The following are key takeaways from the Colorado Automobile Dealers Association’s auto outlook report for Q4 2025

Denver—The Colorado Automobile Dealers Association (CADA) has released it Colorado Auto Outlook report for Q4 2025 covering the state’s new and used vehicle markets. The following are key takeaways from the analysis with data sourced from Experian Automotive.

Six key facts for Colorado new vehicle market

• State market was up 1.4% in 2025. U.S. improved 3.3%.

• Registrations: 225,000 last year, well above the recent low of 194,177 in 2022.

• Market was down 11.9% in Q4 2025 vs. year earlier compared to the 3% increase in Q3.

• Toyota, Ford, Subaru, Hyundai, and Chevrolet were market share leaders.

• Hybrid vehicles accounted more than 31% of Toyota, Lexus, and Honda registrations in the Q4.

• Ford F-Series, Toyota RAV4 and Tesla Model Y were top three sellers in state market. VW ID.4 had a large percentage increase from 2024 to 2025.

Alternative powertrain market: Five key trends

• BEV share fell from 21.6% during the first 10 months of 2025 to just 9.5% in November and

December.

• BEV share during all of last year was 19.6%, up slightly from 19.5% in 2024.

• Hybrid market share increased to 16.2% in November and December of last year, up from 13.2% during the preceding 10 months.

• Plug in hybrid vehicle market share fell to just 2.2% during the last two months of 2025.

• ICE vehicles accounted for 62% of registrations for all of last year.

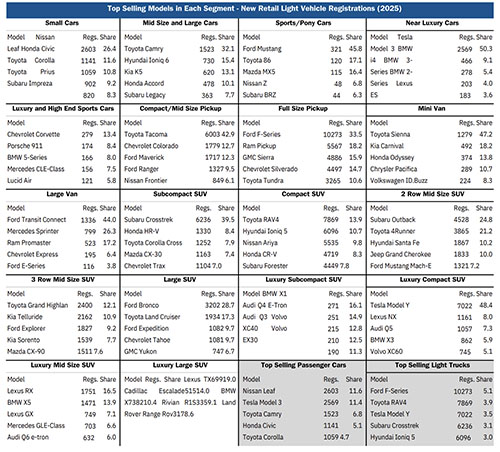

Model Rankings: F-Series and RAV4 were top sellers in state market

The table below shows the top five selling models in 2025 in 20 segments. In addition to unit registrations, it also shows each model’s market share in its respective segment.

Best sellers in primary segments

• Small Cars: Nissan Leaf

• Mid Size and Large Cars: Toyota Camry

• Near Luxury Car: Tesla Model 3

• Full Size Pickup: Ford F-Series

• Subcompact SUV: Subaru Crosstrek

• Compact SUV: Toyota RAV4

• 2 Row Mid Size SUV: Subaru Outback

• Luxury Midsize SUV: Lexus RX

All four regional markets moved higher last year

The figures below represent new vehicles registered to retail customers residing in each of the regions, and includes both purchase and lease transactions.

• Biggest market: Denver Metro — 130,150 registrations.

• Largest percentage increase: Northern Colorado — Up 3.9%.

• Highest BEV share: Denver Metro — 24.1%.

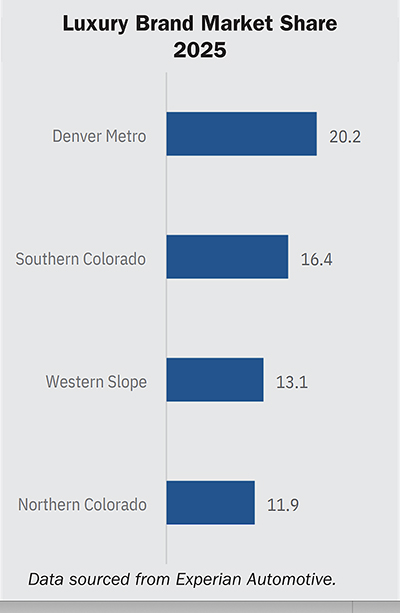

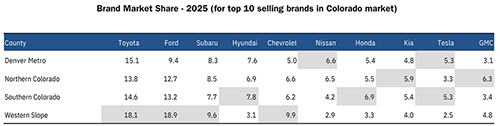

County Markets: Toyota market share exceeded 18% in Western Slope region

The table below shows brand market shares in each of the four regional markets. (Includes top 10 selling brands in the area.) Highest market share for each brand is shaded grey.

Used Vehicle Market Increased 2.3% Last This Year

Three key trends

• The Colorado used vehicle market increased 2.3% from 2024 to 2025, just above the 1.4% increase in new vehicle registrations.

• Registrations for 7-to-10 year-old vehicles increased 4.2% from 2024 to 2025. The 4-to-6 year-old market declined 3.7%.

• Supplies of 4- and 6-year-old vehicles are likely to decline this year versus year earlier. Availability of 5-year-old vehicles should improve.

Comments are closed.