Here are the states with the highest estimated rate hikes, the largest estimated rate decreases, rate changes by insurance company and more for the new year

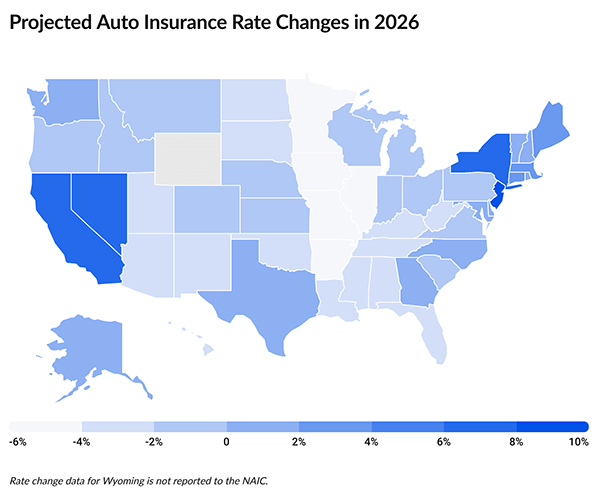

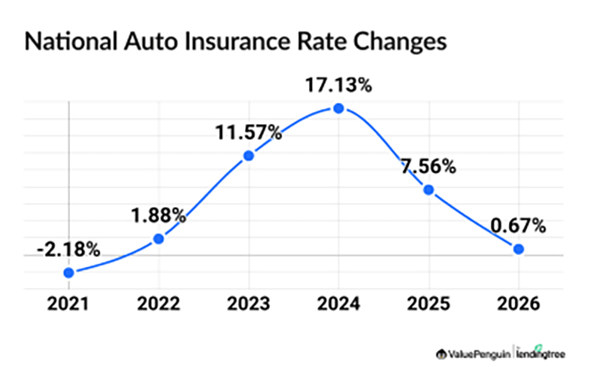

New York—Auto insurance in 2026 is projected to increase by less than 1 percent (0.67%), which is the smallest year-over-year increase since 2022, before high inflation caused car insurance rates to skyrocket with increases of 11.57% in 2023, 17.13% in 2024 and 7.56% in 2025. But depending on the state, rates may increase by over 10% or drop by about 6%.

According to ValuePenguin by LendingTree’s State of Auto Insurance 2026 report, the average cost of full coverage car insurance in the U.S. is $208 per month, or about $2,496 per year, for full coverage, in 2026.

Nevada, Louisiana, Florida, Connecticut and Delaware all have average rates of over $300 per month, making them the five most expensive states for car insurance in the country. All three states — Nevada $335 per month, Louisiana, $327, and Florida, $311 — are at least 50% more expensive than the national average. The report notes that’s a difference of more than $100 per month. Nevada costs more than two and a half times more than a policy in the cheapest state, Vermont.

Vermont ($128 per month), Maine ($129) and Wyoming ($131) have the cheapest full coverage car insurance rates in the U.S, the analysis stated. All three of these largely rural states have rates that are at least 37% cheaper than the national average.

States with the highest estimated rate hikes in 2026

- New Jersey: 10.46%

- Nevada: 6.42%

- California: 6.13%

- New York: 6.02%

- Washington, D.C.: 5.36%

More than half of states are expected to see car insurance rates drop in 2026. Iowa has the largest estimated rate decrease, at 6.19%.

States with the largest estimated rate decreases in 2026

- Iowa: 6.19%

- Minnesota: 5.29%

- Arkansas: 4.70%

- Missouri: 4.45%

- Illinois: 4.26%

During the past five years, Texas had the largest increase in the cost of car insurance in the U.S. Rates in Texas went up by 60.97% between 2020 and 2025. Hawaii has had the most stable car insurance rates over that time period, with an increase of just 4.17%, according to ValuePenquin’s analysis.

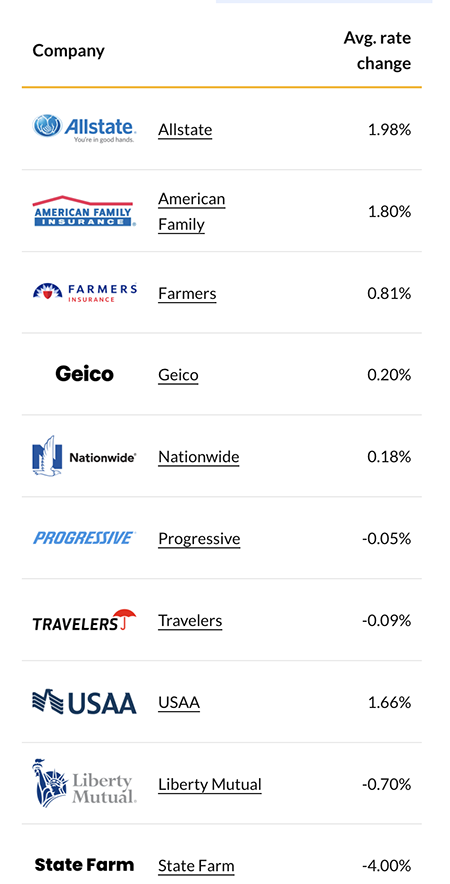

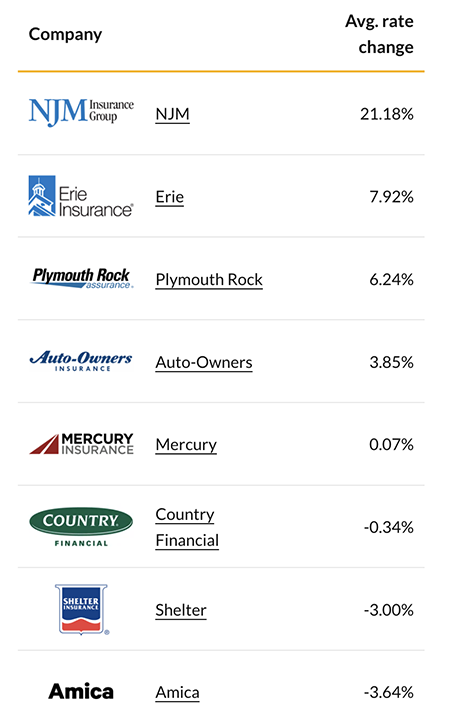

2026 rate changes by insurance company

Whether car insurance rates will go up or down when policies renews in 2026 will also depend on the insurance company.

