Should the economy slow into recession, vehicle use and average annual mileage, both key inputs in tire replacement demand modeling, will likely decrease

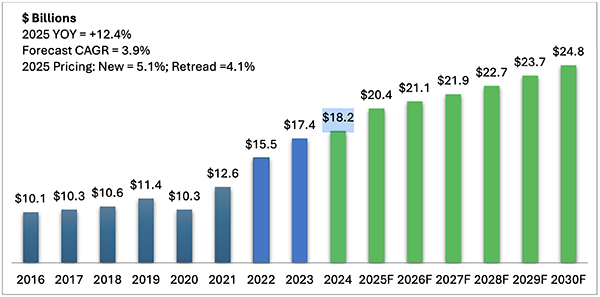

Lombard, Ill.—The total value of the replacement tire market is projected to increase nearly 12.4%, reaching $20.4 billion at current retail prices. This upward shift is largely driven by rising production costs, tariffs on imports and steel, and price increases.

Overall tire replacement demand for Class 6 – 8 power units, trailers and container chassis is forecasted to grow 5.5% over last year, reaching 21.1 million new tire replacements and 16.9 million retread replacements, according to MacKay & Company’s 2025 DataMac Tire Operator Report, just released.

The industry’s leading manufacturers — Michelin, Bridgestone, and Goodyear — retain their dominant market positions, though rankings vary slightly depending on vehicle class. Dependability remains the most important factor influencing purchasing decisions for both new and retread tires, followed closely by past brand experience, product availability, provider support, and tread life. Training quality provided by manufacturers continues to rate lowest among surveyed performance factors, signaling room for improvement.

MacKay & Company also notes that broader economic uncertainty continues to weigh on the market. Factors such as tariffs, inflation, government shutdowns, and a softening truck economy contribute to volatility. Should the economy slow into recession, vehicle utilization and average annual mileage, both key inputs in tire replacement demand modeling, will likely decrease, driving down aftermarket demand.

Comments are closed.