Repair shops using Facepay free up cash for a better position to secure capital for their growth

Mountain View, Calif.—Facepay Inc. has announced that its new offering FacepayCapital is immediately available for all auto repair shops on its platform. This product comes at a time when auto shops are experiencing accelerating demand from the ongoing pandemic.

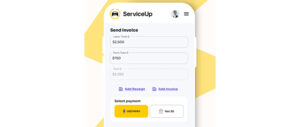

FacepayCapital provides access to funds needed for staffing, diagnostic services, training and other near-term upgrades. Customers who use Facepay tend to have better cash flow and are more likely to get loans or lines of credit approved quickly. FacepayCapital lets customers apply for a loan directly from the product, saving time and paperwork.

Facepay is already helping auto repair shops increase profits, on average $25,000 a year. Auto repair shop adoption of Facepay is accelerating as they deploy Facepay to convert customers from paying with credit cards to direct payments.

This is happening as the repair industry faces a historical increase in credit card rates for all full-service and discount card processors. Facepay offers customer conversion tools to facilitate this shift. According to Dr. Mark Hale, founder of Facepay, “Facepay integrates with all management systems and, when deployed with the workflow, auto repair shops can immediately see up to 40 percent conversion to direct bank payments. This technology is already available in consumer applications used by half of the population.”

FacepayCapital gives repair shops access to term loans and lines of credit to grow their business and presents multiple offers from best-in-class lenders. This capability is integrated directly into the Facepay platform as a one-stop-shop for acquisition, underwriting, origination, and onboarding needed to access the money needed. It is powered by Lendflow, the leading platform for embedded lending.

Shops can free up cash to pay for the loans or credit they need. There is no charge to use FacepayCapital beyond the loan or line of credit service terms.

Webinar, Dec. 16

Westerlund will moderate a one-hour webinar on Thursday, Dec. 16, at 9 AM (PST) / Noon Eastern with an expert panel on the subject of “Growing Your Business in 2022.” Panelists include Kim Hickey, Automotive Training Institute; Ryan Burton, CEO of LeadsNearMe; Monique Mondragon, Shop-Ware; and Brittany Schindler, Facepay Power User and GM of Rod’s Japanese Auto Care Inc. Webinar registration is open now at www.facepay.io.

Comments are closed.