An analysis of acquisition activity at the Core Based Statistical Area (CBSA) level spotlights the metro regions that attracted the most buyer attention last year.

Top 10 CBSAs by Transaction Count

- New York-Newark-Jersey City, NY-NJ-PA, 8 transactions

- San Francisco-Oakland-Hayward, CA, 7 transactions

- Seattle-Tacoma-Bellevue, WA, 7 transactions

- Washington-Arlington-Alexandria, DC-VA-MD-WV, 7 transactions

- Dallas-Fort Worth-Arlington, TX, 6 transactions

- Sacramento-Roseville-Arden-Arcade, CA, 6 transactions

- Denver-Aurora-Lakewood, CO, 5 transactions

- Houston-The Woodlands-Sugar Land, TX, 5 transactions

- Memphis, TN-MS-AR, 5 transactions

- Minneapolis-St. Paul-Bloomington, MN-WI, 5 transactions

The New York-Newark-Jersey City metro’s 2023 acquisitions by consolidators topped all regions nationally, adding 14 shops across 8 transactions. Intense activity was led by Northeast MSO VIVE Collision, which increased its strong regional foothold via key deals like the purchases of 2-shop Collex Collision Experts of NJ and 2-location M3 Collision Group plus other single shop additions. Meanwhile, major consolidators Crash Champions and Caliber Collision also added 2 area shops each as buyers remained focused on gaining share in the highly competitive market which shows no signs of slowing consolidation momentum going into 2024.

The Washington-Baltimore corridor in the Mid-Atlantic saw a surprising flurry of deals. The Washington-Arlington-Alexandria and Baltimore-Columbia-Towson CBSAs ranked among the top 5 nationally for number of shops acquired and top 15 for number of transactions. CollisionRight led activity in the region, purchasing several MSOs including Severn Auto Body, SDR Certified Collision, Canby Motors, and Top Gun Collision to add multiple locations across DC and Baltimore. Asbury Automotive Group also expanded its regional footprint, acquiring 9 shops through its purchase of the Jim Koons Automotive Companies dealer group. Other notable buyers in the region included Caliber Collision (4 new shops) and Joe Hudson’s Collision Center (1 additional shop in Rockville).

The Denver-Aurora-Lakewood CBSA has developed into a highly competitive market, attractive for growth-focused Consolidators but difficult to penetrate. Given land use restrictions that complicate constructing new collision repair facilities, acquiring existing shops provides the most reliable expansion pathway. Classic Collision followed this consolidation route in 2023, adding 9 Denver-area shops to bolt from the market’s #5 player to #2 behind Caliber Collision. Notable deals included the purchases of five Colorado Auto Body shops and three shops of the Signature Collision Group (both of which were represented by Focus Advisors). With only a few independent MSOs left to be acquired in the Denver market, the battle for market share remains tight. Consolidators seeking to increase scale will have to focus on acquiring single shops and smaller MSOs remaining in the region.

Heat map of shop acquisitions in 2023

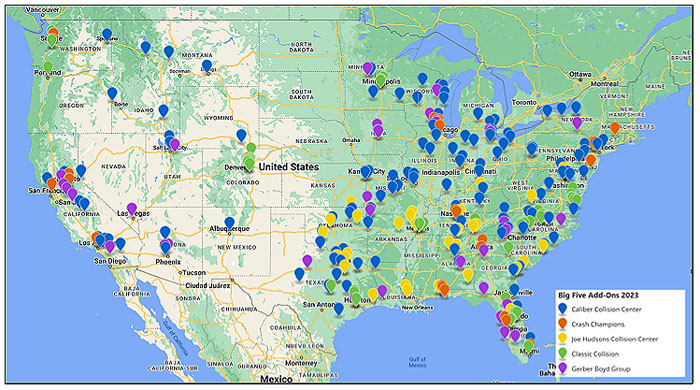

The Big Five Signal Enduring Appetite for Growth

The most active buyers — Caliber Collision, Gerber Collision/Boyd Group, Crash Champions, Classic Collision, and Joe Hudson’s — continued aggressive consolidation efforts in 2023. Together, these leading Consolidators (the “Big Five”) added about 278 shops nationally last year, accounting for 50% of collision industry M&A deal volume.

