New report covers projections for the next five years in both the demand for new entrant technicians and the anticipated supply of tech school and community college graduates

Phoenix—TechForce Foundation, a national not-for-profit dedicated to helping people explore and pursue the technician profession, has announced the release of its 2023 Technician Supply & Demand Report.

The report covers projections for the next five years in both the demand for new entrant technicians (needed to keep up with growth in new positions and replacement of retiring techs) and the supply of graduates being produced by postsecondary tech schools and community colleges nationwide.

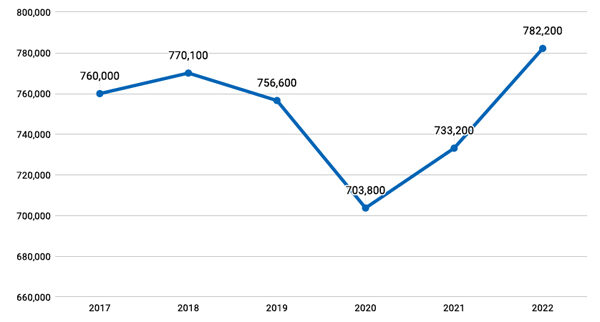

Automotive Technician Employment

The automotive, collision, and diesel industries have suffered from a “massive” gap in supply and demand, leading to a significant technician workforce shortage that has plagued the industry for decades.

In this year’s report, however, TechForce finds that collective completions of postsecondary automotive, collision, diesel, and aviation programs actually increased for the first time in a decade. “This is wonderful news,” stated TechForce Foundation CEO Jennifer Maher.

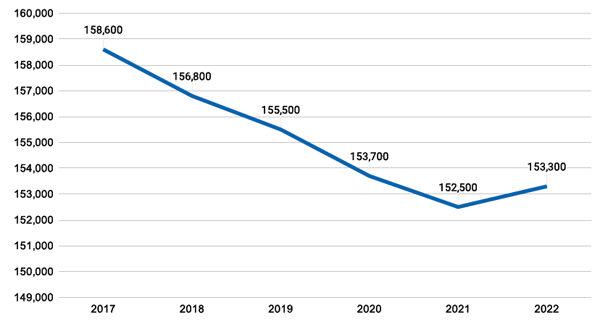

Collision Technician Employment

TechForce’s report shows that the technician workforce grew by 4.3% from 2021 to 2022, outpacing the overall US Labor Force’s growth (4.0%) for the first time. While this is good news, the report still finds the gap remains.

Industry needs 795,000 new automotive, diesel, collision repair, aviation, and avionics technicians to meet demand over the next five years, 2023-2027. Even with the uptick in completions of tech school and community college programs, the gap continues to persist.

Greg Settle, author of the report and Director Emeritus of National Initiatives at TechForce Foundation, said, “Through this year’s data analysis, we expect nearly 800,000 new technicians to be needed over the next five years. This number is down from last year’s projection of one million new hires deemed necessary to fill the gap. While a number of factors influence overall demand, the increase in technical school graduates and the growth of the total number of technicians employed from 2021 to 2022 certainly account for a good part of the decrease.”

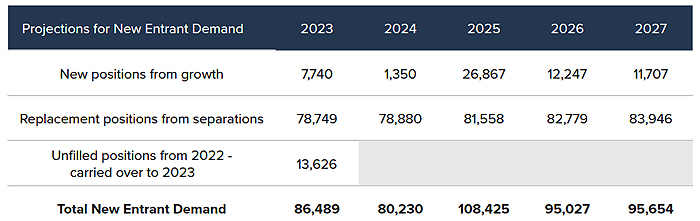

Demand for Automotive New Entrant Technicians

Demand for new entrant technicians comes from two sources; new growth in that sector, and occupational separations. Occupational separations include both retirements and turnover from those leaving the industry for other reasons. As in past years, the demand from occupational separations far outpaces the demand from new growth. For example, between 2023 and 2027, 406,000 positions will be needed due to operational separations, while only 60,000 will come from new growth.

Of the 795,000 new technicians required, automotive technician demand is still the highest at 495,000, he said. Diesel technicians follow at 152,000, Collision Repair at 110,000, and Aviation & Avionics still needs 68,000 new hires.

“Hopefully,” Settle adds, “the past year’s trend of increased graduates continues, as we still have many more open positions than graduates ready to join the workforce. Collision Repair has the biggest challenge ahead with 6.7 jobs available for every graduate, followed by 3.1 for Diesel, 2.6 for Automotive and 1.2 in Aviation.”

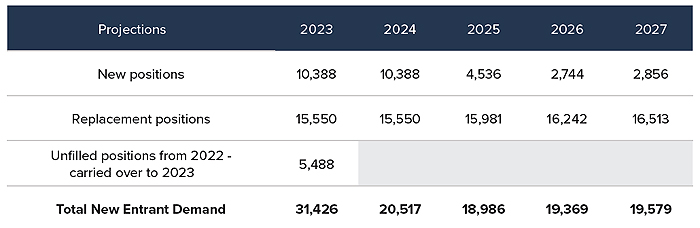

Demand for Collision New Entrant Technicians

Similar to the situation with automotive technicians, the majority of new entrant demand will be created by occupational separations. Additionally, nearly 5,500 unfilled positions from 2022 add to the 2023 demand projections, as seen in the above chart.

Too often, students either don’t start or have to drop out of their technical education because of financial barriers. TechForce will award $2.3 million in scholarships and grants this year alone, “but that’s still only serving 1 in every 3 applicants,” said Maher. “We simply need more donations to help these students get where they’re trying to go, which is employment in an industry that desperately needs them.”

To access the full 2023 Supply and Demand Report visit TechForce.org/Supply-Demand.

Comments are closed.