The challenges they expect to face this year are markedly different than they were during the pandemic as well as prior to the pandemic, according to survey

Naperville, Ill.—At the beginning of 2022, automotive market research firm IMR surveyed independent automotive repair shops to get insight into what they believe their biggest challenges will be in 2022 as well as what challenges they expect to face in the future.

Not surprisingly, the challenges they expect to face this year are markedly different than when these questions were asked during the pandemic as well as when asked prior to the pandemic.

For reference, in 2019, prior to the pandemic, independent repair shops listed their biggest challenges as Finding time for hands-on technician training (42.6%), Staying up to date with advances in diagnostics (31.6%), Keeping up with advances in vehicle technology (31.1%) and Finding good, knowledgeable and motivated technicians (29.2%).

In 2020, during the height of the pandemic, independent repair shops noted their biggest challenges were: Keeping staff/customers safe/Social distancing (55.0%), Getting customers/Keep shop running/Return to normal hours (44.0%), Getting parts on time (34.0%), Getting parts/Finding suppliers with parts in stock (29.2%).

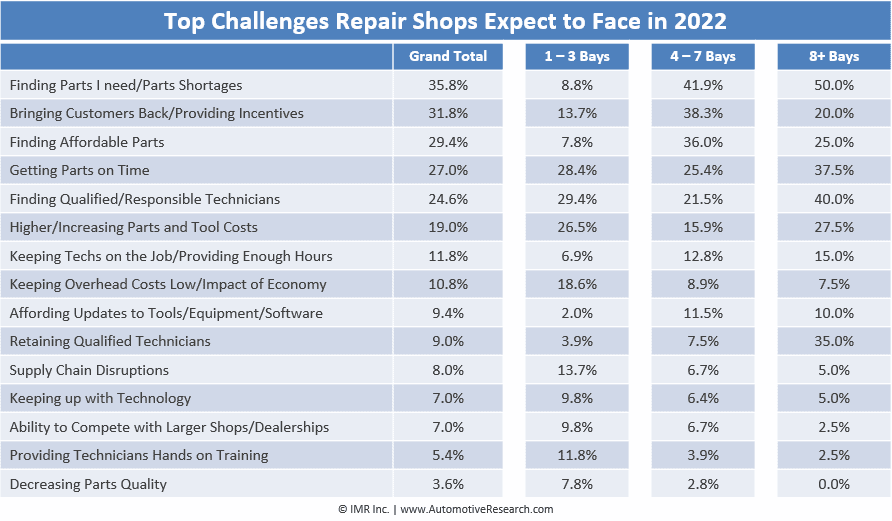

In 2022, independent repair shops state the biggest challenges they expect to face are: Finding parts I need/Parts shortages (35.8%), Bringing customers back/Providing incentives (31.8%), Finding affordable parts (29.4%), Getting parts on time (27.0%).

In total, the challenges auto repair shops expect to face mention finding needed parts, bringing customers back, parts affordability and getting parts on time. However, when IMR looked at the results by bay size it shows that different size shops expect to grapple with the same issues but in a different ranking.

For example, the No. 1-ranked issue for shops with 1 to 3 bays is finding qualified/responsible techs, which happens to be the number two ranked issue for shops with 8-plus bays.

Additionally, while Finding parts I need/Parts shortages is the largest concern, only 8.8% of shops with 1 to 3 bays note the concern, compared to 41.9% of shops with 4 to 7 bays and 50.0% of shops with 8-plus bays. Bringing customers back/Providing incentives was less of a concern amongst shops with 1 to 3 bays (13.7%), shops with 4 to 7 bays (38.3%) and shops with 8-plus bays (20.0%) expect it to be more of a challenge in 2022.

On average, shops with 1 to 3 bays mentioned 2.3 challenges, shops with 4 to 7 bays mentioned 2.6 challenges and shops with 8-plus bays mentioned 3.0 challenges.

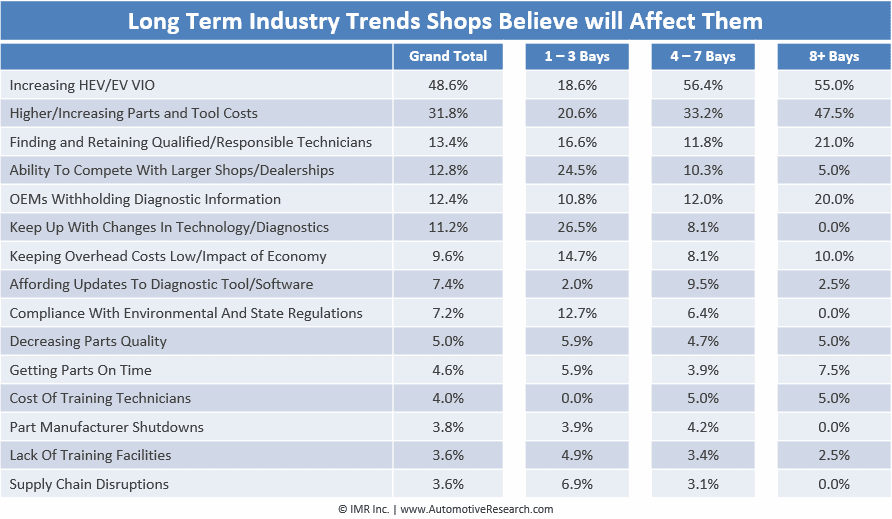

Smaller automotive repair shops with 1 to 3 bays don’t consider an increasing HEV/EV VIO to be as much of a future trend that will affect them as much as they do with the need to keep up with changes in technology and diagnostics and having to compete with larger shops.

An increasing HEV/EV VIO seems to be top of mind for shops with 4 or more bays. It’s the No. 1 future trend they believe will affect them. When IMR released its BEV/HEV insight in July 2021, only 40% of shops believed an increasing BEV/HEV VIO would affect them in the next two years and 30% had made investments in training for their technicians.

About this research

Between Feb. 1 and Feb. 28, IMR interviewed 500 independent repair shops, nationally representative by location in the U.S., to gain insights into the challenges repair shops expect to face in 2022 and what future challenges they see on the horizon.

Comments are closed.