Collision facilities are now required to maintain, or expand, existing capabilities and auto insurers need to account for the additional repair operations

San Diego—With dense electrical architectures, software-driven systems and sensor-heavy designs, battery electric vehicles (BEVs) are now generating high diagnostic and calibration demands — keeping repair complexity firmly in place regardless of market fluctuations.

According to Mitchell’s latest Plugged-In: EV Collision Insights report, BEVs last year averaged 1.70 calibrations per collision repair estimate, compared with 1.54 for ICE vehicles and 1.63 for hybrids (both MHEVs and PHEVs combined).

As calibrations become increasingly common across all vehicle types, markets with higher concentrations of battery electric and hybrid vehicles continue to experience greater repair demands.

As a result, Mitchell states that collision facilities are increasingly required to maintain, or expand, existing capabilities and auto insurers need to account for these additional repair operations and costs when underwriting.

EV Collision Claims Rise Even as Sales of New Models Slow

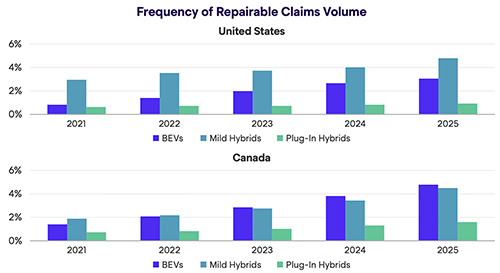

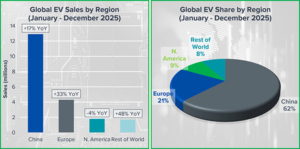

While sales of new BEVs decreased approximately 2% in the U.S., claims for repairable vehicles kept climbing. The share of repairable claims also increased by 6% for PHEVs and 20% for MHEVs year over year in the U.S. and 26% and 29% respectively in Canada.

“Even as BEV adoption slowed in North America last year following the end of government tax incentives, the auto insurance and collision repair industries still saw claims volume rise since more of these automobiles are on the road than ever before,” said Ryan Mandell, Mitchell’s vice president of strategy and market intelligence.

“Due to their dense electrical architectures, software-driven systems and interconnected, sensor-heavy designs, these vehicles require additional diagnostic and calibration operations when damaged that can add cost, complexity and cycle time to each repair.”

The report also highlights annual changes in:

• Vehicle Values: Total loss market values dropped across most powertrain types with BEVs experiencing the largest decline, 6% in the U.S. and 13% in Canada. This was the result of accelerated depreciation, increased availability of lower-cost models and shifting consumer sentiment.

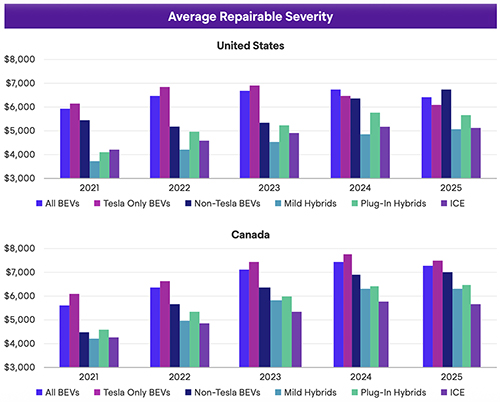

• Claims Severity: Average severity for repairable BEVs also fell by 5% in the U.S. and 2% in Canada. While remaining flat in both countries for PHEVs, claim costs for MHEVs increased by 4% to $5,054 in the U.S. and held steady in Canada at $6,267.

• Parts Selection: OEM parts remain more frequently used in BEV collision repairs. On estimates for repairable vehicles, the percentage of parts dollars designated for OEM parts was 86% and the percentage of repairable parts listed was 13% versus 62% and 15% respectively for ICE vehicles.

Comments are closed.