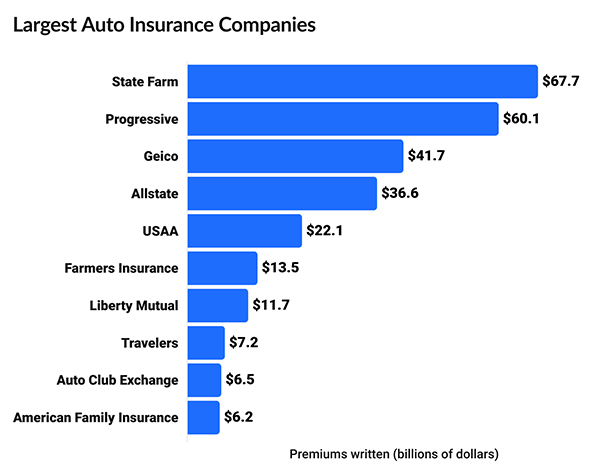

Major insurance companies aren’t expected to raise rates significantly in 2026. In fact, five of the 10 largest car insurance companies in the U.S. are expected to lower their car insurance rates.

Allstate has the largest estimated rate hike among major insurance companies, but it is a modest increase of just 1.98%. On the other hand, ValuePenquin points out that drivers insured with State Farm could see a decrease of around 4% when they renew their policies in 2026.

Major companies

Midsize insurance companies are likely to raise rates more than major companies in 2026. NJM customers may see their rates go up by an average of 21.18% at renewal. Rates at Erie are expected to rise by 7.92%, while Plymouth Rock is expected to raise rates by an average of 6.24%, states the report.

Mid-size companies

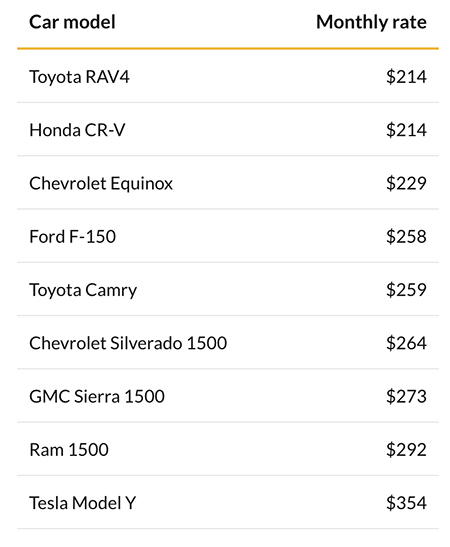

Cost of insurance for the most popular new cars in 2026

The Toyota RAV4 and Honda CR-V are the most affordable new cars to insure in 2026. Full coverage insurance costs about $214 per month for the RAV4 and CR-V, which are both compact crossover SUVs. That’s around 14% less expensive than average among the most popular 2025 models.

Cost of insurance for top-selling cars

The most expensive new car to insure in 2026 is the Tesla Model Y. Full coverage for the Model Y costs an average of $354 per month.

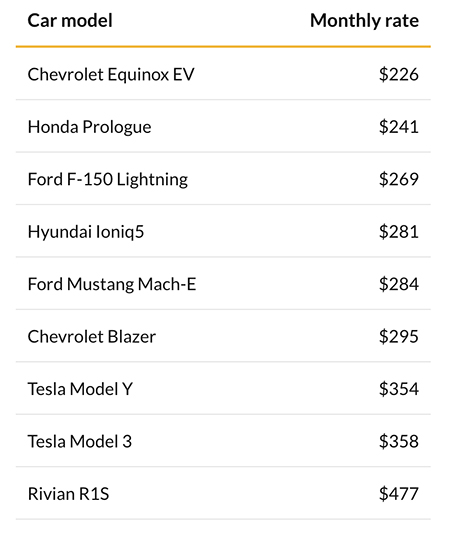

Price of insurance for new electric cars in 2026

Electric vehicle (EV) insurance is getting cheaper in 2026, bringing costs closer to gas-powered vehicles. The top nine EVs cost an average of $309 per month to protect with a full coverage policy. That’s 18% more expensive than the same coverage for a gas-powered car. However, that gap is smaller than in 2025, when EVs cost 23% more to insure, the report states.

For example, a gas-powered Ford F-150 costs an average of $258 per month to insure, while the electric F-150 Lightning costs just 4% more, at $269 per month.

Cost of car insurance for popular EVs

The Chevrolet Equinox EV is the cheapest new model to insure, at $226 per month. Insurance for the most expensive model, the Rivian R1S, costs twice as much, at $477 per month.

In general, electric cars made by legacy manufacturers like Chevrolet, Honda and Ford cost about 49% less to insure than those made by EV-only companies, like Tesla and Rivian. This may be because replacement parts from these brands are easier to find, in addition to lower vehicle prices.

Comments are closed.