Claims rebound in Q3 from Q2 in the U.S. just as expiring government tax incentives prompted record-breaking sales

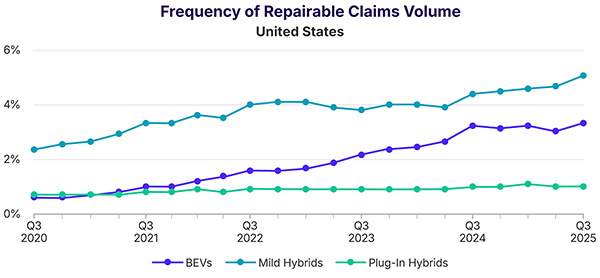

San Diego—A new report from Mitchell highlights a dramatic reversal in U.S. collision claims frequency for repairable battery electric vehicles (BEVs). They dropped for the first time in Q2 before rebounding last quarter to an all-time high of 3.21% just as expiring government tax incentives prompted record-breaking sales.

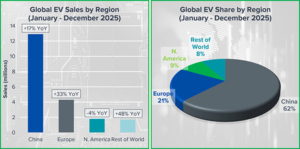

“We’re witnessing the immediate impact of policy changes on BEV adoption and collision claim trends in both the U.S. and Canada,” said Ryan Mandell, Mitchell’s vice president of strategy and market intelligence. “With recent political and trade developments producing uncertainty, many automakers are now diversifying their portfolios to accommodate more hybrid and gasoline-powered alternatives as they reassess their BEV investments and growth targets.”

He added that this gradual, geographically uneven transition to widespread vehicle electrification will require auto insurers and collision repairers to adjust underwriting strategies, business processes and workforce training to support a wider mix of drivetrains.”

Mitchell’s Q3 Plugged-In: EV Collision Insights report also reveals:

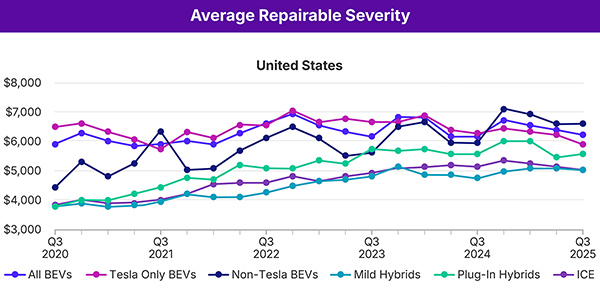

Claims Severity: Average severity for repairable BEVs dropped to $6,185 in the U.S., a decrease of 2.4% and 1.5% respectively from Q2. In both countries, automobiles with an internal combustion engine (ICE) had the lowest average severity followed by mild hybrid electric vehicles (MHEVs) and plug-in hybrid electric vehicles (PHEVs).

Claims Frequency by Region: Regions with the most BEVs per capita also continue to have the highest number of BEV collision claims. Last quarter, California was third at 6.50% for repairable vehicle claims, Quebec was second at 8.37% and British Columbia was first, 8.74%.

Total Loss Market Values: Total loss market values averaged $29,827 for BEVs, a decrease of approximately 1% from Q2, compared with $13,979 for ICE automobiles.

Parts Use: Without a robust alternate parts industry for BEVs, OEM parts are most frequently used in BEV collision repairs. On estimates, 85% of the parts dollars for repairable vehicles in Q3 were designated for OEM parts — a slight increase over the previous quarter — versus 62% for ICE alternatives.

Download the complete report here.

Comments are closed.