By zeroing in on attractive markets and securing leading positions regionally, the Big Five aim to capture insurer volume through scale, density, and performance. Their unrelenting acquisition pace spotlights an enduring consolidation trend as major Consolidators jockey for position in the still-fragmented collision repair landscape.

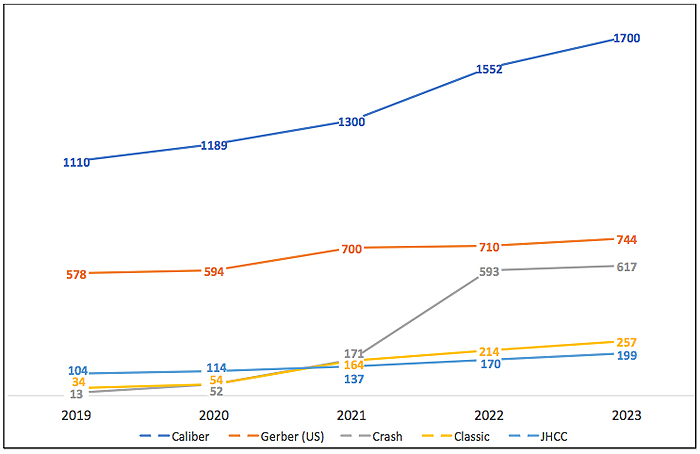

Caliber Collision regained its title as the collision repair industry’s most active acquirer in 2023, adding about 150 shops nationally, of which about half were green/brownfield locations. This expansion grew Caliber’s footprint from 1,552 repair centers in 2022 to more than 1,700 in 2023. Major activity regions included the Midwest (Missouri, Kansas, Iowa, Illinois, Michigan, Minnesota, Ohio) as Caliber targeted key interstate corridors. Out west, Caliber built density through deals across Montana, Idaho, and Utah. And in Caliber’s home state of Texas, numerous additions beefed up its presence including in the Dallas metro.

Gerber Collision & Glass, part of the publicly traded auto services company Boyd Group, nearly doubled its prior year’s acquisition count by securing an estimated 34 shops during 2023. Boosting an already formidable presence, Gerber’s Florida expansion spanned 5 acquisitions from Tallahassee south to Fort Myers. Gerber also made moves out west, acquiring 4 shops to build density throughout regions of California’s Central Valley between Sacramento and Merced. With Boyd Group’s stock price growing by 40% between January 1, 2023 and January 1, 2024 on the back of strong performance, Gerber ended 2023 with an estimated 744 collision repair centers in the US.

After merging with Service King in mid-2022, Crash Champions slowed dramatically, adding just 27 locations. While focused on integrating 336 Service King repairs centers, Crash remained active in key regions like Chicagoland, where it acquired Adams Collision (4 shops) and in Jonesboro, Georgia, where it acquired European Collision Repair (4 shops). Notably, 4 out of the 27 locations added by Crash last year were greenfield developments, signaling Crash’s willingness to build new repair centers from the ground up in attractive markets where acquisition targets may be limited. Crash ended the year with 617 shops.

Classic Collision maintained its momentum adding about 50 shops in 2023 – the second-highest total industrywide behind Caliber Collision. Classic made two of the top five MSO acquisitions this year, including 6-shop MSO Elite Auto Body in the Hampton, VA market and 5-location Colorado Auto Body in the increasingly competitive Denver market. Beyond these larger acquisitions, Classic bolstered its foothold in Minneapolis/St. Paul with 5 add-ons consisting of single shops and small MSOs, and in North Carolina through two 3-shop MSO acquisitions in Charlotte and Chapel Hill. Classic continued its momentum through the end of the year, ending with 257 total repair centers across 16 states.

Joe Hudson’s Collision Centers achieved its most active consolidation year since 2019, focusing growth on its Southern U.S. stronghold. Total acquisitions reached an estimated 38 shops, highlighted by Steve’s Auto Body, a 4-shop Arkansas-based MSO. Texas proved a major target as well with 8 add-ons, most of which were in the Dallas region. Expansion extended into Alabama with 4 shops, and Tennessee with 3 shops. Joe Hudson’s consistent pace resulted in 199 total shops by year-end 2023.

