Soaring numbers in next five years will increase logistical and inventory burdens of manufacturers, distributors, retailers, and installers

Fort Wayne, Ind.—The number of products required to repair the diverse, aging, and increasingly complex population of cars and light trucks on U.S. roads is expanding at an exponential rate, according to a new report, causing the aftermarket proliferation problem to grow in size and scope.

“Light vehicle aftermarket parts proliferation is being fueled by three major factors,” states the 2021 Lang Aftermarket Annual, which projects that parts proliferation will “soar over the next five years, increasing the logistical and inventory burdens of manufacturers, distributors, retailers, and installers.”

Three Factors Driving Parts Proliferation

Parts proliferation in the light vehicle aftermarket is being driven by three factors: foreign nameplate expansion, the aging vehicle population, and the growing complexity of vehicles.

• Factor 1: Foreign Nameplates

Foreign nameplates represent an increasing number of light vehicles in operation (VIO). The foreign nameplate VIO share will reach 51 percent by the end of 2021. Since 2010, the foreign nameplate share of cars and light trucks has increased by more than one third.

• Factor 2: Vehicle Age

The light vehicle average age will climb significantly between 2020 and 2024, and the age mix of vehicles is shifting toward higher age categories.

Cars and light trucks at least 14 years old will be one of the fastest growing vehicle age groups between 2020 and 2024. This will boost the average age of cars and light trucks and extend the vehicle age range for which parts must be stocked.

• Factor 3: Vehicle Complexity

Cars and light trucks have become more complex, with this advanced technology affecting virtually all vehicle operating systems.

The number of aftermarket smart parts (vehicle components with special sensors and software) will increase by an estimated 40 percent from 2020 through 2024. During these five years, the number of vehicles with Advanced Driver Assistance Systems (ADAS) will soar.

Vehicle technology is adding significantly to the number and cost of parts that manufacturers, distributors, retailers, and installers must inventory and manage in order to support the repair of light vehicles.

Factors That Will Grow With More Intensity

The following three factors that are driving parts proliferation will intensify over the coming years, increasing the inventory and logistical demands on the aftermarket supply chain in all channels and at all levels of the distribution system.

• Factor 1: COVID-19 Impact

COVID-19, by reducing the sales of new vehicles during 2020 and for some time in the future, will accelerate vehicle age growth and expand the size of older age groups of cars and light trucks.

COVID -19 has also greatly accelerated the growth of eCommerce, which will lead to changes in the distribution channels that already are struggling to deal with the growth of parts proliferation.

• Factor 2: eCommerce Silver Lining

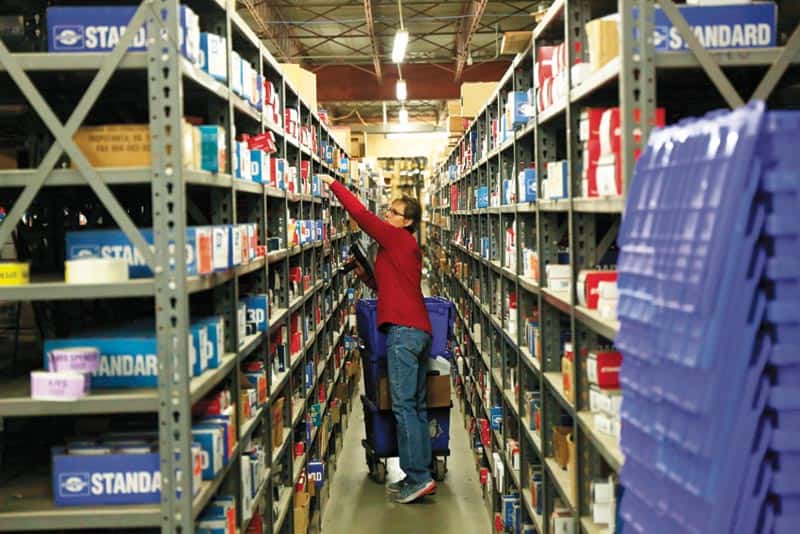

Parts proliferation is forcing many eCommerce sellers to rely on conventional aftermarket distribution channels to supply and fulfill parts that they sell. The “long tail” of many aftermarket products makes it difficult for eCommerce sellers to keep an inventory of a large percentage of the products that they sell, contrary to many other types of product categories that they handle.

Ironically, as eCommerce sellers increase their volume, many traditional warehouses and other distribution centers are being tapped to provide the fast-growing eCommerce sellers with an increasing volume of the products that they sell.

• Factor 1: DIFM Versus DIY

Generally, Do-It-Yourself buyers (DIYers) will wait longer to receive products necessary for vehicle repair than customers taking their vehicles to a repair shop (Do-It-For-Me or DIFM market).

Consequently, parts proliferation disproportionately places greater challenges on the DIFM market, which depends on the rapid delivery of products to the installation point for customer satisfaction.

Comments are closed.