Close to one-third of U.S. automakers expect parts and service to contribute no less than half of their entire revenue within the next five years

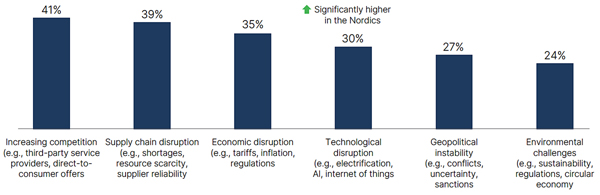

Chicago—Automakers are increasingly turning their attention to the aftermarket as a reliable source of profitability in rising economic uncertainty, fueled by tariffs, ever-changing trade policies and supply chain fragility.

Parts and service, once considered support functions for OEMs, are now gaining traction as a core component of profitability for automakers around the world.

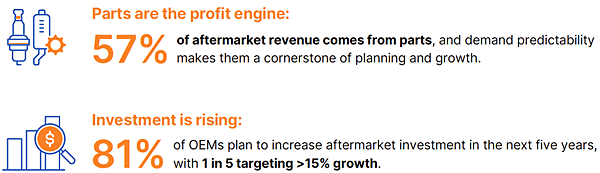

The service bay now accounts for 10–29% of manufacturers’ revenue globally, and those numbers are expected to grow to to 30–49% within the next five years, according to new research from Syncron, a SaaS company specializing in aftermarket service software.

The advice to automakers? “Treat aftermarket as a boardroom priority, with dedicated investment and cross-functional alignment,” states the report. And they are. Almost half of automakers report that improving aftermarket services and operations are a top strategic priority through the next two years.

Even more striking, the analysis states, is that aftermarket parts can generate up to 50% of total profits. OEMs have recognized that service is the fastest growth sectors and they are are focused on developing aftermarket strategies to gain more market share.

According to Syncron’s research, in the U.S., close to one-third of automakers expect the aftermarket to contribute no less than half of their entire revenue with the next five years.

Instead of being a traditionally reactive support function, the service bay is becoming a revenue-driving core of their business models.

Download the report here.

Comments are closed.