Shop add-ons by the Big Five in 2023

Shops owned by the Big Five Consolidators at Year-End (2019-2023)*

Accelerating Consolidators Increase Deal Momentum

In the two largest single deals of 2023, Quality Collision Group acquired 14-shop Schaefer Autobody Centers in St. Louis and 9-shop Cascade Collision Repair in the Salt Lake City area. This instantly vaulted Quality to a top 2 spot regionally behind only Caliber Collision in both St. Louis and Salt Lake City. Another notable pickup was Relentless Collision, a 3-shop Raleigh MSO formerly owned by industry veteran, Todd McGowan. With 32 total acquisitions last year, Quality ended the year in 9 states with 62 repair centers.

Further building its Midwest and Northeast density, CollisionRight added an estimated 22 locations during 2023 including 5-shop Michigan operator Auto Pride Collision. Also acquired were 4 separate 3-location regional MSOs: Woods Collision (Ohio), D’s Paint & Body (Illinois), Severn Auto Body (Maryland), and Centerline Collision (Pennsylvania). This activity brings CollisionRight’s 2023 year-end total to 89 shops.

After rapid growth in recent years, Kaizen Collision took a strategic pause on acquisitions during 2023 – maintaining its network of 48 repair centers nationally.

Northeast super-regional VIVE Collision saw a breakout year, nearly doubling its total with the addition of 18 shops. Founders, Vartan Jerian, Scott Leffler, and Phil Taub, defined the playbook for expanding in this challenging region. Beyond adding 5 metro New York/New Jersey shops, VIVE entered Pennsylvania via an innovative partnership with dealership group Vinart (also represented by Focus Advisors). VIVE ended the year with a successful exit by early PE investor, Garnett Station. VIVE’s new PE sponsor Greenbriar Equity Group aims to support VIVE’s ongoing organic, M&A, and operational growth initiatives.

Puget Collision, backed by investment firm Eagle Merchant Partners, further solidified its growing Pacific Northwest presence with 13 additions during 2023 headlined by Camille Eber’s 3-shop Fix Auto operation out of Portland. In just over 2 years since its founding, Puget has quickly scaled through strategic regional acquisitions to finish 2023 with 32 total shops.

Former Indy racer Jim Guthrie’s OpenRoad Collision continued building scale in 2023 after rapidly launching in 2022. OpenRoad remains focused on regional expansion with 14 new locations added in 2023. Backed by LP First and Trivest, Guthrie and team are leveraging years of operational experience founding top Southwest MSO Car Crafters to establish a leading Mountain West and Southwest platform. They ended the year with 26 shops across Texas, New Mexico, Oklahoma, and Arizona.

Family office backed BrightPoint Auto Body made 3 acquisitions in 2023. Potentially more impactful was welcoming industry executive Paul Williams as BrightPoint’s new President. Williams joined after 4 years as Vice President of Operations at Gerber Collision, bringing invaluable experience to guide BrightPoint’s growth efforts.

Shops owned by the Accelerating Consolidators at Year-End (2019-2023)*

Private Equity Interest Continues, Now Looking Down Stream

Private equity interest in collision repair continued rising in 2023, with more firms actively searching for deals in the sector compared to 2022. However, with less than a handful of large-scale platform MSO opportunities emerging annually, competition remains high for deals meeting larger PE investment criteria. Typically targeting platforms with $30+ million in revenue and $5+ million in EBITDA, investors are still finding the limited options attractive. Recognizing accessible scale opportunities will stay relatively scarce, private equity firms expanded their focus downstream in 2023 – pursuing smaller regional MSO platforms led by experienced and ambitious entrepreneurs.

Key factors driving positive PE sentiment include:

- Steady revenue growth driven by consistent parts/labor inflation

- Resilient through economic cycles with third party insurance payors delivering sustainable cash flows

- Potential for an umbrella valuation event if/when sector leader Caliber Collision goes public

- Highly fragmented industry with no shortage of independent acquisition target shops at reasonable valuations

In 2023, Greenbriar Equity Group was the lone new private capital entrant via its recapitalization of Northeastern consolidator VIVE Collision. But with over 25 PE firms actively searching within the sector, more proprietary regional platforms seem likely to emerge over the next five years.

