Toyota reigned again this quarter as the top-selling brand, capturing 17.4 percent of the state’s market share compared to Tesla’s 9.8 percent

Sacramento, Calif.—California’s new light vehicle market continued its steady climb through the third quarter, with registrations rising 5.4 percent YTD and 3.6 percent in Q3 compared to the same period in 2024.

The state is on track to see a modest annual increase by year-end, according to the California New Car Dealers Association (CNCDA)’s “Q3 2025 California Auto Outlook” report, using data sourced from Experian.

Source: Experian

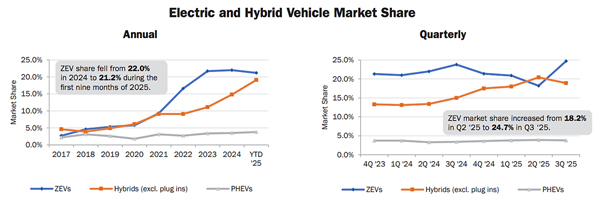

The quarter’s most striking shift came in zero-emission vehicle (ZEV) sales, which spiked to 24.7 percent of the market. The increase was likely fueled by consumers rushing to purchase electric vehicles before September’s federal tax credit expiration. Despite this short-term lift, ZEV market share stands at 21.2 percent YTD, short of 2024’s posted 22 percent, signaling continued challenges for sustained EV adoption.

Source: Experian

Tesla Slides as Toyota Shines

Tesla has fallen for two straight years in the Golden State as registrations declined 15.1 percent YTD, dropping 9.4 percent in Q3. Toyota reigned again this quarter as California’s top-selling brand, capturing 17.4 percent of the state’s market share compared to Tesla’s 9.8 percent. Toyota registrations continue to climb, posting the most significant market share gain among all brands with a 1 percent increase YTD, and a sizable 2.4 percent jump in Q3.

The Toyota Camry also beat out Tesla’s Model 3 as the top-selling passenger car YTD, capturing 12.8 percent of the market.

Alternative Powertrain Registrations on the Rise

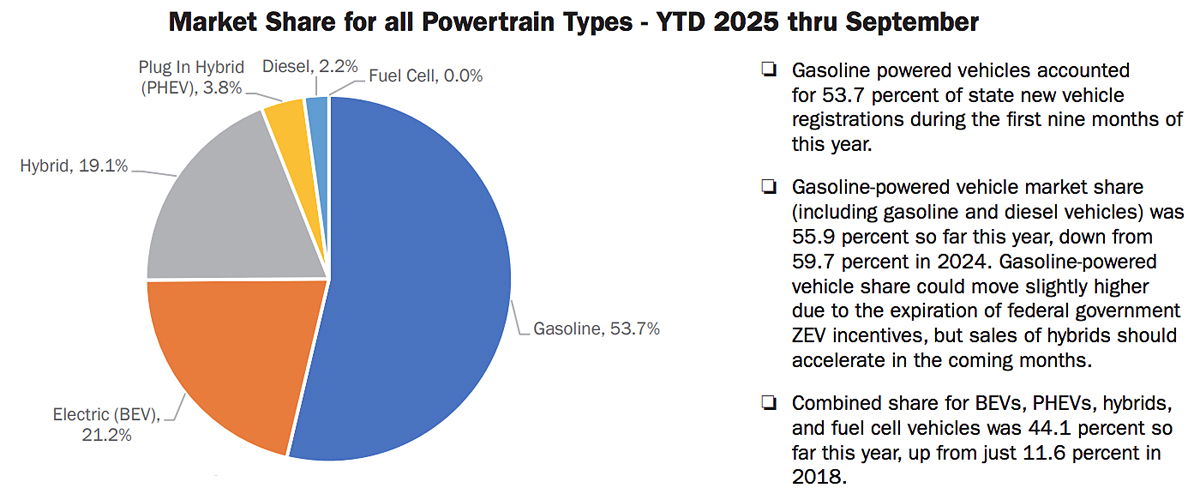

While the ZEV market was unusually strong this quarter, hybrid registrations accounted for 18.9 percent of new registrations in Q3, posting 19.1 percent YTD. This surpasses 2024’s 14.8 percent hybrid total, suggesting that Californians want cleaner transportation options. However, they also prefer a balanced, gradual transition to the electrification of their personal transportation.

“Dealers are seeing real enthusiasm from customers for the latest hybrid and electric technologies, especially as the mainstay brands expand their lineups,” said Robb Hernandez, CNCDA Chairman and president of Camino Real Chevrolet. “Californians want choices that fit their lives and budgets. Our dealers are here to provide hybrids, EVs, or gas-powered options that meet them where they are.”

Combined sales of hybrids, plug-in hybrids, and zero-emission vehicles have reached 44.1 percent YTD, showing progress toward cleaner transportation in the state, but not at the all-electric pace policymakers envisioned. Despite ZEVs reaching their highest quarterly share (24.7 percent) since early 2023, the spike is expected to fade now that federal tax credits have expired.

The California Air Resources Board’s Advanced Clean Cars II (ACC2) mandate continues to face legal uncertainty after being struck down earlier this year under the Congressional Review Act. The ACC2 mandate excluded all hybrids and many PHEV models.

While litigation is ongoing, policymakers’ goal of 100 percent ZEV sales by 2035 remains far from current consumer trends, and it is highly unlikely that ZEV sales would have met the initial 35 percent threshold for model year 2026.

Brand and Model Rankings

Toyota leads the California market, followed by Honda (10.9 percent), Tesla (9.8 percent), Ford (7.7 percent), and Chevrolet (6.5 percent).

Top passenger car models include the Toyota Camry (45,617 registrations), Tesla Model 3 (44,173), and Honda Civic (41,130). Leading light trucks include the Tesla Model Y (79,448), Toyota RAV4 (49,584), and Honda CR-V (41,217).

Brands showing notable growth YTD include Buick, Jeep, Acura, Genesis, Cadillac, and Land Rover, each posting increases above 20 percent compared to Q3 2024.

Regional Trends

Northern California outpaced the rest of the state, with registrations up 5 percent and a ZEV share of 24.9 percent. Southern California saw a 2.9 percent gain, with ZEVs accounting for 22.2 percent. The San Francisco Bay Area, Los Angeles/Orange Counties, and San Diego County all posted moderate growth.

Franchised dealerships continue to lead in consumer engagement and accessibility, accounting for nearly half (49.7 percent) of all ZEV sales in the state, a gain from 40.8 percent one year ago.

Statewide Outlook

With the federal EV credit now expired, economists expect ZEV sales to normalize in Q4 as market forces and consumer preferences rebalance. The state’s total new vehicle registrations are projected to reach 1.74 million units in 2025, a slight increase from 2024.

Comments are closed.