Quick lube shops continue to move ahead, franchise chains hold steady but lose some ground, and dealers struggle to keep up

Troy, Mich.—The automotive service industry has taken different turns over the past 18 months. Quick lube shops continue to move ahead, franchise chains hold steady but lose some ground, and dealers struggle to keep up.

Ducker Carlisle analyzed billions of transactions across the United States to highlight how these shifts unfold across the market. The following are the executive summary and main takeaways from the research.

• Quick lube shops consistently deliver the most reliable performance, outpacing other providers for a year and a half and maintaining that lead even in slower months like July 2025. Their lower ticket prices keep customers coming back, and their price increases align with the rest of the industry.

• Franchise chains track closer to the industry average. They outperform dealers and independent repair facilities in transaction counts but keep giving up share to faster-growing quick lube and tire shops. Their prices sit in the middle — roughly three times the cost of quick lube visits and about half the cost of dealer service.

• OEM dealers, meanwhile, continue to face pressure. They briefly rebounded in March 2025 due to tariffs, but that momentum quickly faded. By July, they lagged behind every other segment. With fewer transactions than in prior years, dealers have leaned on higher prices, leading the industry in dollars-per-transaction growth since early 2024.

Market Share Analysis

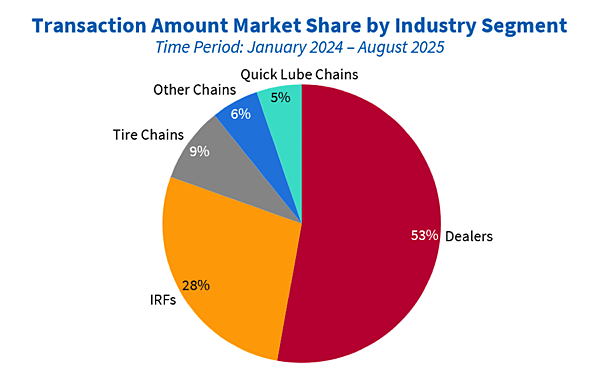

Ducker Carlisle filters the transaction data to focus on customer transactions within the five main industry segments in the automotive service sector: OEM dealers, independent repair facilities (IRFs), quick lube chains, tire chains, and other franchise chains.

Using data from these segments, Ducker Carlisle calculates market share and other key metrics for its business intelligence tool, Aftershare.

The Aftershare data shows that dealers hold slightly more than half the market, IRFs maintain a little more than a quarter, and the remaining share spreads across the three chain segments. A time-based view of this data reveals current market dynamics and highlights which segments gain or lose share.

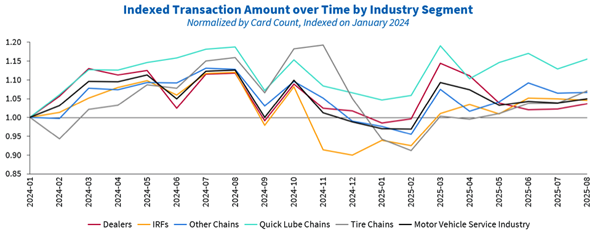

The indexed chart below illustrates how sales in each segment shift over time.

In 2024, the service industry segments moved closely together, with tire chains showing slightly more cyclical behavior and quick lube chains performing slightly above others.

In response to tariff threats, the entire industry experienced a sales spike in March 2025, as customers scheduled larger, more comprehensive services ahead of anticipated price hikes. Each segment reacted differently following that initial spike.

Despite an initial dip in April 2025, quick lube chains stayed ahead of other segments in the months that followed. Before 2025, dealers hovered around or slightly below average industry sales levels and briefly surged in March 2025.

After that, their performance dropped below all other segments from June through August 2025. IRF sales stayed below industry averages in Q4 of 2024 but rebounded after the March tariff-related spike.

In recent months, IRFs, tire chains, and other franchise chains have maintained sales near the industry average and remained stable after the initial spike.

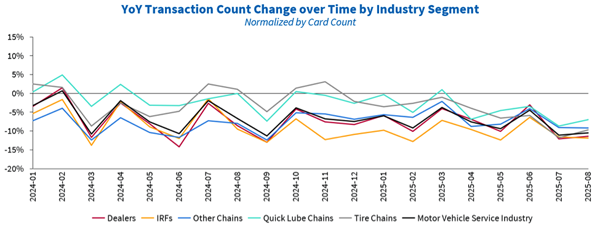

The year over year (YoY) transaction count chart shows the service industry consistently falling below the prior year’s transaction volumes. Dealers, for example, trailed previous-year levels in every month except one, which suggests they raised prices to offset declining transaction counts.

In contrast, quick lube and tire chains stayed closest to prior-year transaction levels — and even exceeded them in some months — indicating stronger transaction volumes.

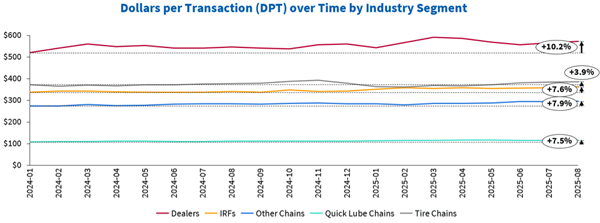

Lastly, dollars per transaction (DPT) measures the average transaction value and serves as a proxy for pricing. Even with their higher pricing, dealers increased their DPT by about 10% since the beginning of 2024, showing a strategy to raise prices in response to declining transaction counts and to preserve market share.

Tire chains posted the smallest DPT increase, while IRFs, quick lube chains, and other franchise chains increased their DPT by around 7–8%.

Quick lube chains continue to record the highest transaction counts among all industry segments. Their low average DPT keeps customers coming in, and consistent transaction volumes — combined with a steady rise in average transaction value — drive their overall sales growth.

Comments are closed.