Why China is set to become the next auto hub for innovation and technology

The argument over battery-powered electric vehicles is no longer about whether or when it will happen—it’s about who will rule it.

China has long pulled its weight in the industry, ranking as the largest automotive market since 2008. Now, it’s projected to take the reins on the new era of electrification as well. The Chinese government and state-owned companies have strategically positioned themselves around the electric vehicle (EV) supply chain over the last few years. They have secured themselves as the next automotive hub for innovation and the technology crucial to EVs. Soon, China will dominate the production and sales of vehicles and be the source for invention, trends and industry benchmarking.

With a new king on the hill, what does it mean for the U.S. and German markets that have long dominated the technology around the internal combustion engine?

How China positioned itself around electrification

China’s rise to the top didn’t happen by accident. Instead of competing against long-standing powerhouses in the internal combustion engine (ICE) market, China focused its energy on gaining a competitive advantage in a newly emerging market. Strategic foresight and planning, paired with critical decisions on government policy directed by the Chinese government, led to this sudden rise to power.

The Chinese government made early investments into battery technologies and organized strategic political moves to drive global industrial policy and regulations to leapfrog the world in EV and drive the global economy to this higher level of electrification.

Using legislation to welcome the shift to EV

In September 2017, Xin Guobin, China’s Vice-Minister of Industry and Information Technology, told a forum of automakers in Tianjin that the government would ban the production and sale of fossil fuel cars. The finalized policy looks like it could call for 50 percent of vehicle sales to be plug-in hybrid or battery electric vehicles (BEVs) by 2035 — a modified version of California’s zero-emission mandate.

When articulated in 2017, this policy set the stage for a procession of global legislations calling for more aggressive policies against carbon-producing ICE vehicles. Since then, the UK and California have pushed for a 100 percent plug-in hybrid and BEV market by 2035. Our inclination is that the new Biden administration will likely follow suit with similar policies as well.

Norway has also called for a 100 percent alternatively-powered market by 2025, with Denmark, the Netherlands, Sweden, and China’s Hainan province following behind with a 2030 zero-emission target date.

Even less aggressive countries, such as South Korea and Japan, have still set forth legislation that will require plug-in hybrids and BEVs to account for 30 percent of vehicle sales by 2030.

Dominating the battery market

The other move that secured China’s rank as an electrification leader was its heavy investment in battery technology. While many of the company’s that emerged from China’s early investment programs have since fallen off, one company has successfully risen to become the world’s largest producer of batteries in just 10 years.

CATL (Contemporary Amperex Technology Co., Limited) began its operations in 2011 and focused on designing and producing lithium-ion batteries for EVs and energy storage systems. Now it is the market leader in price and has been at the center of many other battery breakthroughs. Their revolutionary cobalt-free lithium iron phosphate battery dropped the cost of battery cells to below $60 kWh. They then reduced costs by streamlining the production process with a “cell-to-pack” packaging process that eliminates the intermediate step of bundling cells.

CATL has even teamed up with TESLA, the only other notable competitor in the industry, and has plans to supply the electric car company with an improved long-life nickel-manganese-cobalt (NMC) battery. CATL’s ability to drive costs to and below $100 kWh—the necessary amount to be on par with the cost of ICE vehicles—has drastically sped up the transition to BEVs.

With CATL serving as the hub of battery technology, even if a vehicle is “American-made” or “German-made,” the technology behind it could still come from China.

Ability to Scale

China’s final key area in their move to the top is a strength they’ve long been known for—volume and scale. Electronic systems scale differently than mechanical components, and automakers and suppliers will use this concept to drive competitiveness through large-scale electrification strategies, leveraging common architectures.

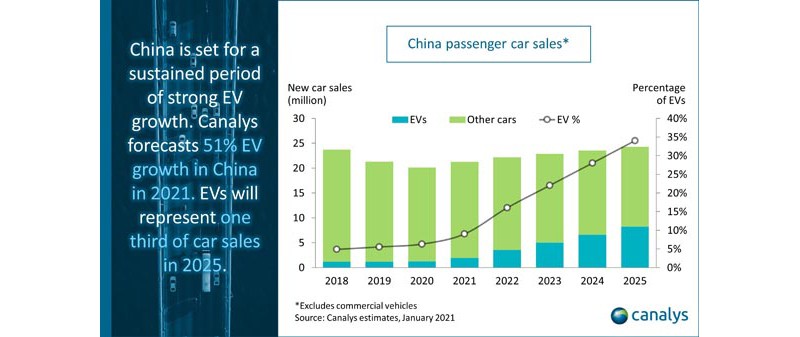

China is already the largest auto market globally, with more new vehicle sales per year than any other country, and their reach is only expected to increase. By 2030, China is expected to produce one-third of global production.

Finding your place in the shift of power

China has successfully steered the global automotive industry toward BEVs to create a dominant position in the new market. This transition should serve as yet another reminder to traditional automotive businesses, or “Old Co.” companies, to invest in scenario planning to successfully adapt and refocus their product portfolios and business strategies accordingly. China will become a critical market for gauging your overall success for “New Co.” organizations, manufacturers of semiconductors, battery technology, and parts for the new EV ecosystem.

Competitors in the autonomous vehicle (AV) space should also closely watch China’s policy and industry changes within AV. China will likely use similar strategies in the next wave of disruptions to gain a competitive advantage regarding AVs and the centralized computing systems that will power them.

As a strategic automotive consultant, Paul Eichenberg collaborates with automotive suppliers to develop and execute creative, innovative solutions to their industry’s complex challenges. His experience working in the automotive supply industry makes him an expert in existing problems. His passion for the future of automotive technology makes him an insightful resource and thought leader.

Comments are closed.