Steven E. Schillinger is a P.E. and PBE consultant in addition to being “actively retired.” He can be reached at schillingersteven@gmail.com and linkedin.com/in/seschillinger.

Automotive repair shops will soon see a rise in demand that could cause financial problems when the coronavirus disruption recovers. These problems will stem from the fact that many shops might have cash flow troubles. During the Covid-19 interruption, most shops will still have continued expenses for:

• Mortgage and rent

• Day-to-day expenses

• Payroll and taxes

• Parts and paint supplies

• Vendors and equipment

• Garage keeper insurance

On the other hand, most automotive repair shops get their revenues from third-party insurance companies, auto dealers, and municipalities. The problem, aside from discounted payments, is that many third parties pay slowly. They can take 60, 90, or even 120 days to pay. As a vehicle repair shop operator, this delay means that their shop may not have the financial resources to cover all operating expenses until payment is received.

During the current coronavirus disruption, we are all experiencing the fact that it’s extremely difficult to conduct business and not run into cash-flow problems. This does not mean that your shop is not profitable. Some aren’t, but many are. However, you still have to manage your shop efficiently and keep track of finances.

Conventional financing

One way to solve unexpected cash flow problems when your shop recovers is to use conventional financing. In many cases, this will be the only option.

Shop owners can get conventional financing through banks, lending institutions, and brokers. Individuals may also want to consider a government guaranteed loan, such as an SBA 7a. With small business loans, the government provides a guarantee to the lender in case you don’t pay. A government guarantee makes the SBA loans most attractive to banks. See National Small Business Environmental Assistance Program for information on Covid-19 loan resources.

However, banks still underwrite loans and lines of credit conventionally. Getting conventional financing is simple – but not easy. The process takes much time and requires substantial documentation. For small amounts (under $30,000), shop owners should consider SBA Microloans.

Recapture cash flow

The challenge during these tough times is that many auto shops simply need positive cash flow. They might have cash-flow problems because of the disruption and cannot afford to wait for insurance payments. If insurance companies, dealers and municipalities paid quickly, the cash flow problem would go away. The cash-flow disruption is widespread for:

• Collision shops

• Dealerships

• Equipment providers

• Multi-shop operators

One way to fix a cash-flow problem is to finance accounts receivable. This solution provides many of the benefits shop owners would normally realize from quick payments, without requiring insurance companies or organizations to pay more quickly. It works by partnering your business with an organization that secures funding using regulatory resources and insurance claims as collateral.

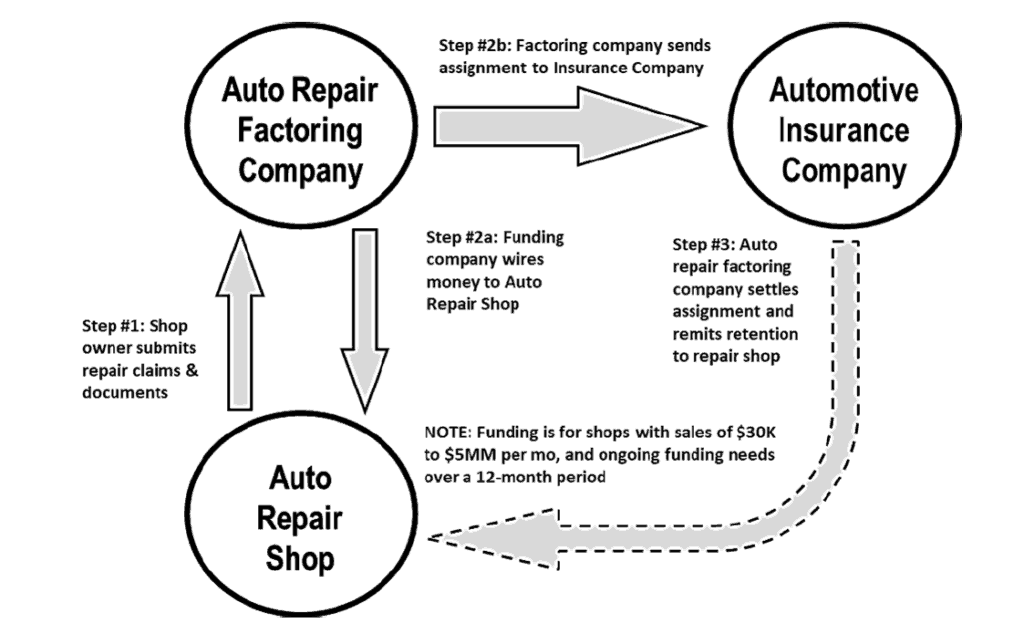

Most transactions are funded in two installments. The first installment is wired as soon as the claims are submitted and covers 60 percent to 75 percent of the net payable value of the claims. The following diagram explains how this transaction works:

Each transaction settles once the insurance company pays the claim. The settlement amount covers any funds that were retained and not advanced, less the factoring company fee. Proof of compliance with the following regulations is typically required:

• EPA hazardous waste permit

• EPA air emissions inventory permit

• EPA spill prevention and control countermeasures

• NESHAP 6h employee training (BECCA, I-CAR, GMG-EnviroSafe)

• NESHAP 6h hands-on training (Axalta, PPG, Sherwin-Williams, Sikkens)

• OSHA employee medical evaluation (spray coating shop employees)

• OSHA employee fit testing (spray coating employees only)

• Garage keeper insurance policy

• Building and fire code permit

Costs

As a rule of thumb, a vehicle repair factoring line of credit is often more expensive than conventional financing options. This expense is due to the fact that factoring companies do not underwrite transactions using banking rules. Instead, they focus (almost exclusively) on regulatory compliance and the credit strength of the company paying for claims. From an underwriting perspective, the transactions funded are riskier and, therefore, more expensive. Costs vary between 2 percent and 4 percent per 30 days.

Advantages of auto shop repair factoring

This solution has three distinct advantages. First, it can be used by shops that don’t have an extensive regulatory history. In most cases, it can be used by service and repair shops during the coronavirus recovery period as long as they have some track record with their garage keeper insurance company.

Second, the underwriting process is quick. Shops can often get funded in a week or two. And third, the credit line is not fixed and can grow with the business.

Disadvantages of auto shop repair factoring

There are disadvantages to accounts receivable financing. The first disadvantage is the cost, which has been discussed herein. Factoring is expensive and will only work for shop owners that have a healthy profit margin. The second disadvantage is that factoring only solves some problems caused by the Covid-19 pandemic, not fundamental business or financial issues.

How auto shop repair factoring works

Shop owners use accounts receivable financing, aka factoring, when and if it is beneficial. Shop owners choose the invoices that they want to factor. Flexibility to factor what you want, when you want, if and when it’s beneficial is vital. Factoring is not a loan, so you are not incurring any debt. Money is immediately available while you maintain full command of your operation.

Factoring improves cash flow by reducing the time to get cash. As a result, shop owners get immediate access to funds for payroll, paying vendors and other operational expenses. Factoring allows shop owners and operators to minimize troubles associated with the unfortunate coronavirus disruption.

Comments are closed.