Current Private Equity Backed Consolidators

| Private Equity Owner | Collision Repair Platform |

| Alvarez & Marsal Capital | Crash Champions |

| CenterOak Partners | CollisionRight |

| Clearlake Capital | Crash Champions/Service King |

| Eagle Merchant Partners | Puget Collision |

| Garnett Station | VIVE Collision |

| Hellman & Friedman | Caliber Holdings |

| Incline Equity Partners | Certified Collision Group |

| Leonard Green | Caliber Holdings |

| LNC Partners | Kaizen Collision Centers |

| LP First Capital | OpenRoad Collision |

| New Mountain Capital | Classic Collision Centers |

| OMERS | Caliber Holdings |

| Roark Capital Group | Driven Brands |

| Southworth Capital | BrightPoint Auto Body |

| Susquehanna Private Capital | Quality Collision Group |

| Trivest Partners | OpenRoad Collision |

| TSG Consumer | Joe Hudson’s Collision Centers |

| Greenbriar Equity Group L.P. | VIVE Collision |

Top MSO Acquisitions of 2023*

| MSO | Shops | City | State | Acquirer |

| Schaefer Autobody Centers | 14 | St Louis | MO | Quality Collision Group |

| Cascade Collision Repair | 9 | Salt Lake City | UT | Quality Collision Group |

| Herbers Autobody Repair | 6 | Edmonton | AB | LIFT Auto Group |

| Elite Auto Body Inc of Hampton VA | 6 | Hampton | VA | Classic Collision |

| Colorado Auto Body | 5 | Aurora | CO | Classic Collision |

| Auto Pride Collision MI | 5 | Flushing | MI | CollisionRight LLC |

| Steves Auto Body LLC AR | 4 | Jonesboro | AR | Joe Hudson’s Collision Center |

| Adams Collision – Chicago | 4 | Lake in the Hills | IL | Crash Champions |

| ECR European Collision Repair | 4 | Jonesboro | GA | Crash Champions |

| Woods Collision Center | 3 | Williamsburg | OH | CollisionRight LLC |

| Ds Paint & Body Shop | 3 | Peoria Heights | IL | CollisionRight LLC |

| Severn Auto Body Inc | 3 | Annapolis | MD | CollisionRight LLC |

| Relentless Collision LLC | 3 | Raleigh | NC | Quality Collision Group |

| CARSTAR Mark Wasmuth | 3 | Chapel Hill | NC | Classic Collision |

| Carstar Jerry Rhynes Collision Repair | 3 | Charlotte | NC | Classic Collision |

| Fix Auto Camille Eber | 3 | Portland | OR | Puget Collision LLC |

| West Delray Collision | 3 | Delray Beach | FL | Star Collision Centers |

| Signature Collision Centers | 3 | Greeley | CO | Classic Collision |

| Auto Craft Collision Center AL | 3 | Fairhope | AL | Crash Champions |

| Centerline Collision LLC | 3 | Pittsburgh | PA | CollisionRight LLC |

| Steve Stymeist Collision Centers | 3 | Placerville | CA | Crash Champions |

2024 Speculations

With proven acquisition playbooks and consistent capital access, 2024 is shaping up as a potentially massive year for the Big Five. As interest rates normalize, deal velocity could accelerate industrywide. Additionally, several major private equity-backed platforms are approaching anticipated ~5-year hold targets, priming them for possible recapitalizations or sale processes. Combinations among the Big Five and the Accelerators may be realized.

2024 is likely to see even more private equity investors in the industry. We expect many of the new entrants will shift their initial acquisitions to smaller independents, targeting strong regional MSOs for new roll-up plays. The table seems set for 2024 to take industry consolidation to yet another level through strategic expansions, financial sponsor reconfigurations and new capital sources hungry for a piece of the action.

Independent MSOs will continue to grow as they find more opportunities to acquire single shops, smaller MSOs, and building their own brownfield and greenfield shops. Access to capital for the most aggressive independents may constrain their growth to some extent. But we expect additional financing sources to become available as the risk associated with well- managed positive cash flowing entities declines in the eyes of investors. With attractive exits almost always an alternative to protect the downside risk of these investors, we expect to see more and more independent MSOs grow beyond $50 million in revenues.

*Chart data and statistics on industry shop counts and acquisition volumes represent our best estimates from available public information, not statements of absolute fact.

Comments are closed.